Matchless An Example Of Cash Flow From Investment Activity Is Ytd Balance Sheet Template

The balance sheet and the income statement are two of the three major financial statements that small businesses prepare to report on their financial performance along with the cash flow statement.

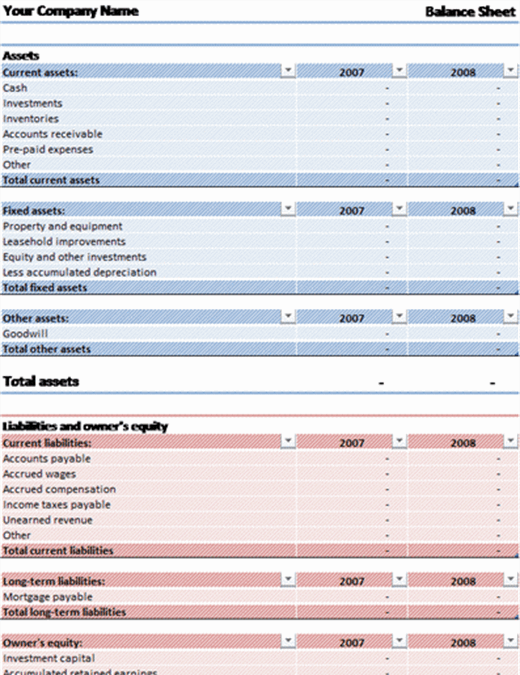

An example of cash flow from investment activity is ytd balance sheet template. 2 focuses on the differences between net income and net cash flow from operating activities-Direct. A balance sheet is a summary of the financial balances of a company while a cash flow statement shows how the changes in the balance sheet accountsand income on the income statement affect. Balance Sheet Example.

In financial accounting a cash flow statement also known as statement of cash flows or funds flow statement is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents and breaks the analysis down to operating investing and financing activities. The following five items may cause a difference between the balance sheets cash account and the statement of cash flows and adjustments must be made. A balance sheet is a snapshot of your companys net worth at a given point in time.

First lets take a closer look at what cash flow statements do for your business and. This simple cash flow statement template is for small-business owners and entrepreneurs who need an example of standard formatting for a statement of cash flows. This is the total of all outstanding invoices issued to families.

When used as part of good business practices in a Finance and Accounting Department a company can improve its liquidity analysis as well as reduce the chances that the company runs into an unexpected cash crunch. Customize the categories used to suit your needs. The cash account on the balance sheet should reflect the total cash available to the firm as calculated on the statement of cash flows.

You can use the indirect method to create the statement of cash flows from the information in the balance sheet and income statement. For cash flow monitoring and decision making purposes the various bank account balances displayed in the Balance Sheet provide a more accurate and complete cash position compared to what appears on bank statements. Adjusts net income for items that do not affect cash to determine net cash provided by operating activities.

In other words a balance sheet can show you what your company owns and how much it owes. Reduces profit but does not impact cash flow it is a non-cash expense. This example of a simple balance sheet.