Divine Expected Credit Loss Ind As

Ind AS 109 introduces a requirement to compute Expected Credit Loss ECL on all financial assets at.

Expected credit loss ind as. Ind AS 109 similar to IFRS 9 significantly impacts financial services organisations. The loss allowance for financial assets with objective evidence of impairment by CUX. The expected loss impairment model would apply to loans debt securities and trade receivables measured at amortized cost or at FVOCI fair value through other comprehensive income.

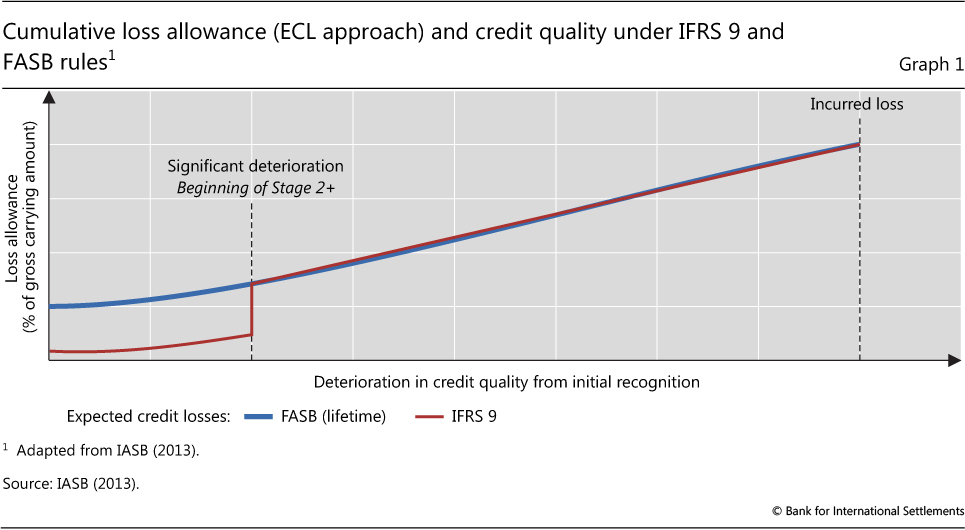

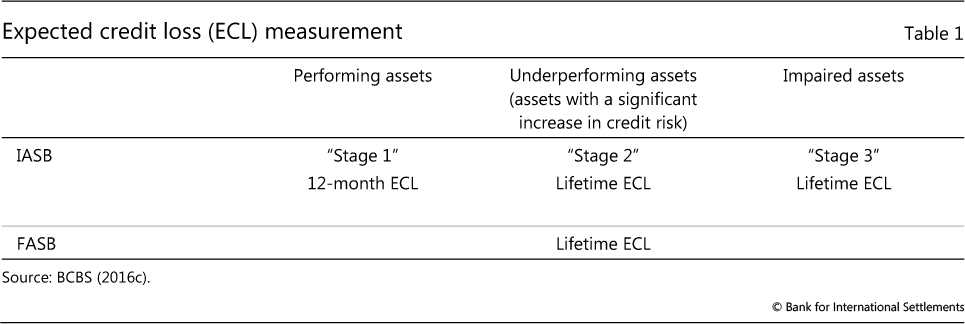

Stage 3 includes financial assets that have objective evidence of impairment at the. Lifetime ECL are the expected credit losses that result from all possible default events over the expected life of the financial instrument. The expected increase in unemployment in Region X caused a net increase in financial assets whose loss allowance is equal to lifetime expected credit losses and caused a netincrease of CUX in the lifetime expected credit losses allowance.

