Fabulous Restructuring Charges Income Statement

Restructuring charges may cost the company immediately but are beneficial in the long run.

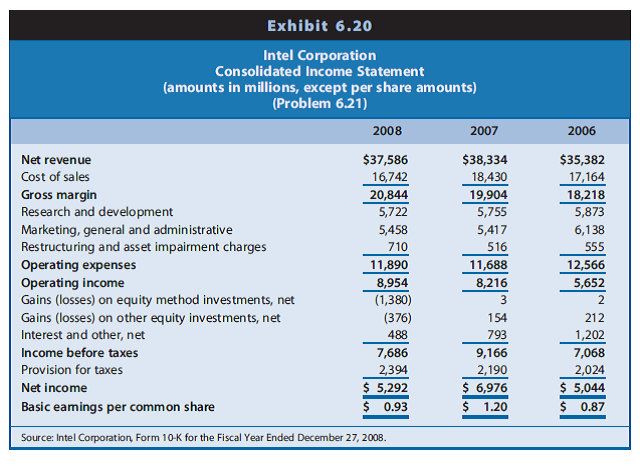

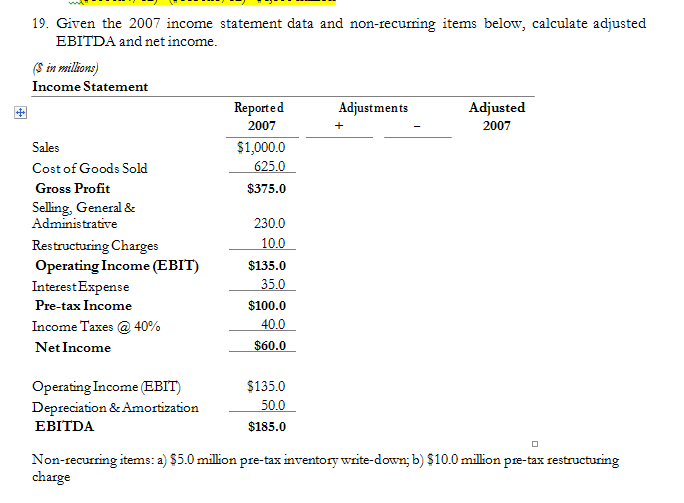

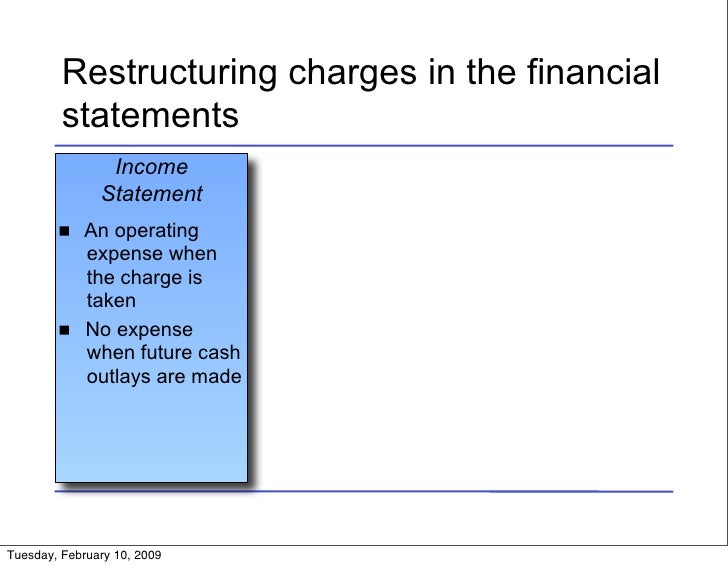

Restructuring charges income statement. Restructuring charges in the financial statements Income Balance Cash Flow Statement Sheet Statement An operating Creates a Non-cash portion expense when restructuring increases the charge is liability when the operating taken charge is taken activities when the charge is Liability is No expense taken reduced by when future cash amount of cash Cash outlays outlays are made outlays. Restructuring Charges Meaning The term restructuring expenses is also a footnote in the financial statements that describes the details relevant to the restructuring charges. Restructuring charges will often have a significant impact on a companys income statement as a result.

