Out Of This World Current Tax Assets In Balance Sheet

Cash and Cash Equivalents.

Current tax assets in balance sheet. A current asset is any asset that will provide an economic benefit for or within one year. It is the opposite of a deferred tax liability which represents income taxes owed. As per the requirement of Ind AS 12 Income Taxes.

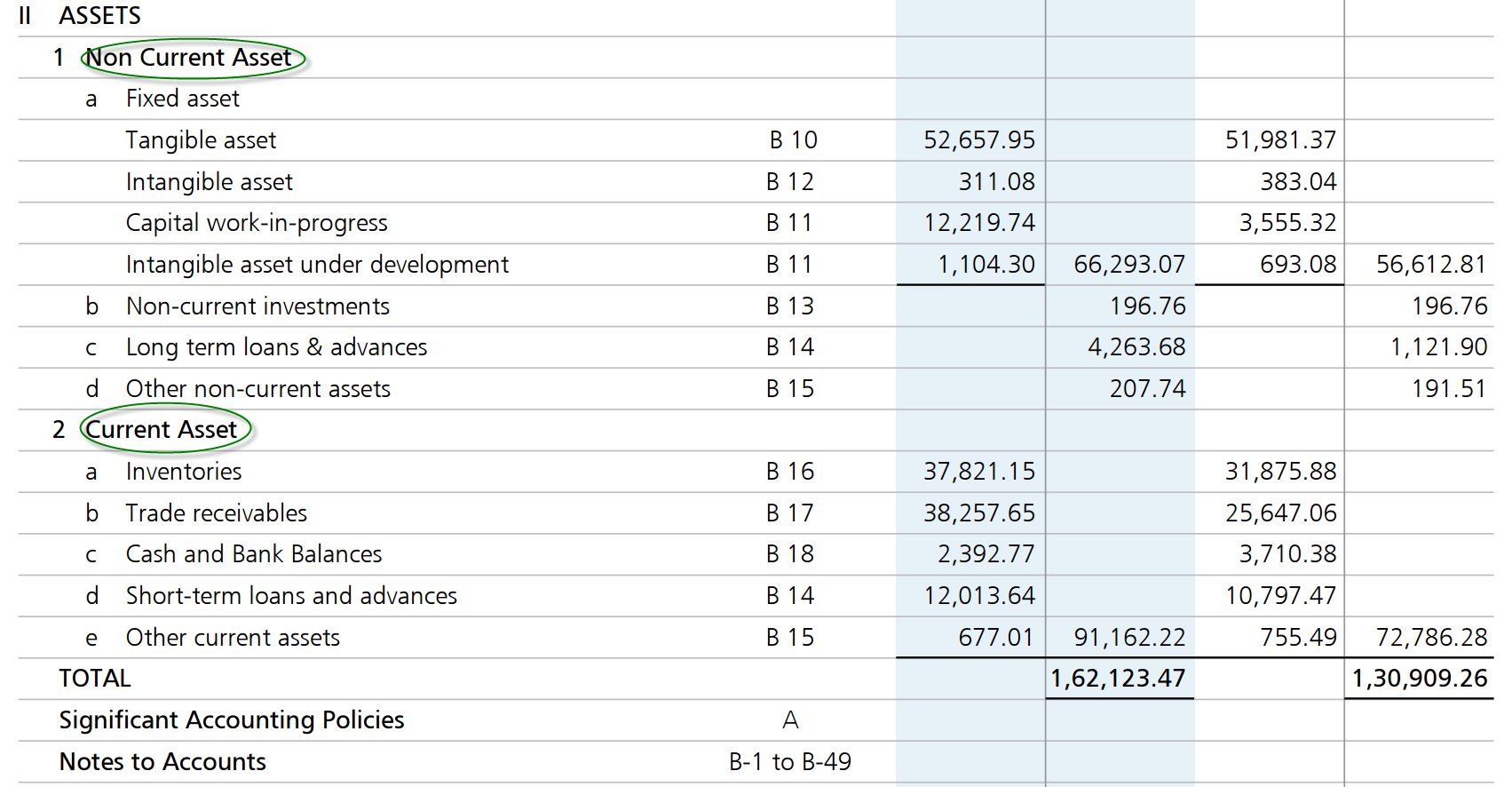