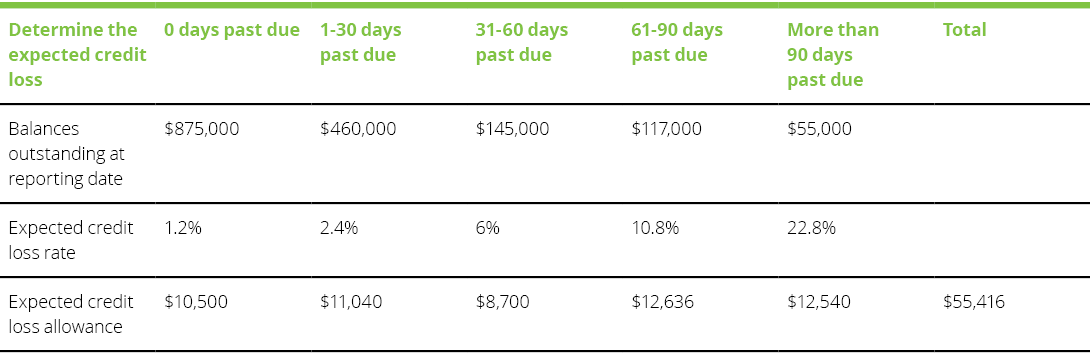

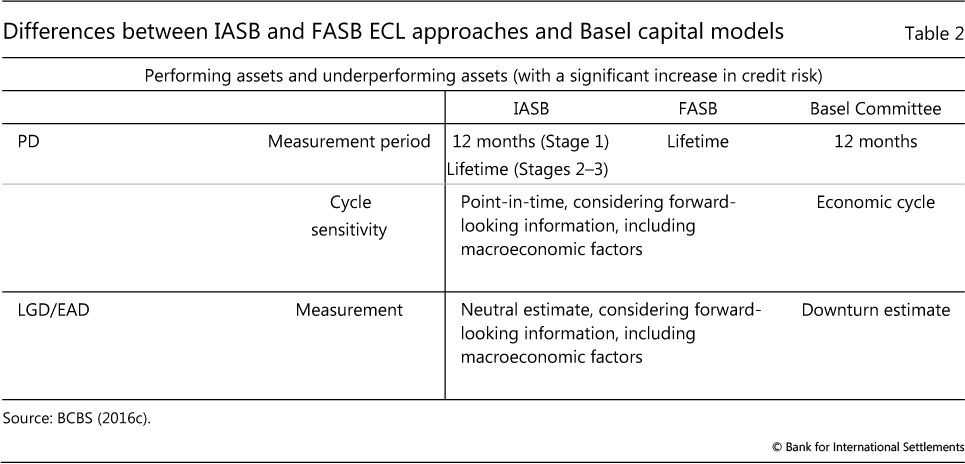

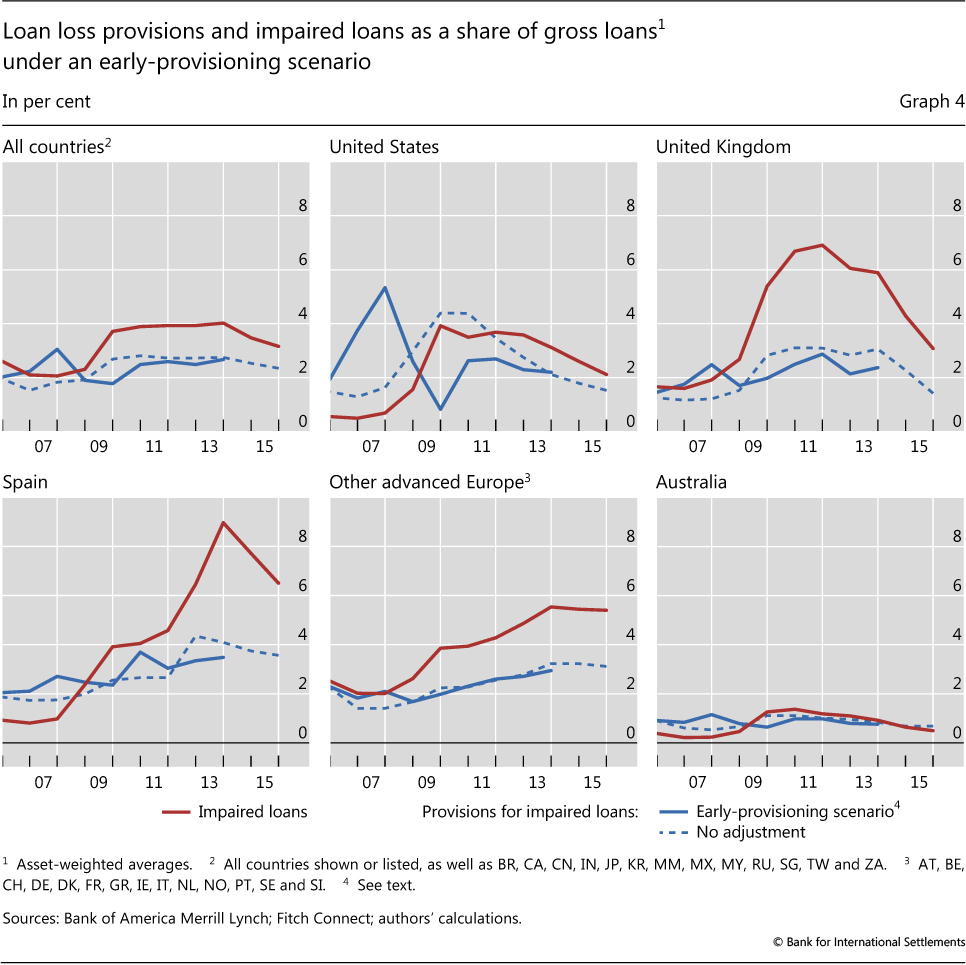

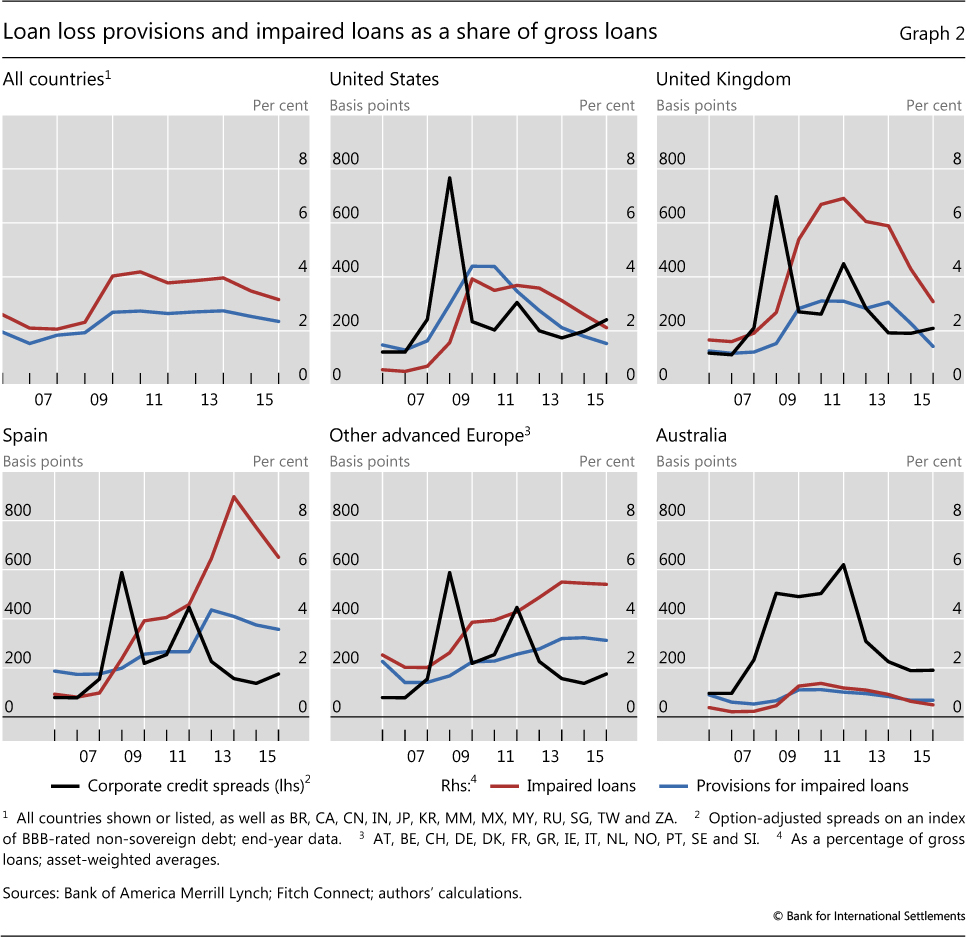

In the post Ind AS era Ind AS 109 elaborates on how to calculate bad debts provision for trade receivables and how to arrive at the default percentages for each age group of trade receivables. Basel and IASB have changed this basic framework to move to expected loss modelling framework where lenders are now expected to forecast losses that may happen in future months and years. Expected credit losses are the weighted average credit losses with the probability of default PD as the weight.

