Stunning Form No 26as Meaning

CBDT in May 2020 vide notification 302020 notified the revised form 26AS to make it more comprehensive.

Form no 26as meaning. Form 26AS is a consolidated tax deduction statement which keeps all your annual record of any tax paid by you or on your behalf. Form 26AS confirms that your tax deducted tax paid by you is received by the government. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal.

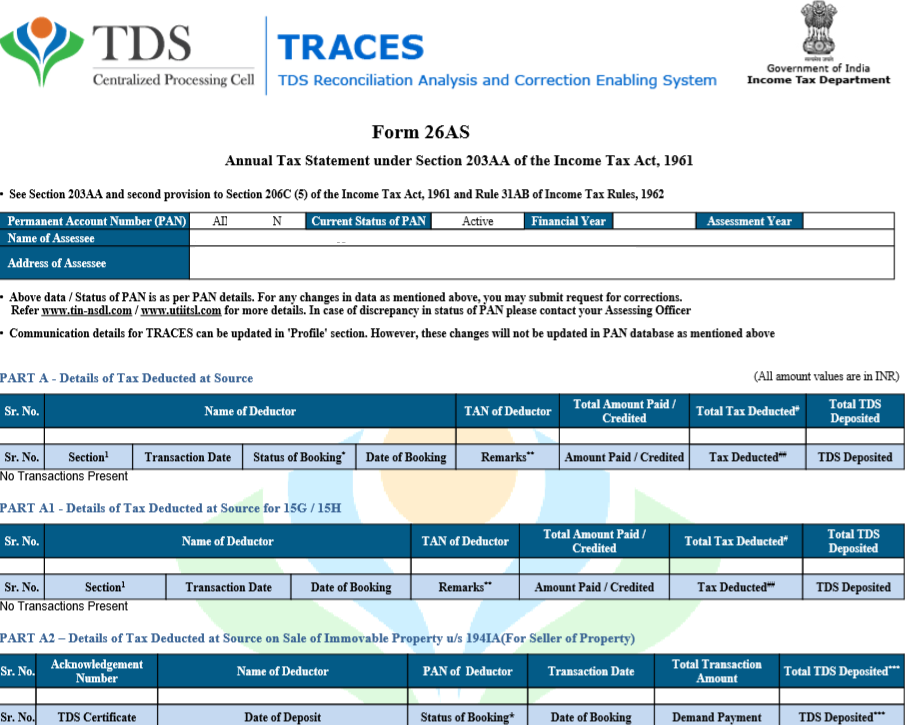

Form 26AS is divided in six parts. Form 26AS is an annual statement which includes all the details pertaining to the tax deducted at source TDS information regarding the tax collected by your collectors the advance tax you have paid self-assessment tax payments information regarding the refund you have received over the course of a financial year regular assessment tax that you have deposited and information regarding high-value. It is issued by the Income Tax Department and is a kind of record of your incomes and taxes.

