Casual Proforma Of Reconciliation Statement

On the bank statement compare the companys list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in transit.

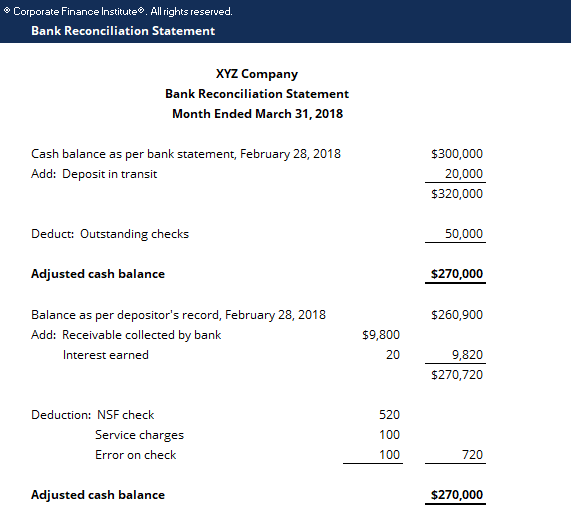

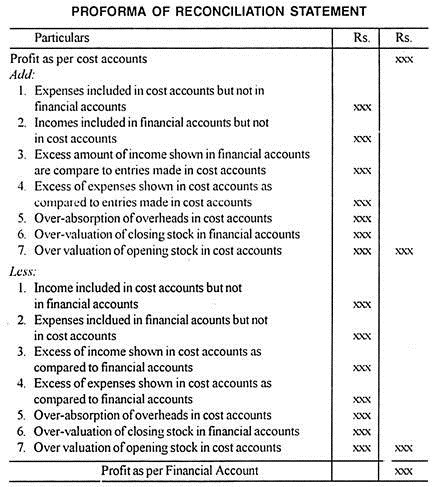

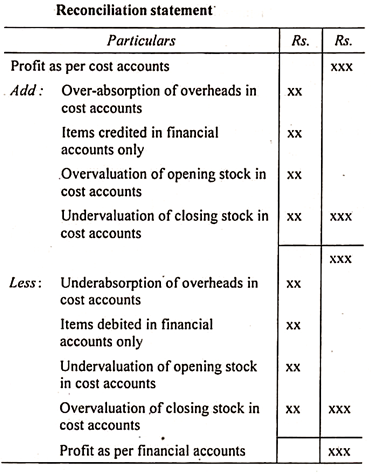

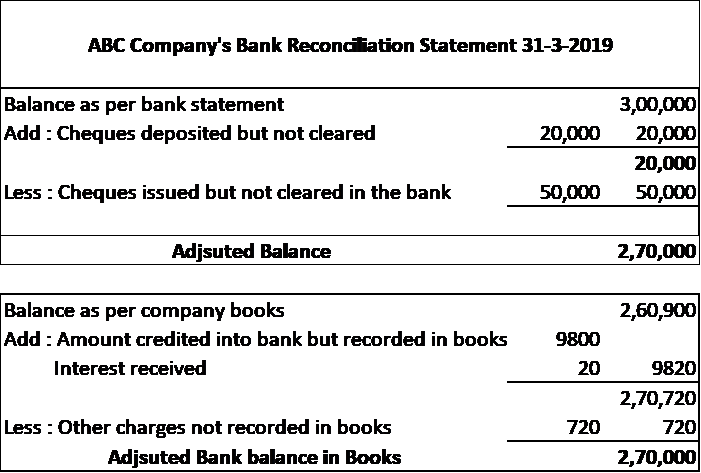

Proforma of reconciliation statement. The proforma bank reconciliation statement will be shown below. Deduct any outstanding checks. Below is a brief format of the Bank Reconciliation Statement.

Format for Bank Reconciliation Statement. Proforma for Reconciliation Cell for uploading on Website of AG Office Reconciliation Statement for the month of 2020 of. BRS shows causes of errors between cash book and bank statement.

Moreover financial and cost books are kept separately. A bank reconciliation is a process where individuals or organizations make sure that the financial statements figures perfectly accord with their respective bank accounts paperwork. Balance per bank statement.

You can use Bank Reconciliation Statement Format in your manual and computer practice. It ensures that payments have been processed and money has been deposited on the same date. As part of the process a summary statement or financial audit report that features the withdrawals deposits and other banking activities has to be made.

Following are the transactions which usually appear in companys records but not in the bank statement. Here I am giving the Performa of comparative income statement. Using the cash balance shown on the bank statement add back any deposits in transit.

An accountant prepares the reconciliation statement once a month. Proforma or Format of the bank reconciliation statement when starting with the balance of cash book. Types of Bank Reconciliation Statement.