Cool Transportation Industry Financial Ratios

If you want to customize an industry Profit Loss statement for developing a full financial report start here.

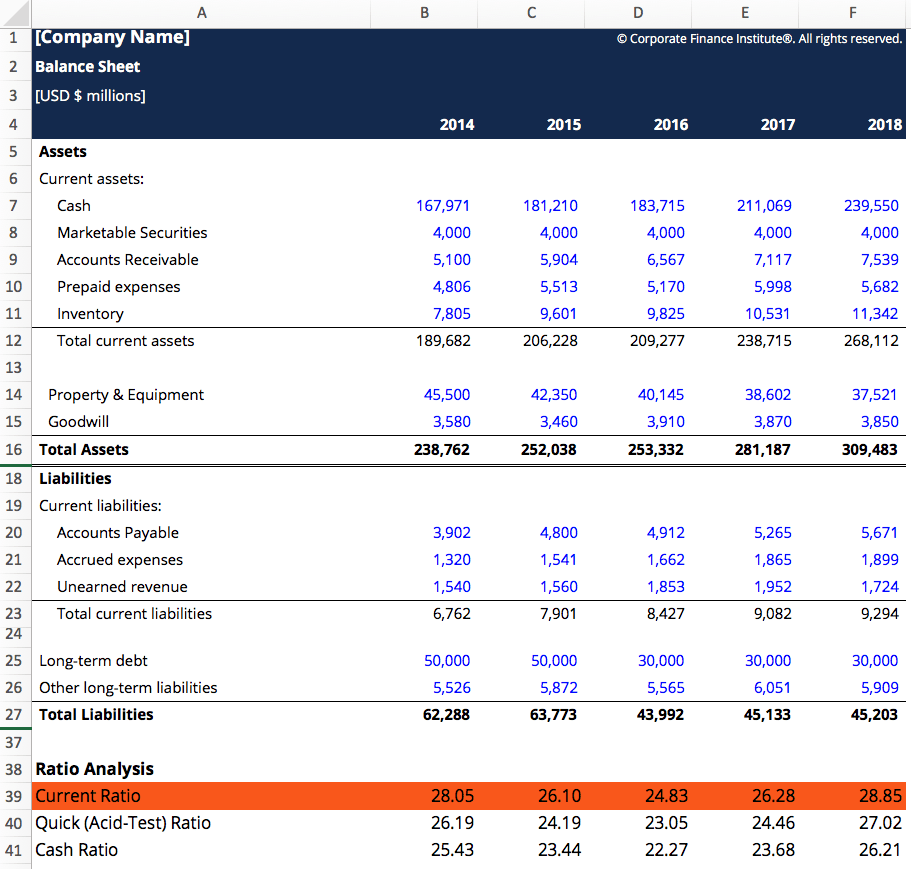

Transportation industry financial ratios. Gross and net profitability. Debt ratios Debt ratio Total debt to total assets Equity ratio Financial levarage Debt to equity ratio liquidity ratios Current ratio Quick ratio Cash ratio market value ratios and indicators of work efficiency property and productivity reproduction. 1 Defined as the ratio of operating surplus to operating receipts.

84 rows railroad transportation. To be successful all businesses within the transportation industry need to analyse and understand their financial statistics and ratios including. BizStats develops industry financial benchmark reports on.

Having a debt-capital ratio between 20 percent to 30 percent is the mark of a strong trucking firm with those below 20 percent rated very highly. Average industry financial ratios for US. Fuel 23 Financing 4 Tires 3 Repairs and maintenance 4 Vehicle depreciation 10 SGA 8.

Land transport Water transport and Air transport segments include their. Financial returns ie return on equity ROE of the sample is magnified by financial leverage total assetsequity and is thus more than proportionally affected by the drivers of the ROA. Profit Loss Balance Sheet and Financial Ratios.