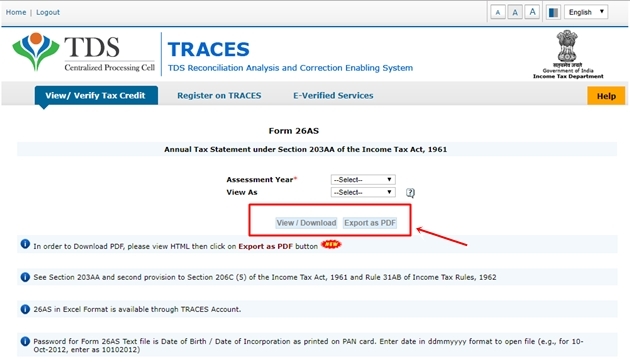

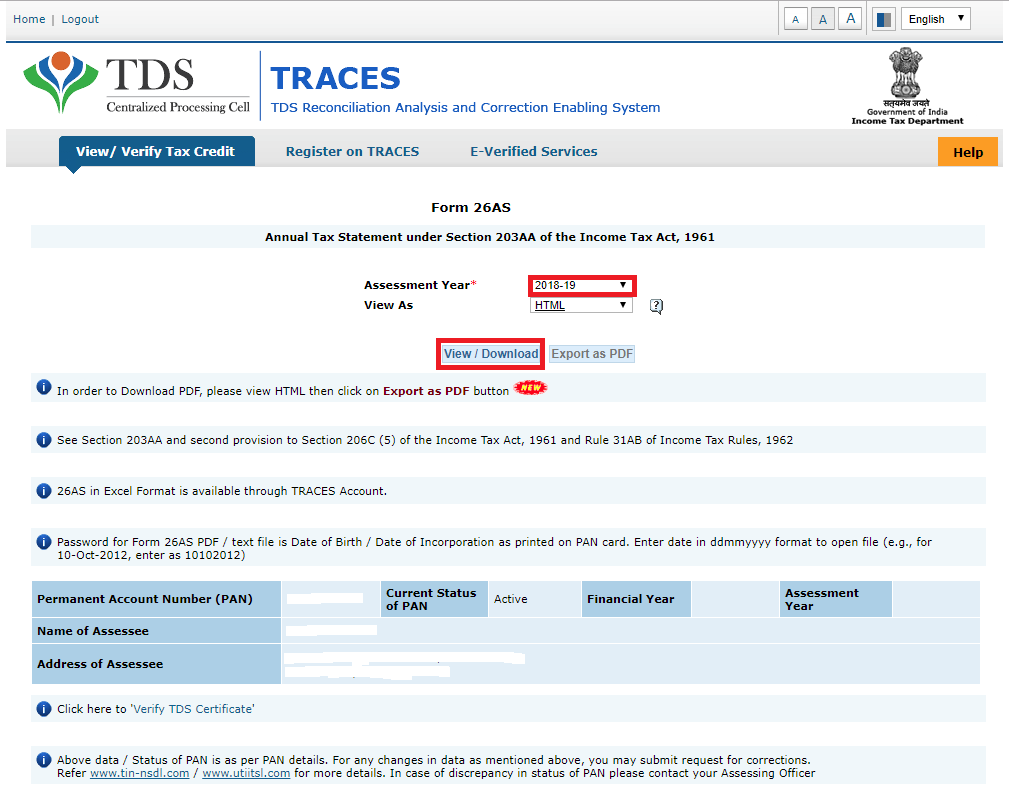

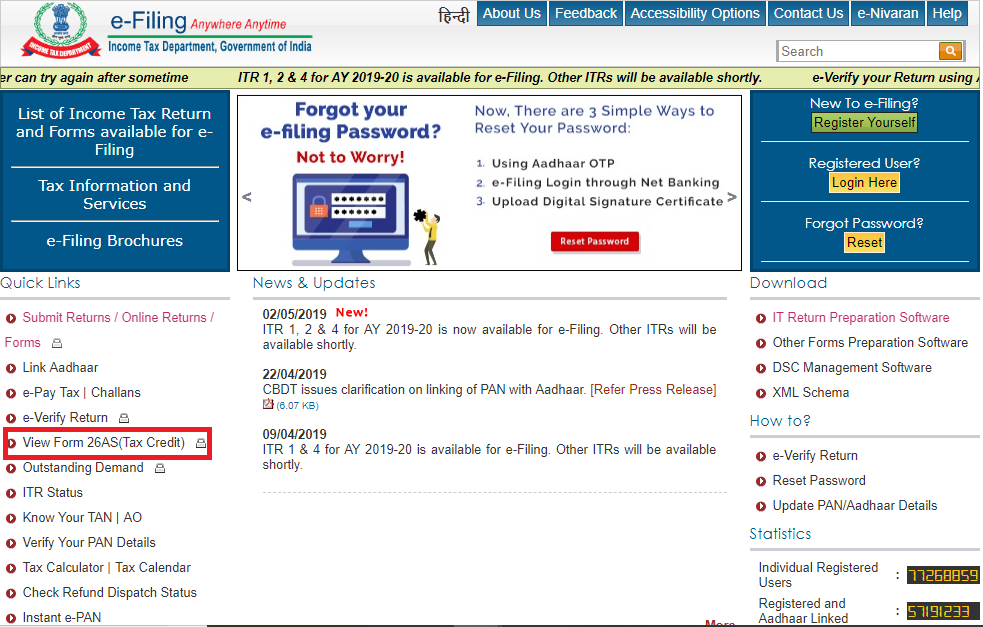

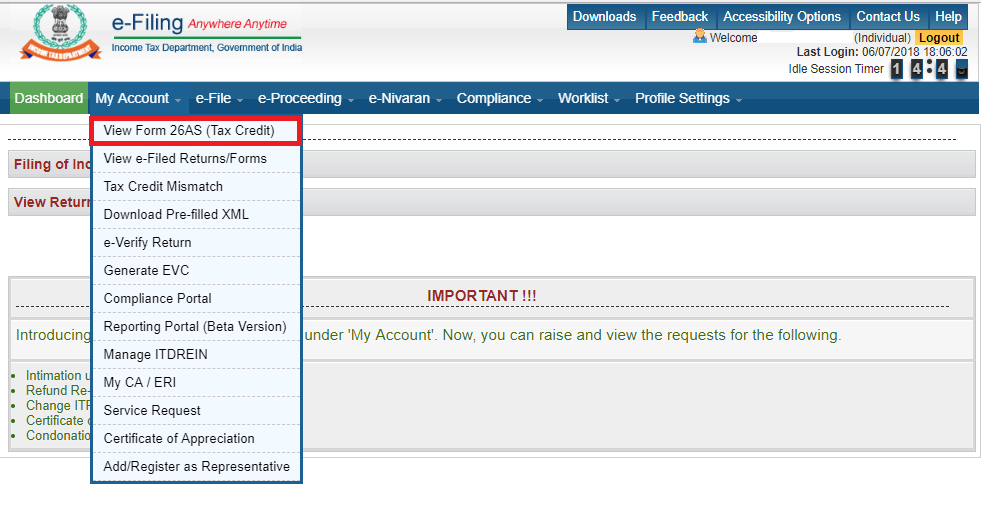

View Tax Credit Statement Form 26AS Perform the following steps to view or download the Form-26AS from e-Filing portal. The IT department also tallies all. Here we can see information about total TDS deducted by deductor during the year.

Table of Contents. Logon to e-Filing Portal wwwincometaxindiaefilinggovin. In other words form 26AS tax credit statement is a consolidated income tax statement.

Form 26AS is a consolidated Income Tax statement issued to the PAN holders. This form and its use by tax authoritiestax payers is governed by Section 203AA Rule 31AB of the Income Tax Act 1961. What is Form 26AS.

It is your asset deposited with Income tax department. Form 26AS is in essence an acknowledgement of sorts when it comes to Tax Deducted at Source TDS. 19 June 2012 26 as is Income tax deposits by way TDSTCS advance self assessment tax etc.