Nice Each Of The Following Accounts Is Closed To Income Summary

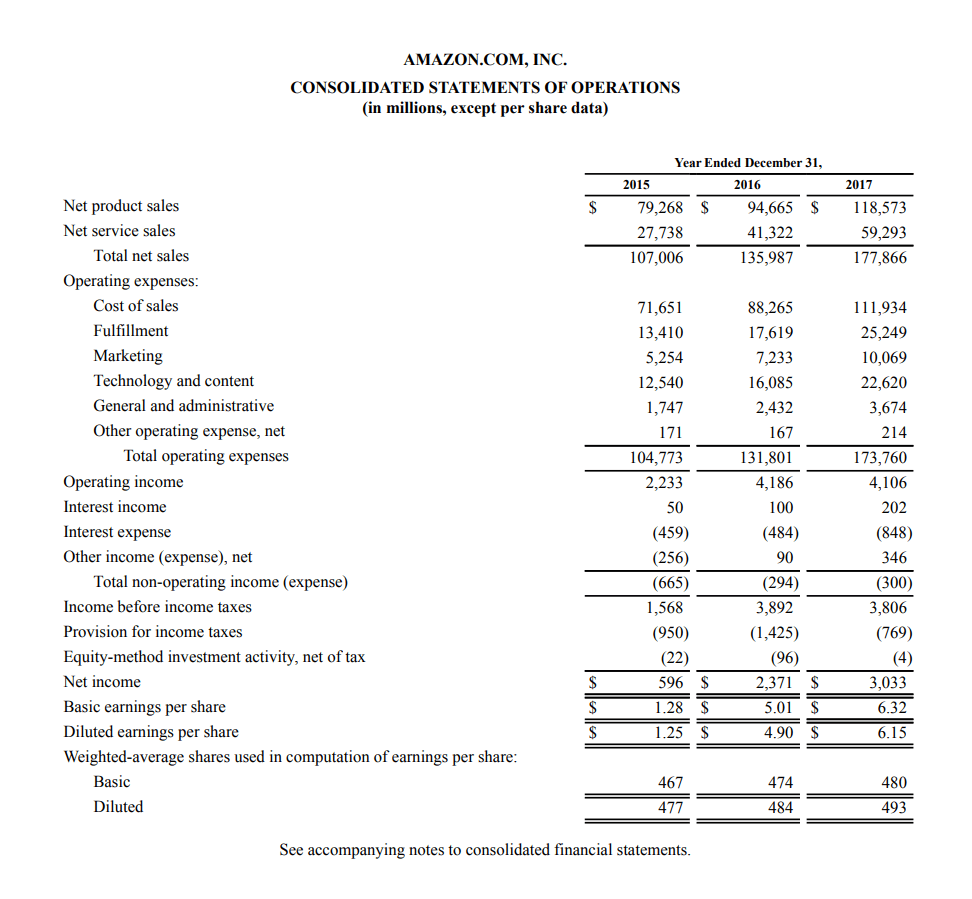

Taking the example above total revenues of 20000 minus total expenses of 5000 gives a net income of 15000 as reflected in the income summary.

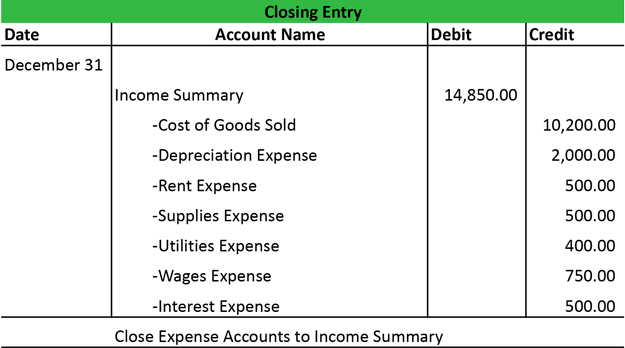

Each of the following accounts is closed to income summary. After the other two accounts are closed the net income is reflected. So that all assets liabilities and equity accounts. In addition the income summary account which is an account used to summarize temporary account balances before shifting the net balance elsewhere is also a temporary account.

Accounting Which of the following accounts is closed to Income Summary at the end of the accounting period. All of these are closed to Income Summary. Temporary accounts are the revenue expense and dividend accounts which measure activity for a specific time period.

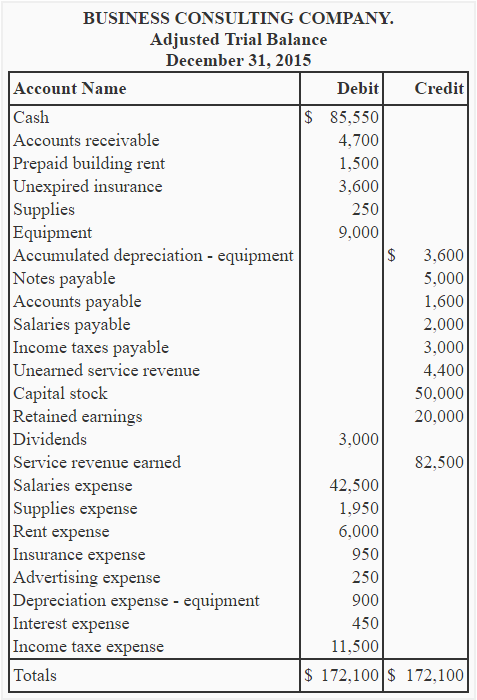

Each of the following accounts is closed to Income Summary except a. Each value will be debited and then credited to the account as one value as shown below. The trial balance above only has one revenue account Landscaping Revenue.

Accounting questions and answers. At the same date Debra Allen Capital has a credit balance of 1476000 and Debra Allen Drawing has a. Closing the revenue accounts transferring the credit balances in the revenue accounts to a clearing account called Income Summary.

After all revenue and expense accounts are closed the income summary accounts balance equals the companys net income or loss for the period. The most common types of temporary accounts are for revenue expenses gains and losses - essentially any account that appears in the income statement. 1 True False 5.

If the Income Summary has a debit balance the amount is the companys net loss. The income summary closes revenue accounts expenses accounts and dividend accounts. Each of the following accounts is closed to Income Summary except A.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)