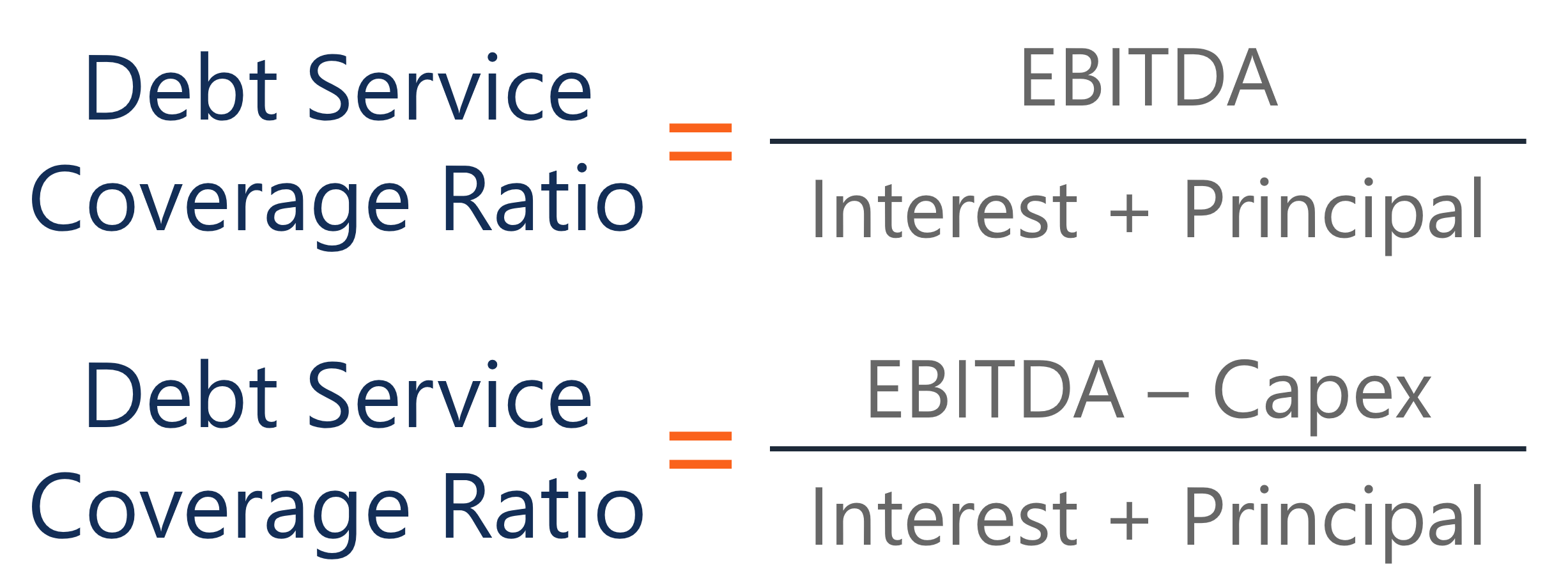

22 rows Transportation By Air. On the trailing twelve months basis Transport Logistics Industrys Cash cash equivalent grew by 573 in the 1 Q 2021 sequentially faster than Current Liabilities this led to improvement in Transport Logistics Industrys Quick Ratio to 056 in the 1 Q 2021 above Transport Logistics Industry average Quick Ratio. 1 Earnings Before Interest Taxes Deprecation and Amortization.

Manufacturing Industry Ratio To gauge the appropriateness of operations and to determine how well the manufacturing process is going a company uses the following financial ratios to evaluate its business. They also need sufficient working capital. On the trailing twelve months basis Transportation Sector s Cash cash equivalent grew by 14249 in the 2 Q 2021 sequentially faster than Current Liabilities this led to improvement in Transportation Sectors Quick Ratio to 083 in the 2 Q 2021 above Transportation Sector average Quick Ratio.

:max_bytes(150000):strip_icc()/balance_sheet-5bfc2f1246e0fb00514577bc.jpg)