IND AS 109 requires entities to recognize and measure a credit loss allowance or provision based on an expected credit loss model ECL. As per Ind AS 109 impairment losses of financial assets should be recognised in the amount of Expected Credit Loss ECL. Lifetime ECL are the expected credit losses that result from all possible default events over the expected life of the financial instrument.

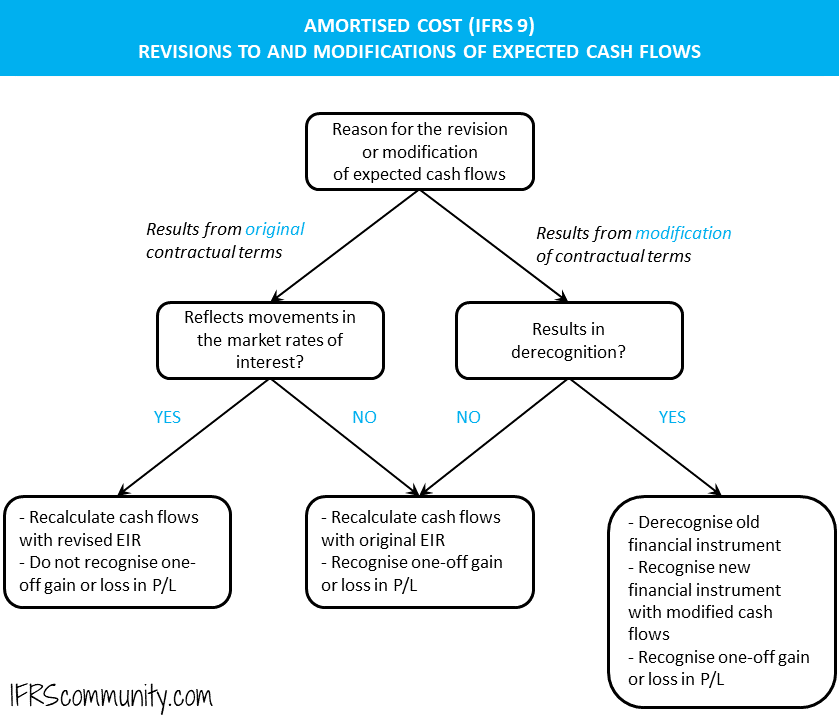

Comprehensive summary on approaches of Expected Credit Loss ECL under Ind AS 109 Financial Instruments. The objective of this standard is to establish reporting principles that will present relevant and useful information to users of financial statements for the assessment of the amount timings and uncertainty of the entitys future cash flows. This is a big leap in framework and brings.

Credit losses are not just an issue for banks. TreasuryConsultingGroup TCG RahulMagan TreasuryX RahulMaganYouTubeForeignExchangeMaverickThinkers ImpetusX Rahul Magan Treasury Fixed Income. Accounting thus becomes more of a forward-looking credit-risk management.