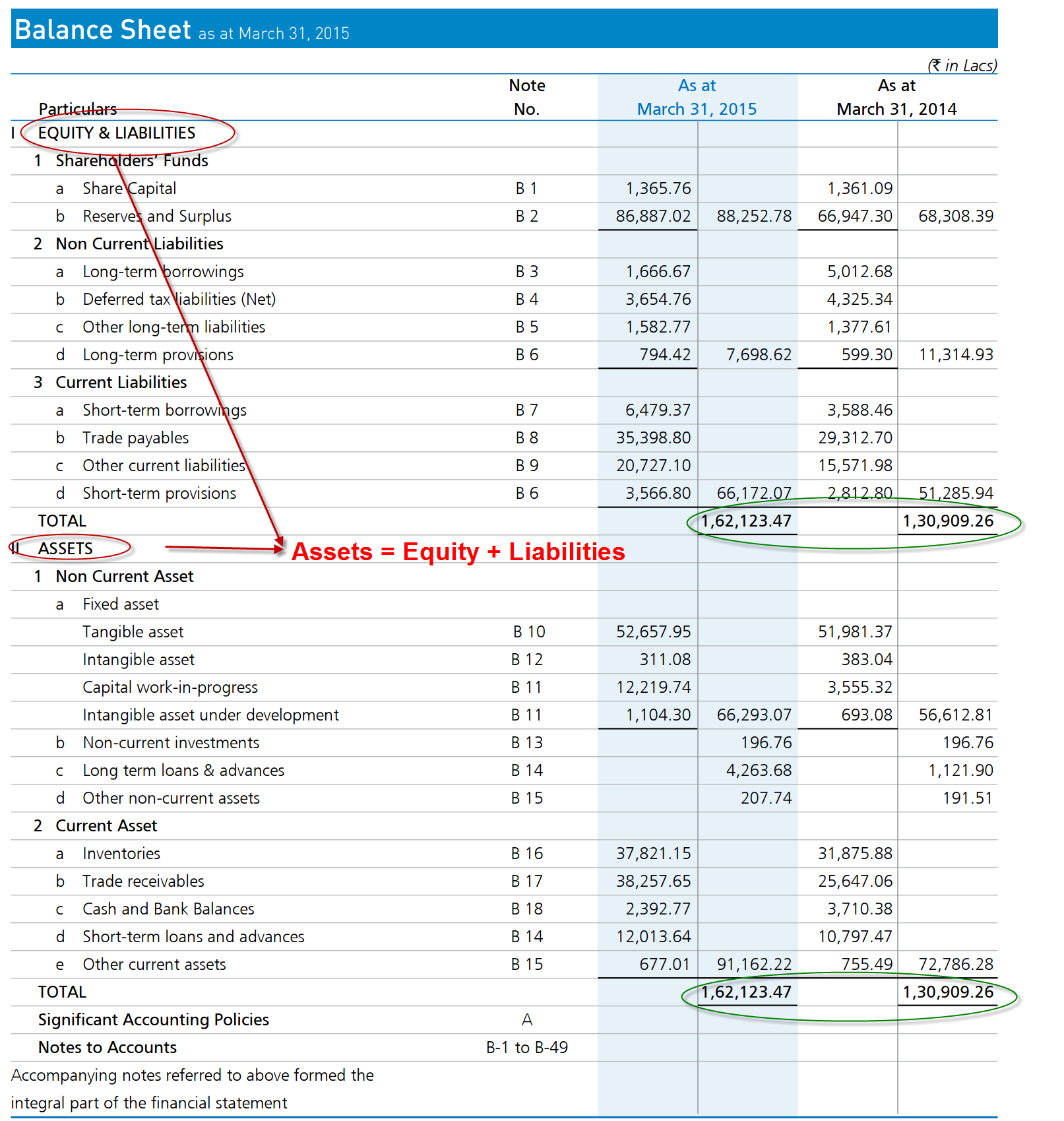

Current tax assets and liabilities are measured at the amount expected to be paid to recovered from taxation authorities using the rateslaws that have been enacted or substantively enacted by the balance sheet date. For instance a company may report on its balance sheet a fleet of 10 cars as assets worth 200000. Lets take a look at the assets of Alta Genetics.

