Outrageous Significant Accounting Policies For Private Limited Company

Accounting policies shall be disclosed for all material components.

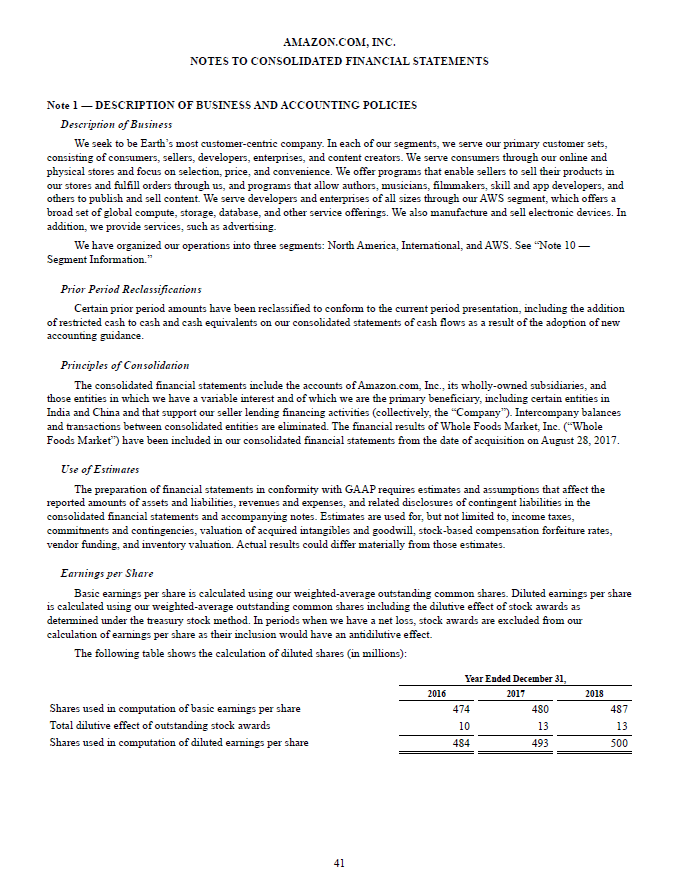

Significant accounting policies for private limited company. Cash flow statement A small company is not required to produce a cash flow. Significant Accounting Policies Basis of accounting - These financial statements have been prepared in accordance with the Generally Accepted Accounting Principles in India Indian GAAP including the Accounting Standards notified under Section 133 of the Companies Act 2013 read with Rule 7 of the Companies Accounts Rules 2014 and the relevant provisions of the Companies Act. Ii Depreciation on assets has been provided based on useful life prescribed in Schedule II of the Companies Act 2013 on straight line basis.

BASIS OF PREPARATION OF FINANCIAL STATEMENTS These financial statements have been prepared to comply with Accounting Principles Generally accepted in India Indian GAAP the Accounting Standards notified under the Companies Accounting Standards Rules 2006 and the relevant provisions of the Companies Act 1956. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion on. Significant Accounting Policies a Basis of Preparation The financial statements are prepared in accordance with the Indian Generally Accepted Accounting Principles GAAP applicable Accounting Standards issued by The Institute of Chartered Accountants of India and under the historical cost convention on accrual basis.

Such disclosure helps users of financial statements eg investors creditors vendors to understand. A Basis of Accounting The Company follows the Mercantile System of Accounting and recognizes Income Expenditure on Accrual Basis except interest on Fixed Deposits which are account for on as and when incurred. Significant accounting policies and notes to the accounts for the year ended March 31 2013.

Basis of consolidation a These consolidated financial statements for the. Iii Expenses are accounted on. In deciding whether a particular accounting policy shall be disclosed management considers whether disclosure will assist users in understanding how transactions other events and conditions are reflected in the reported financial performance and financial position.

Dividend Policy----- The Company has not yet adopted a policy regarding payment of dividends. Significant accounting policies Disclosure of accounting policies 1. B Use of Estimates.

Significant Accounting Policies. Accounts are prepared on Historical Cost convention and as a going concern. Summary of Significant Accounting Policies.

/paper-with-title-international-financial-reporting-standards--ifrs---850740234-6e303822ed5e4800b523b0ac24db396c.jpg)