Brilliant Reformulated Income Statement Example

Articulation of Reformulated Financial Statements Income Statement NIt OIt -NFEt Balance Sheet Net operating assets Net financial obligationsNOAt NOA t -1 OIt - Ct-It NFOt NFOt-1 NFEt Ct-It dt Common stockholders equity CSEt CSEt-1 OIt NFEt - dt Cashflow Statement FCF or Ct-It dt Ft.

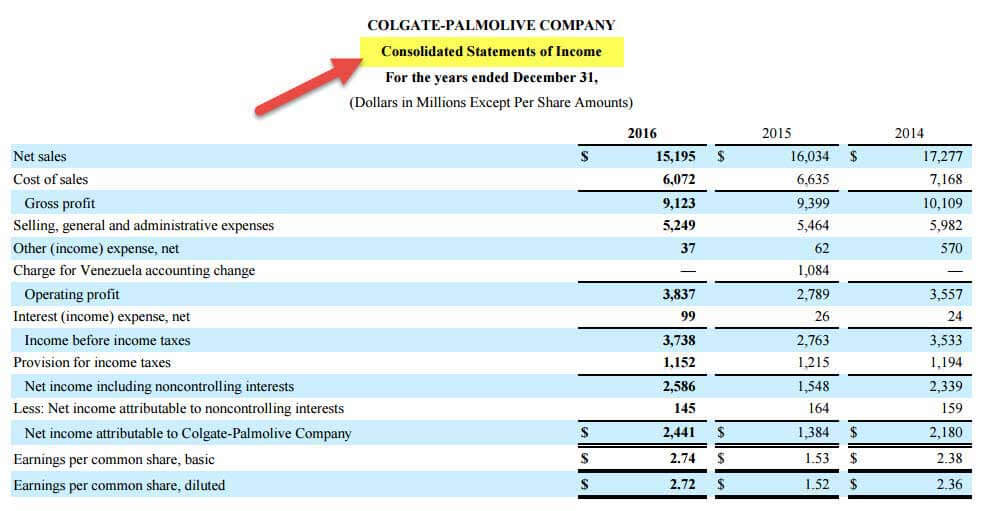

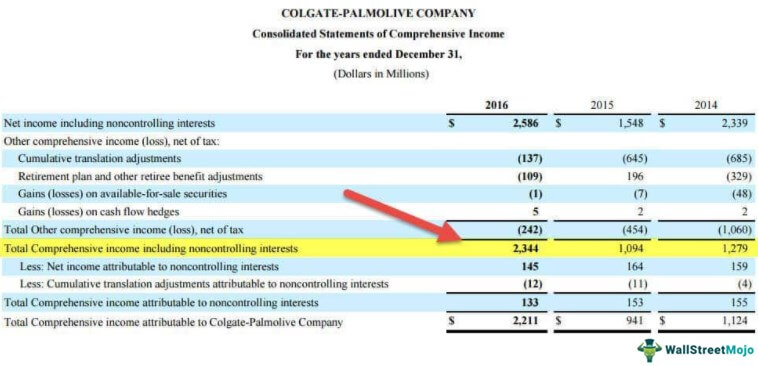

Reformulated income statement example. The total tax reported was 3612 million on income in the income statement minus 4002 million in tax benefits from stock options. Net operating assets NOA in contrast to total assets used in ROA analysis are calculated from balance sheet components. Tax is allocated to components of the statement with no allocation to items reported on an after-tax basis Reformulated Comprehensive Income Statement.

The reformulated statement combines the two statements and separates the two types of operations. This statement examples of financial statements reformulated income statement analysis is. Totals on the income statement and balance sheet.

First we see that sales increased from 2017 to 2018 which appears to be a good sign for XYZ. The income statement is very thorough in highlighting these details. Testing Relationships in Reformulated Income Statements Medium Fill in the missing numbers indicated by capital letters in the following reformulated income statement.

The Reformulated Income Statement 1 1. Reformulation of a Balance Sheet and Income Statement EasyReformulate the following balance sheet and income statement for a manufacturing concern. The Reformulated Income Statement Rather than reporting other comprehensive income within the equity statement Chubb reports a separate comprehensive income statement below the income statement in the case.

Amounts are in millions of dollars. Reformulated financial statement - YouTube. The reformulaon of balance sheet and income statement enforces the mainrule onecannotvalueacompanywithoutknowingthebusiness Knowingthebusinessisnecessarytodisnguishbetweenoperangand.

What is the firms effective tax rate on operating i ncome. Not only does it explain the cost of goods sold which relate to the operating activities but it also includes other unrelated costs such as taxes. O Direct calculation better for forecasted statements o Tax shield approach better for reconciling historical statements 1.