Cool Pro Forma Definition Accounting

Proforma Earnings Balance Sheet Cash Flow Statement Free Cash Flow Variance Analysis.

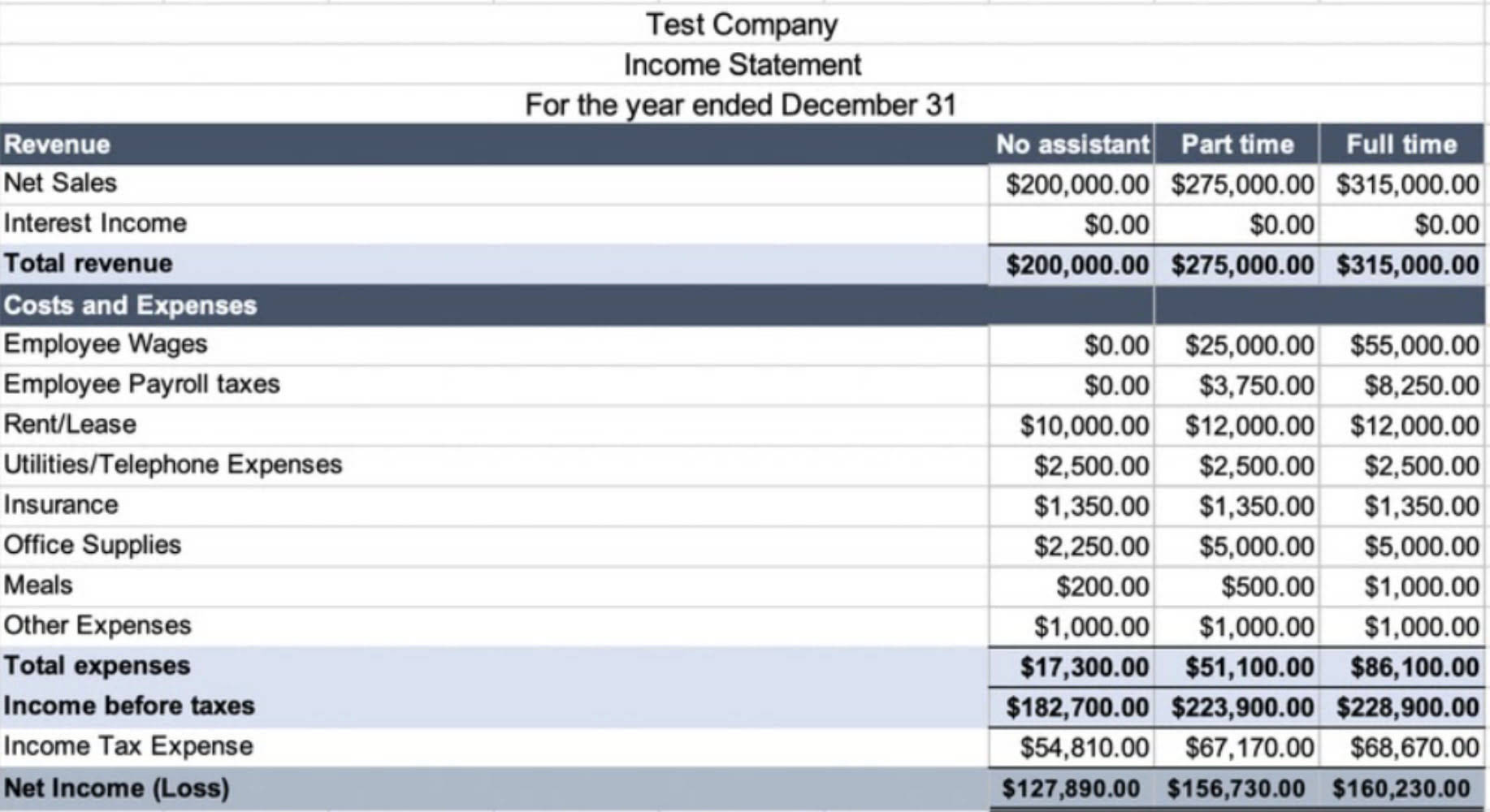

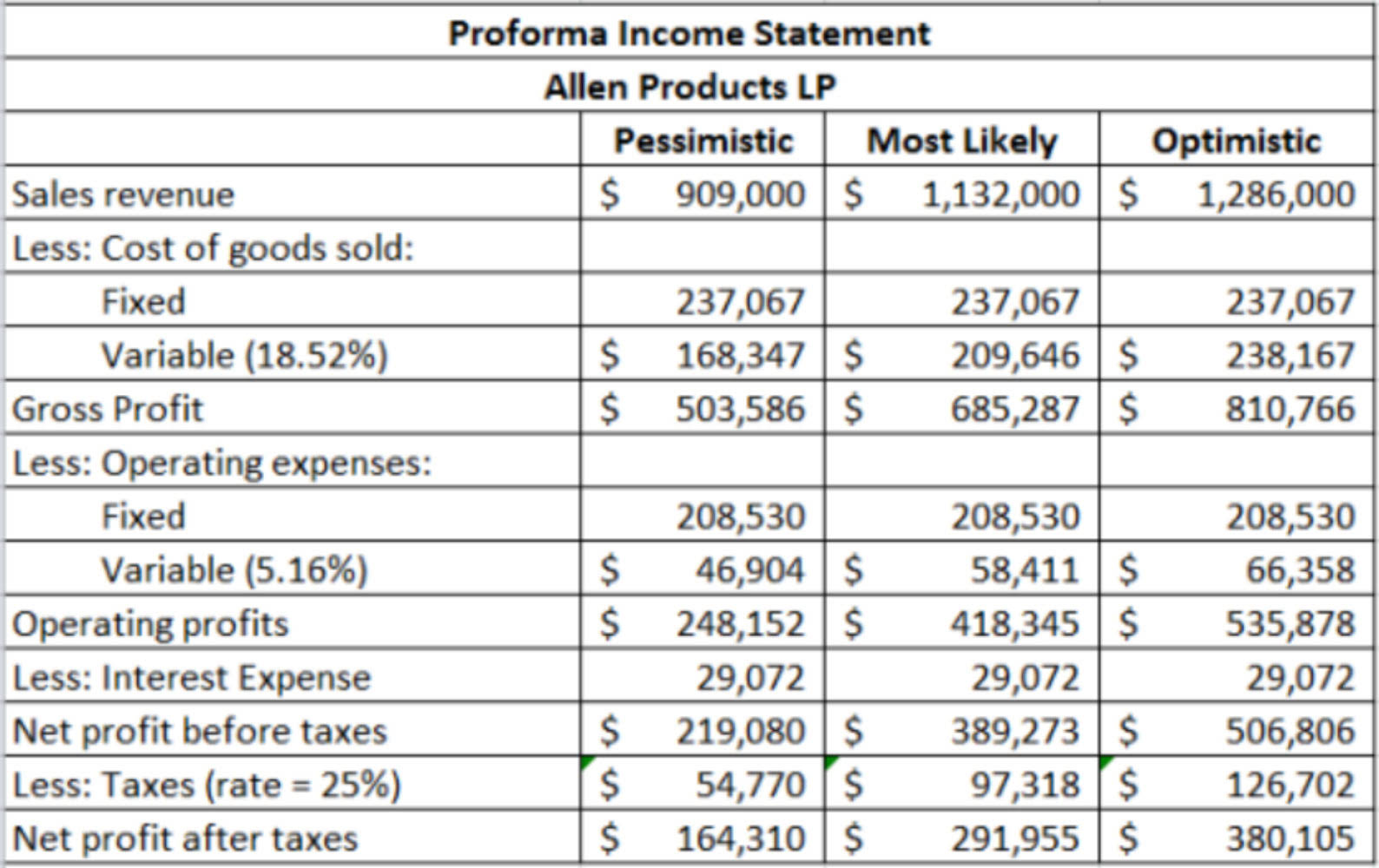

