Formidable Accounting For Impairment Of Investment In Subsidiary

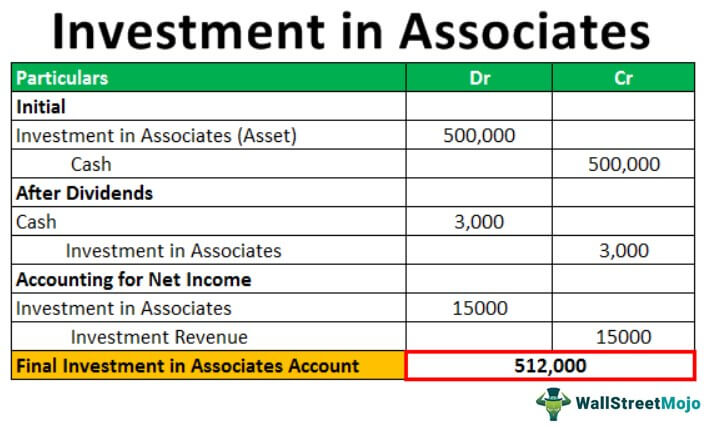

Then the impairment amount.

Accounting for impairment of investment in subsidiary. 07 Jan 2010 The IFRIC considered the comment letters received to the proposed amendments to IAS. Ad Find what you want on topsearchco. Ad Find Accounting For Investments.

Ad Find Accounting Investment. Ad This is the newest place to search delivering top results from across the web. Accounting for sale of investment in subsidiary Partial disposal of an investment in a subsidiary will have implications to the parent financial statement.

This has been treated as an investment in a subsidiary in the draft accounts at cost. Key definitions IAS 366 Impairment loss. A new standard in alternative investments.

If parent lost control over the subsidiary we need to stop consolidation and recognize investment by using the equity method. On disposal of the investment the difference between disposal proceeds and the. Whereas the subsidiary company will report the.

In this case the 5 million difference is an impaired goodwill expense and is recorded as such on the companys income statement as a line item. Determine the amount of the investment in the subsidiary that you must write off. Ad Find Accounting Investment.

If 100 share capital of an entity is owned by the parent company then such an entity will be referred to as wholly-owned subsidiary. Debit the account called impaired goodwill expense by the amount of the write-off in a journal entry in your accounting records. The consideration was 400000.