Divine Cipla Financial Ratios

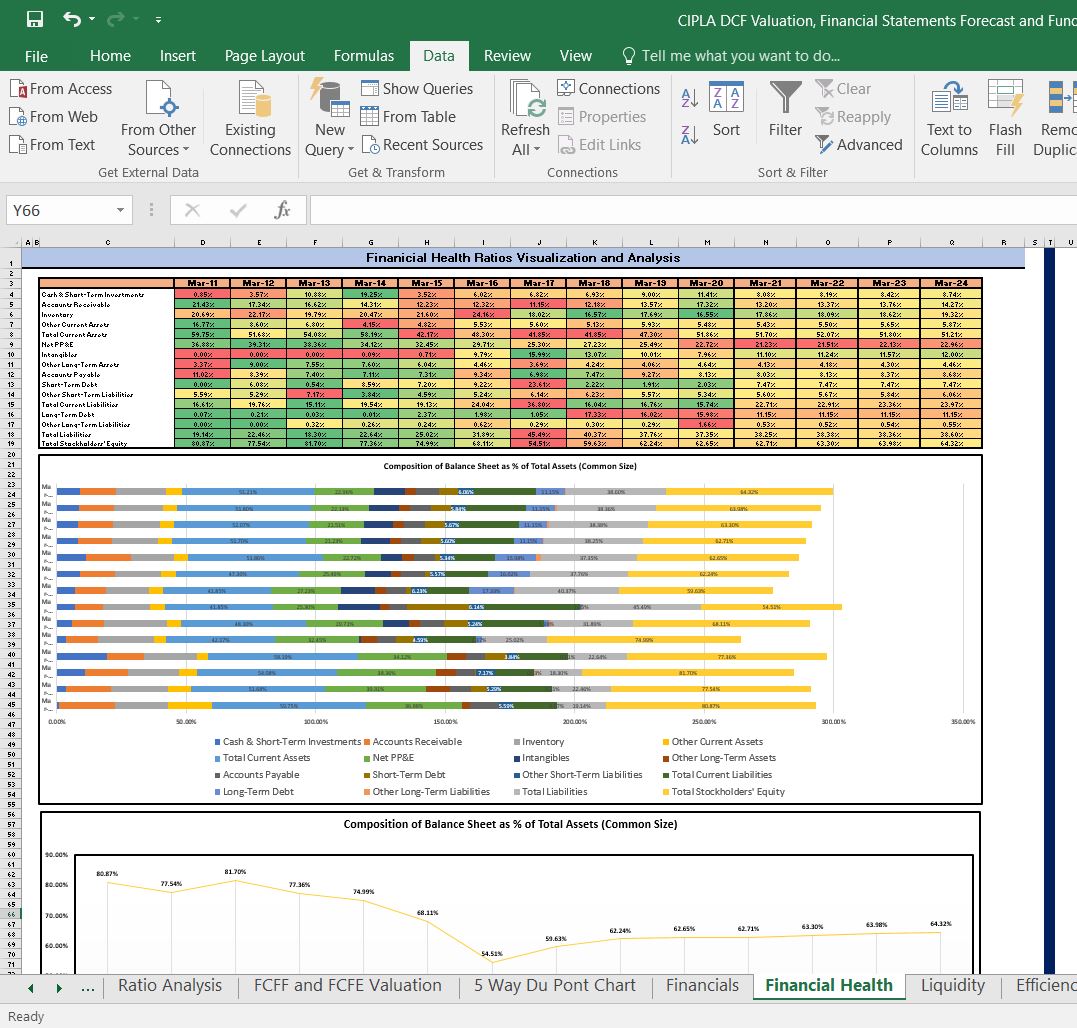

This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Cipla Ltds latest financial reports.

Cipla financial ratios. It employs 1300 scientists and has seen double-digit investments in RD in recent years. The EVEBITDA NTM ratio of Cipla Limited is slightly lower than its historical 5-year average. Ciplas Earnings per Share Diluted for the trailing twelve months TTM ended in Mar.

Book value per share. Operating Margin 2844. Diluted EPS Rs 1689.

Hamied Chairman 84th AGM. According to these financial ratios Cipla Limiteds valuation is way above the market valuation of its sector. Operating Margin 2375.

This section also provides graphical representation of Cipla Ltds key financial ratios. The EVEBITDA NTM ratio of Cipla Limited is significantly higher than the average of its sector Pharmaceuticals. Basic EPS Rs 1693.

Operational Financial Ratios. The current ratio of Cipla Ltd is above the standard norm of 21 for the years 2011 and 2012 ie 243 and 261. YEAR 2011 2012 2013 CURRENT RATIO 243 261 194 Interpretation.

Per Share Ratios. Transcript of the 84th AGM. It has 46 state of the art manufacturing facilities across 5 countries and has 1500 products.