Marvelous Horizontal Financial Analysis Examples Of Bank Liabilities

However for a bank a deposit is a liability on its balance sheet whereas loans are assets because the bank pays depositors interest but earns interest income from loans.

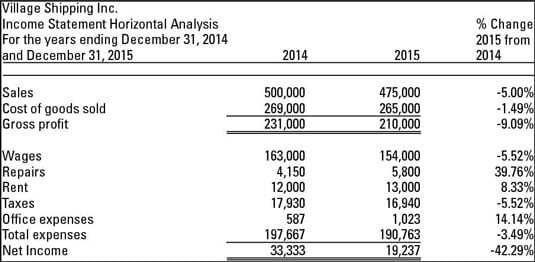

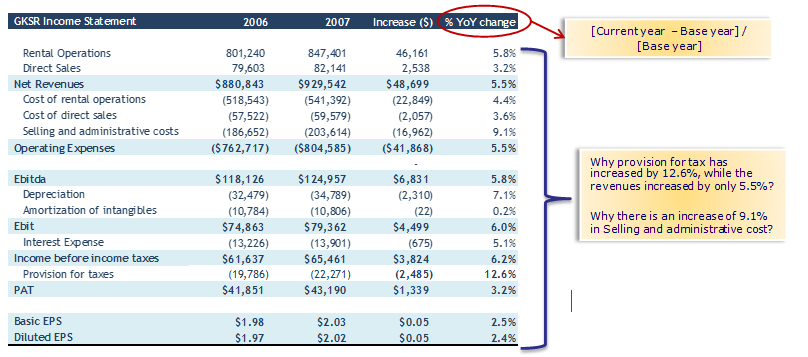

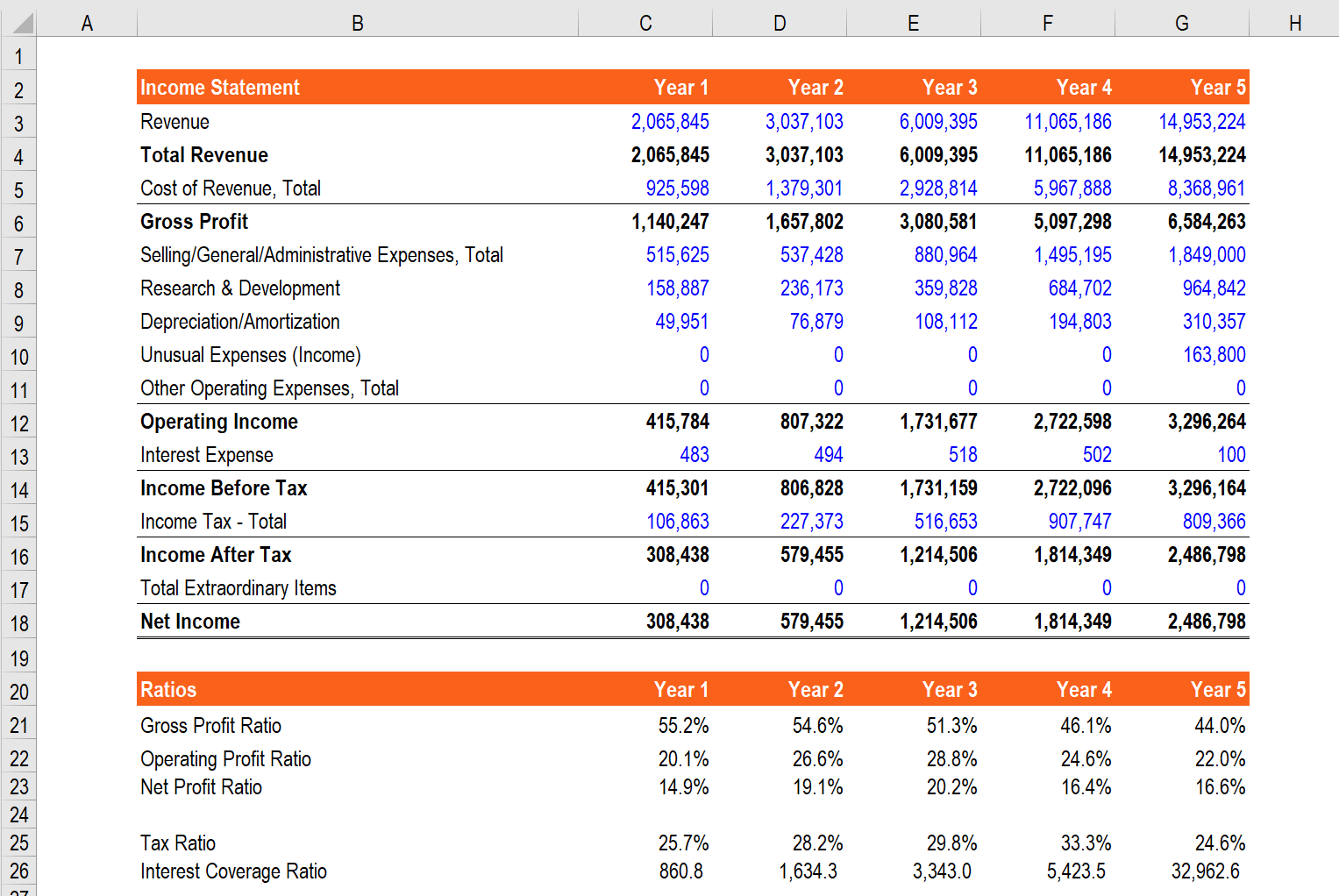

Horizontal financial analysis examples of bank liabilities. Horizontal analysis is the aggregation of information in the financial statement that may have changed over time. For example a 2 million profit year looks impressive following a 025 million profit year but not after a 10 million profit year. General Techniques for Financial Statement Analysis 124 How to Detect and Prevent Financial Statement Fraud Vertical Analysis As illustrated in the above example vertical analysis of the income statement uses total sales as the base amount and all other items are then analyzed as a percentage of that total.

