Awesome Cra Form T2125 For 2019

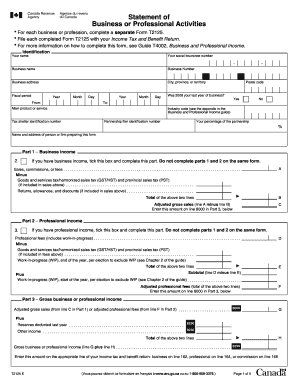

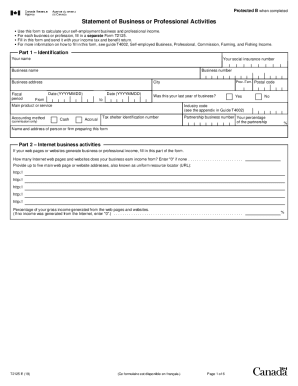

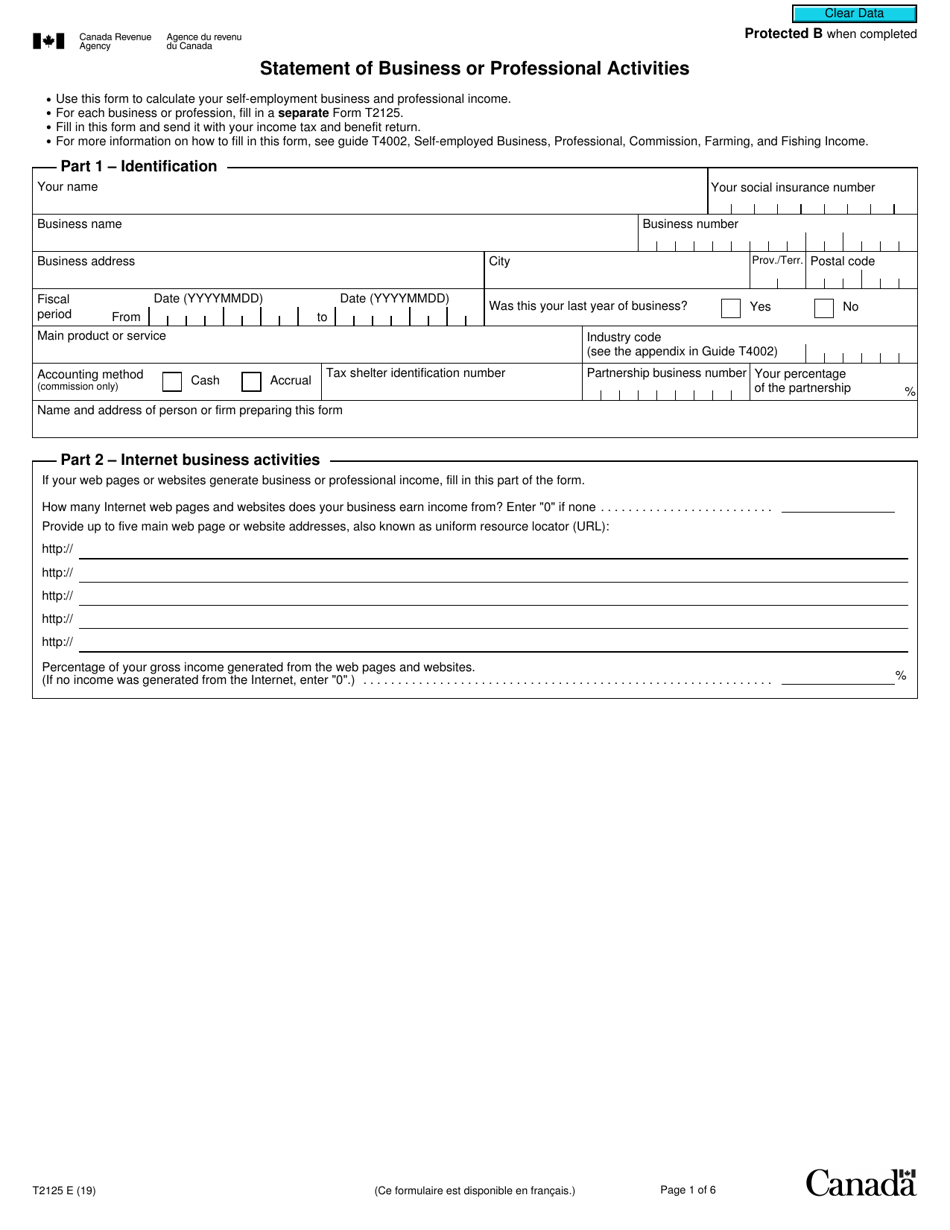

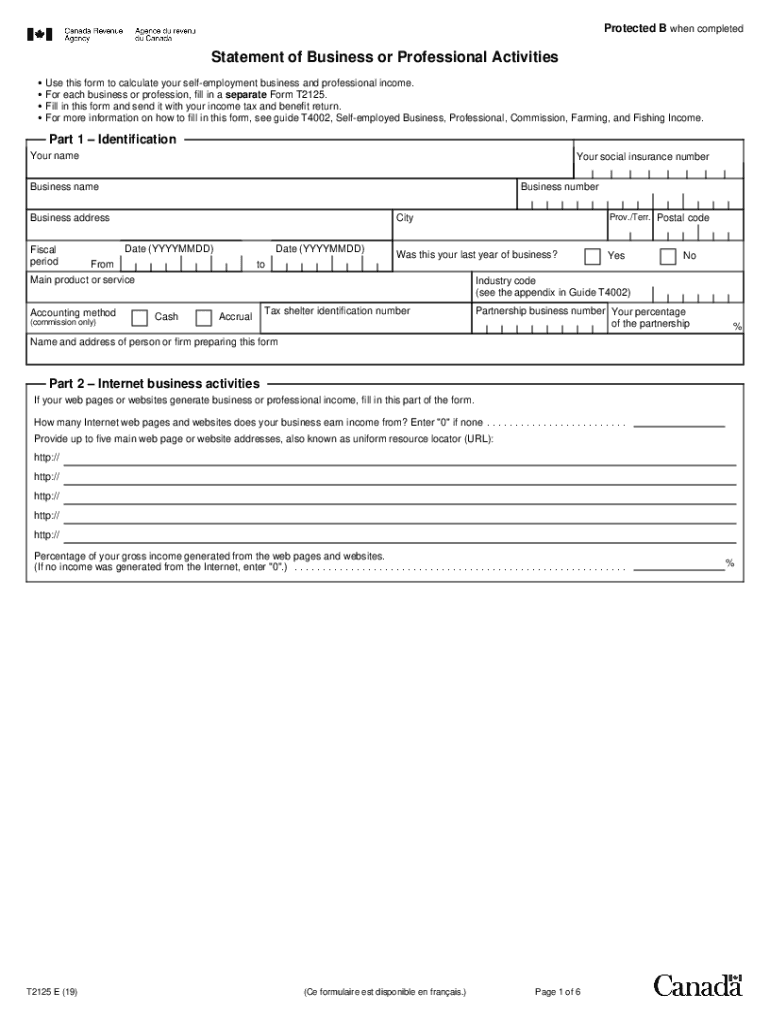

Although Form T2125 is an important part of reporting your business and professional income and expenses it may not be the only way you report to the CRA.

Cra form t2125 for 2019. As announced by the Government the Circuit Breaker will end on 1 June 2020 with measures to be progressively lifted in three phases. Business Income vs Professional Income. There is no mention of claiming the cost of a motor vehicle as a.

The form helps you to calculate your net income or loss from business activities which you then report on form T1 for your personal income taxes. Instead you had to print it from the CRA website which was no easy matter for folks who didnt. Your search for an easy-to-customize free-to-use Cra Form T2125 2012 2019 ends here at CocoSign.

If you do not change your answer the T2125 will continue to come up. On line 9281 of your T2125 form Motor vehicle expenses you may be eligible to claim. CRAs office at mTower will be opened from 2 June 2020.

