Exemplary Purchase Of A Building Cash Flow Statement

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

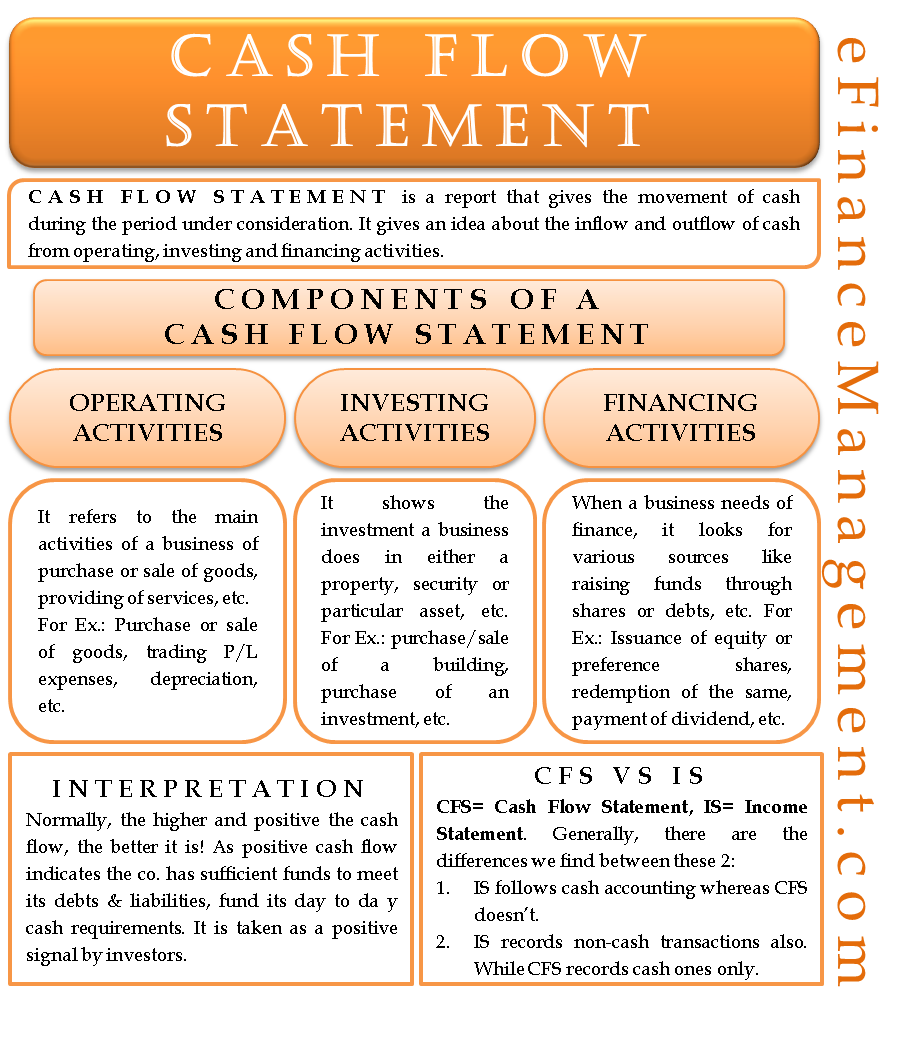

IAS 7 Statement of Cash Flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

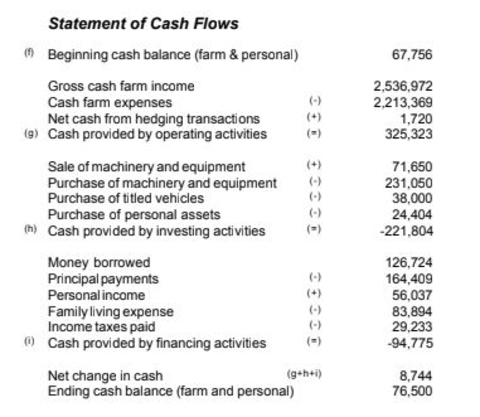

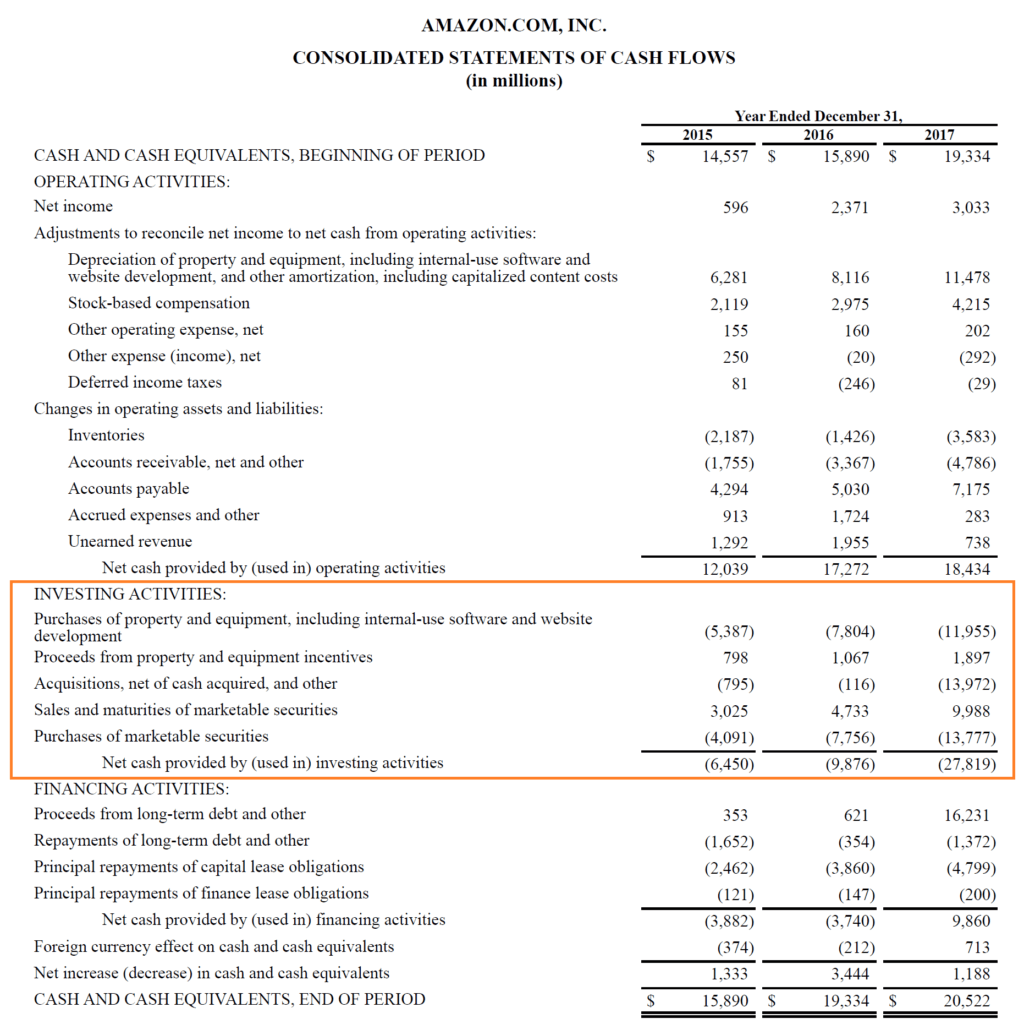

Purchase of a building cash flow statement. We also include cash inflows in this section relating to the sale of a non-current asset that we have. At the bottom of our cash flow statement we see our total cash flow for the month. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back.

For example one could be spending cash on computer equipment on vehicles or even on a building one purchased. Even though our net income listed at the top of the cash flow statement and taken from our income statement was 60000 we only received 42500. The purchase of the building should be investing cash outflow and the issuance of debentures as financing cash outflows while the issuanceof shares as investing cash outflow.

Depreciation and amortization from that number. Reduces profit but does not impact cash flow it is a non-cash expense. The sources of information appearing in the table can be used to prepare a cash flow statement.

A statement of cash flow classifies and presents cash flows under three headings. Thus investing activities mainly involves cash outflows for a business. Cash Flow And The Statement Of Cash Flows.

From the net income line on the income statement. This could include cash receipts from the sale of goods or services the purchase of raw materials payments to suppliers for goods or services and payments to employees. To do that determine net income and remove non-cash expenses eg.

Statement of Cash Flows presents a principles-based definition of the classifications of cash flows. Equipment Purchase 15000 Net Cash from Investing 20000. Example of Statement of Cash Flows.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)