Neat Comparison Of Financial Statements Of Two Companies

This analysis detects changes in a companys performance and highlights trends.

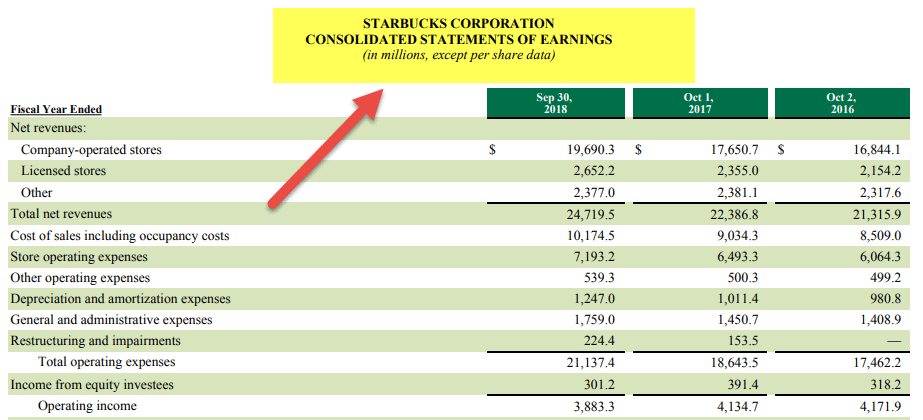

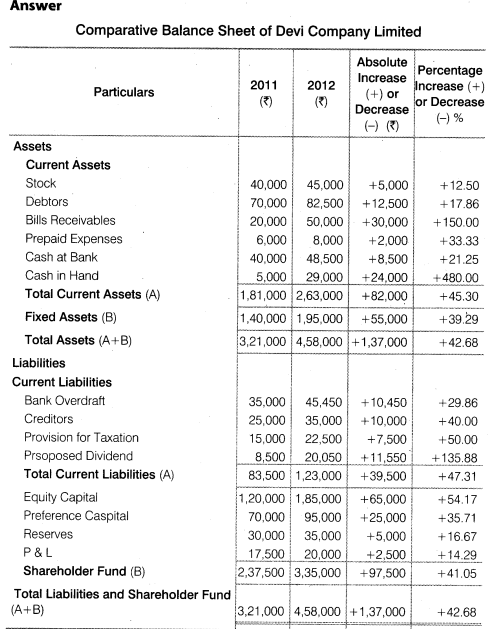

Comparison of financial statements of two companies. The income statement showing results for multiple periods. Example it can be shown in a view from balance sheet profit and loss account and budgetary control system or in any accounting organization that shows relationship between accounting data. Hence this technique is also termed as Horizontal Analysis.

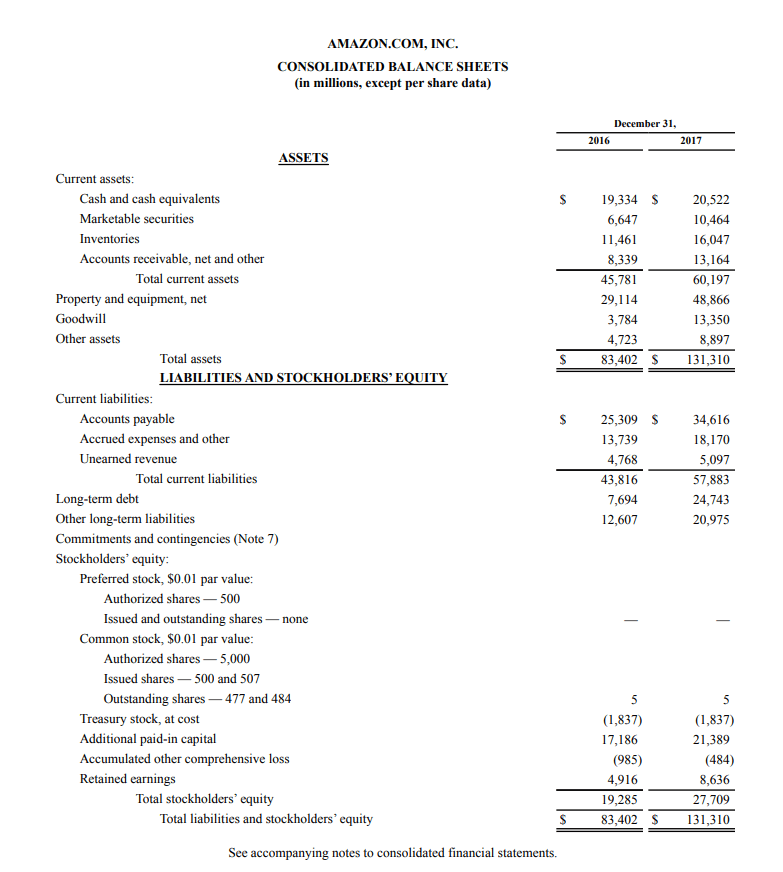

Both companies are US based firms that operate internationally. How do you do a comparative analysis of two companies. Ratio analysis simplifies the process of comparing the financial statements of multiple companies.

Although the notes were omitted a statement from each companys auditor is included. Lots of new companies entered this marketFrom all of them we choose two cement. Comparative Analysis of Financial Statements Between Two Companies.

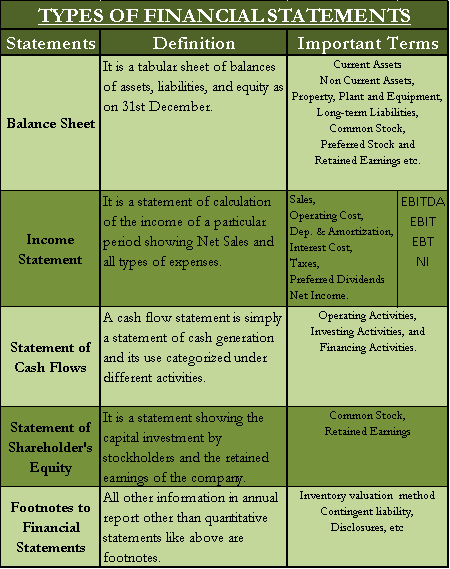

There are five basic types of financial ratios used. Financial Statement Analysis Comparison of Two Companies. Find the most recent financial statements for two companies of same company industry which are listed in KLSE Kuala Lumpur Stock ExchangeEvaluate the financial position and performance for each of these two companies using accounting ratio analysis.

Wed 24 Jun 2020 Financial Statements. Comparative analysis of financial statement between two TextileCompanys10 IntroductionIn our country textile companies are doing very well business. Gross Profit Margin Gross profit margin will help us to understand companys manufacturing and distribution efficiency during the production process.

A Case Report on the Financial Statements of Reed Elsevier and Thomson Corporation Executive Summary With the objective to understand the business performance of the two entities we reviewed the 2007 financial statements of both company and tried to obtain. Preparing Comparative Financial Statements is the most commonly used technique for analyzing financial statements. This technique determines the profitability and financial position of a business by comparing financial statements for two or more time periods.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)