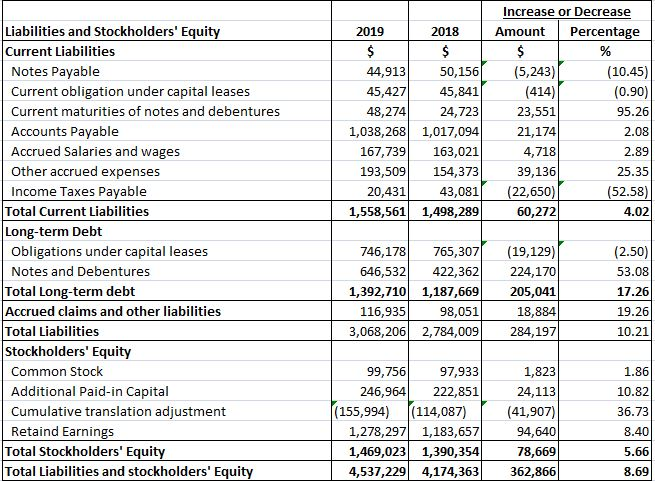

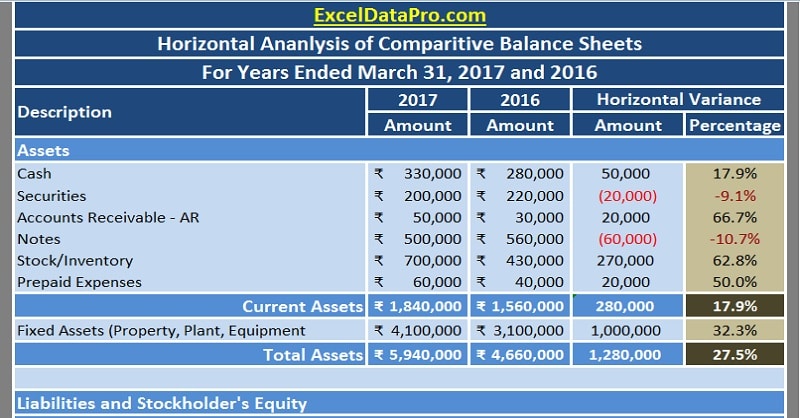

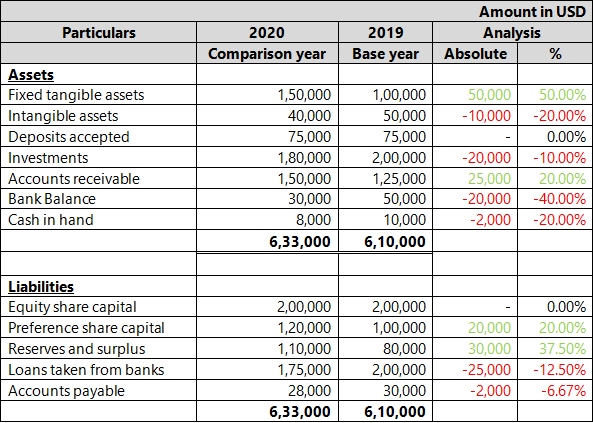

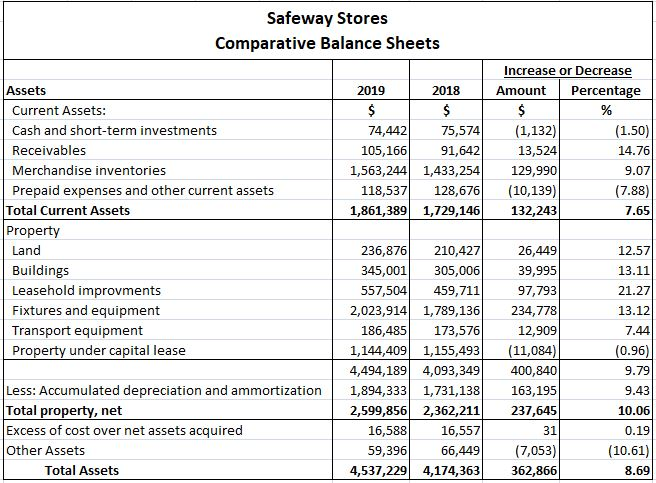

Financial Statement Analysis is a method of reviewing a nd analyzing a. Horizontal analysis of financial statements is a technique used to evaluate trends and growth pattern of financial performance over time by comparing historical data such as line items and financial ratios over a number of accounting period. Horizontal analysis is facilitated by showing changes between years in both Rupees and age form.

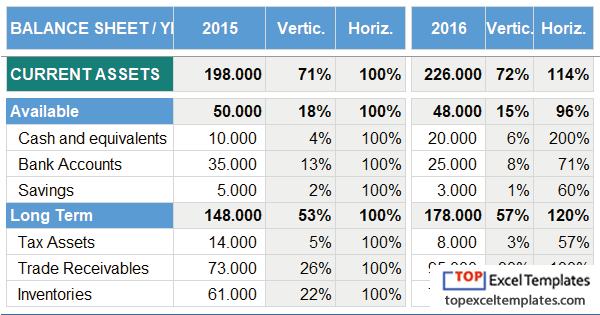

Horizontal Analysis or Tre nd Analysis. Horizontal analysis is the technique of evaluating financial statements to know the changes in the amounts of corresponding financial items over a period. Cash and cash equivalents accounts receivable.

Check IRPTR to see if the taxpayer filed a Report of Foreign Bank and Financial Accounts FinCEN Form 114 formally TD F 90-221 which indicates the taxpayer has a financial interest in or signature authority over a foreign financial account that has an aggregate value greater than 10000 at any time during a calendar year. 1 Horizontal and Vertical Analysis. Horizontal Analysis is very useful for Financial Modeling and Forecasting.

The analysis computes the percentage changes in each income statement amount at the far right. Generally speaking also for banks. Step 1 Perform the horizontal analysis of income statement and balance sheet historical data.

As compared to the last year s. Current Assets only consider short-term liquidity in-flow and are thus expected to be due within one year eg. ANALYSIS TOOLS HORIZONTAL TREND ANALYSIS evaluates a series of financial statement data over a period of time.