Small businesses like yours use assets to generate more sales and increase their bottom linealso known as net income. The larger income tax payable on tax returns creates a deferred tax asset which companies can use to pay for deferred income tax expense in the future. Because these assets are easily turned into cash they are sometimes referred to as liquid assets.

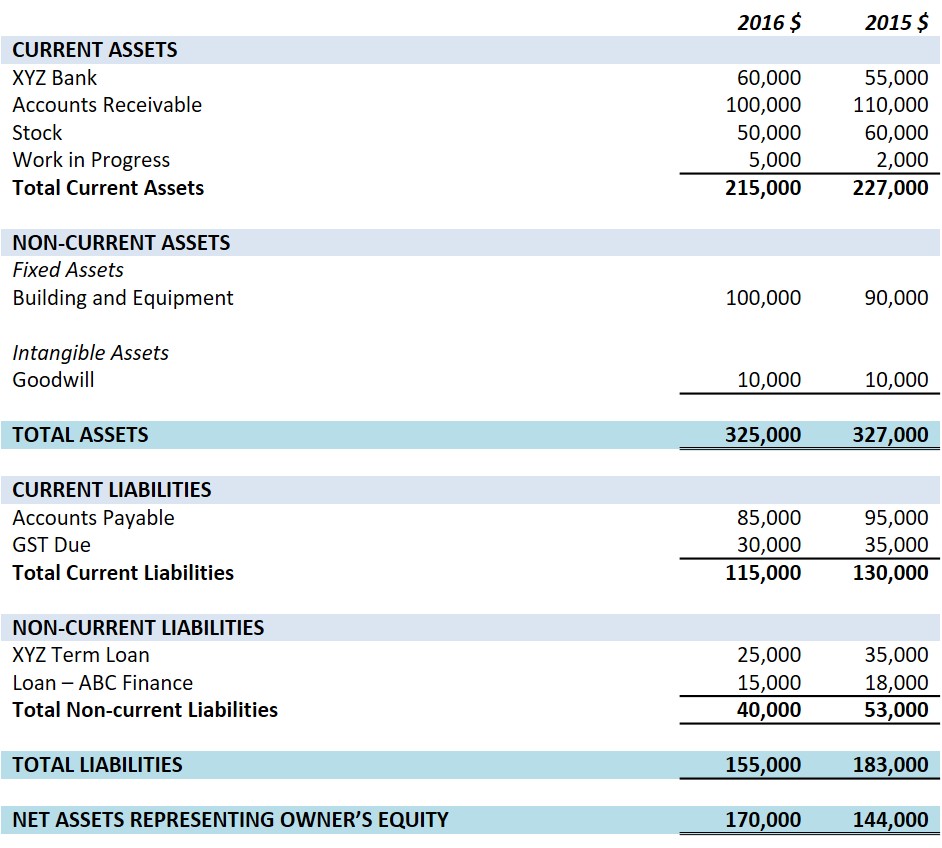

Given the above information the companys December 31 balance sheet will report 1500 as the current asset prepaid expenses. Deferred taxes are items on the balance sheet that arise from overpayment or advance payment of taxes resulting in a refund later. Current assets on the balance sheet include cash cash equivalents short-term investments and other assets that can be quickly converted to cashwithin 12 months or less.

There are some assets which can be disposed to generate cash immediately which are known as liquid assets and some other which are held to generate cash within some time within one year but not immediately. Tax Basis Balance Sheet Assets The difference between the way you report assets in a regular balance sheet and a tax basis balance sheet is that tax basis balance sheets reflect the current tax basis value of assets. Current Assets are the assets which can be converted in cash within a short period of time not more than one year.

Income taxes payable a current liability on the balance sheet for the amount of income taxes owed to the various governments as of the date of the balance sheet. Under Current Assets theyve got five items. Prepaid expenses is the money set aside for goods or services before you receive delivery.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)