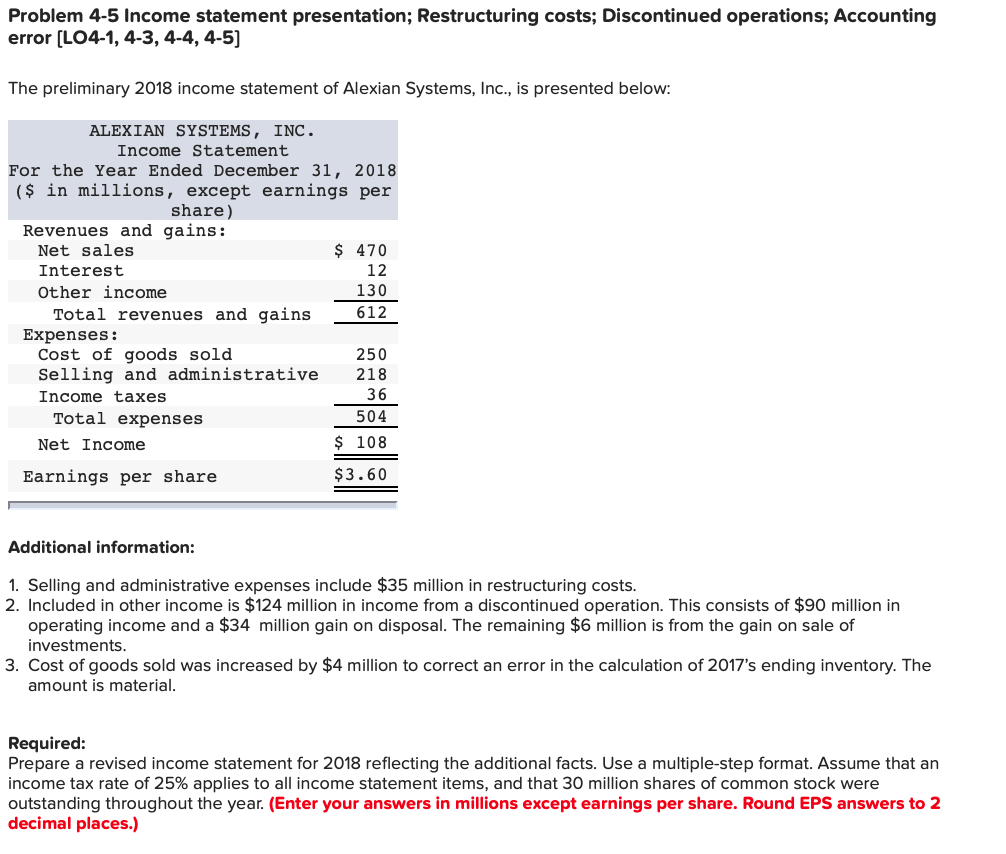

The use of restructuring charges is for the calculation of net income. Income Statement Presentation of Restructuring Charges SAB 67. Net income may be manipulated by inflating the amount for a restructuring charge.

A restructuring charge will be written in financial analysis as decreasing a companys operating income and diluted earnings. The requirements of SAB 67. The term restructuring expenses is also a footnote in the financial statements that describes the details relevant to the restructuring charges.

This cost is shown as a line item on the income statement. These write-offs are supposed to. Ad Find Income Statement Form.

They are commonly identified as restructuring charges unusual or nonrecurring items and discontinued operations. Restructuring charges are generally considered a component of income from continuing operations and separately disclosed if material Restructuring charges should not be preceded by a subtotal that could be construed as representing income from continuing operations before restructuring charges. For example if a company lays off a group of people and gives them 12 months of severance pay due at the end of each month the company incurs the expense when the people are laid off and recognizes it on the income statement then.

A restructuring accrual occurs when the restructuring is actually incurred. Us Financial statement presentation guide 367. Restructuring in business combinations acquiree vs.

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)