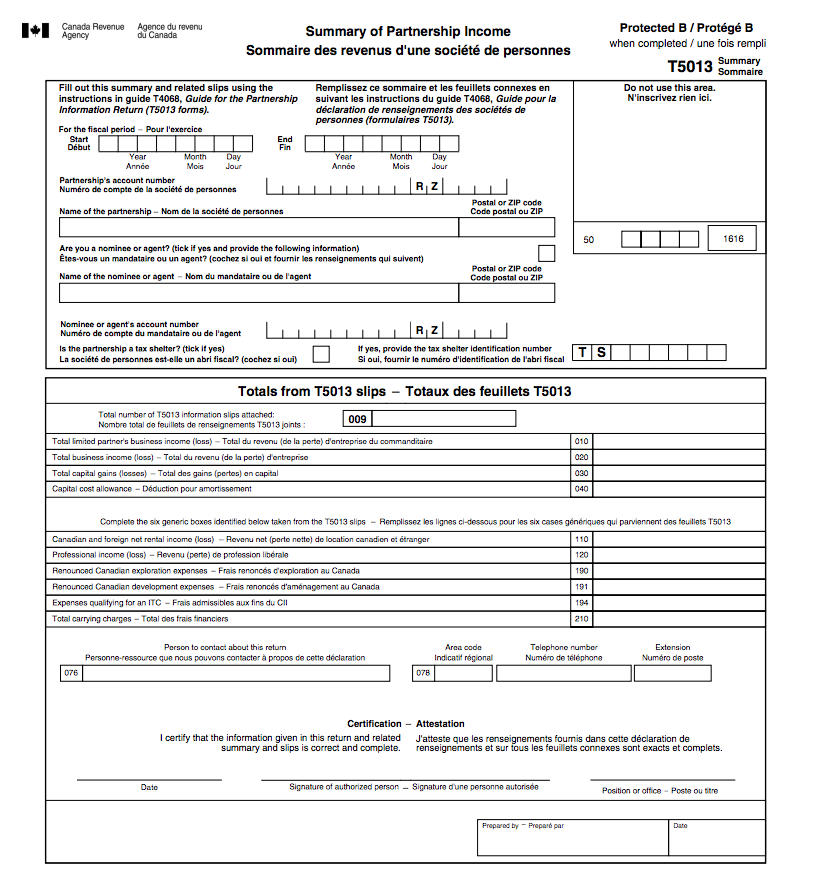

Otherwise each partner fills out the CRAs T2125 form to report their share percentage of the partnerships income and expenses. A T2125 form is a schedule that goes along with a tax return and it lists income and expenses where taxpayers operate certain types of businesses. Avail yourself of the massiveness of professionally crafted templates CocoSign has to offer.

Cra form 2125 t2125 form 2019 Related to cra ca t2125 Part 1613 Mechanical tests on contacts and terminations Test 16m Unwra This is a preview click here to buy the full publication IEC 605121613 Edition 10 200805 INTERNATIONAL STANDARD NORME INTERNATIONALE Connectors for electronic Part 52 Control. The key to deductibily when you are a business owner is incurring the expense to earn income. If your business is incorporated you claim these same motor vehicle expenses on your T2 corporate income tax return.

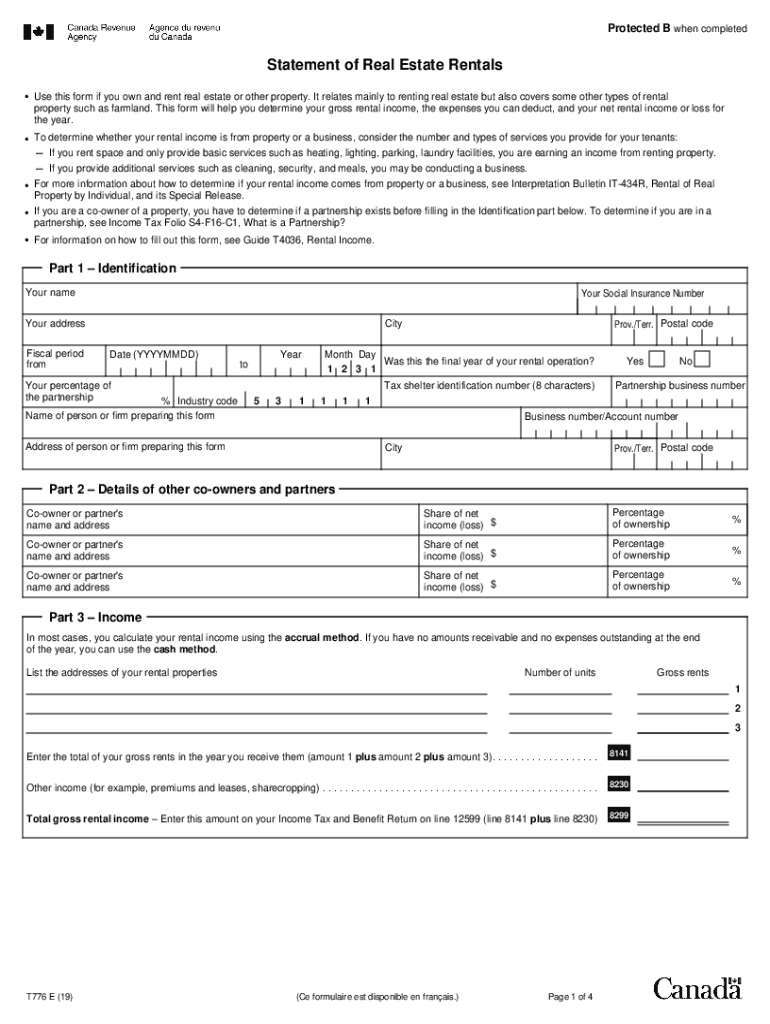

If youre filing a Québec tax return youll also have to complete a TP-80-V. To minimise your time spent in public space please contact us via our online feedback form. This form can help you calculate your gross income and your net income loss which are required when you complete your Federal Income Tax and Benefit Return.