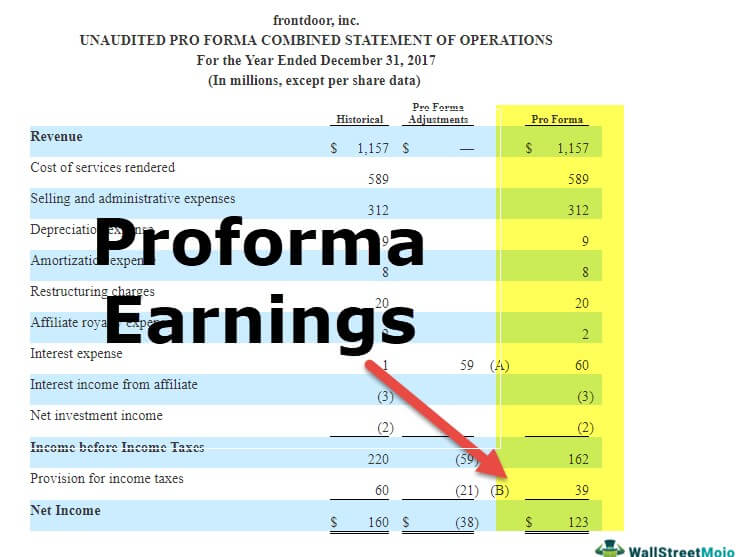

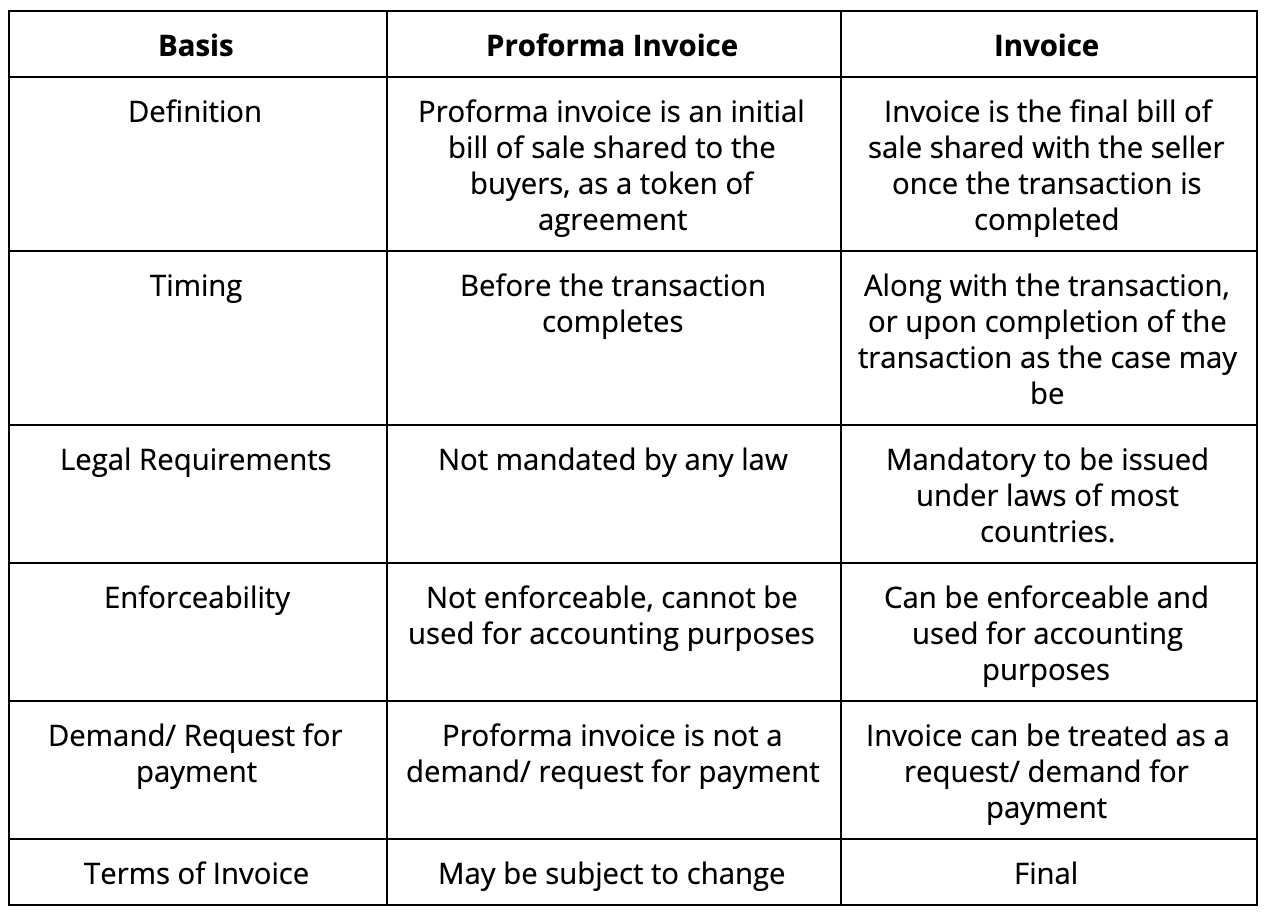

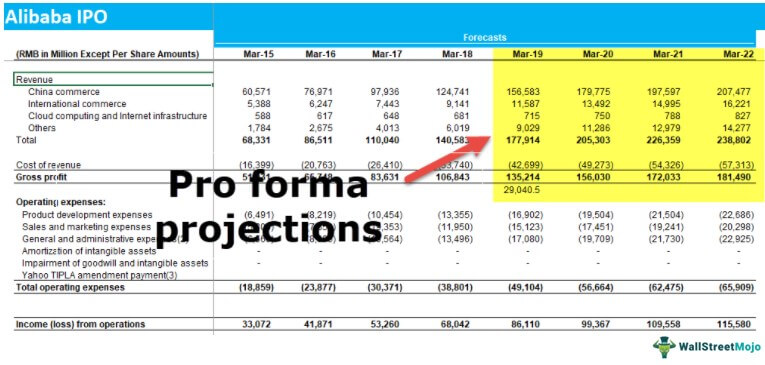

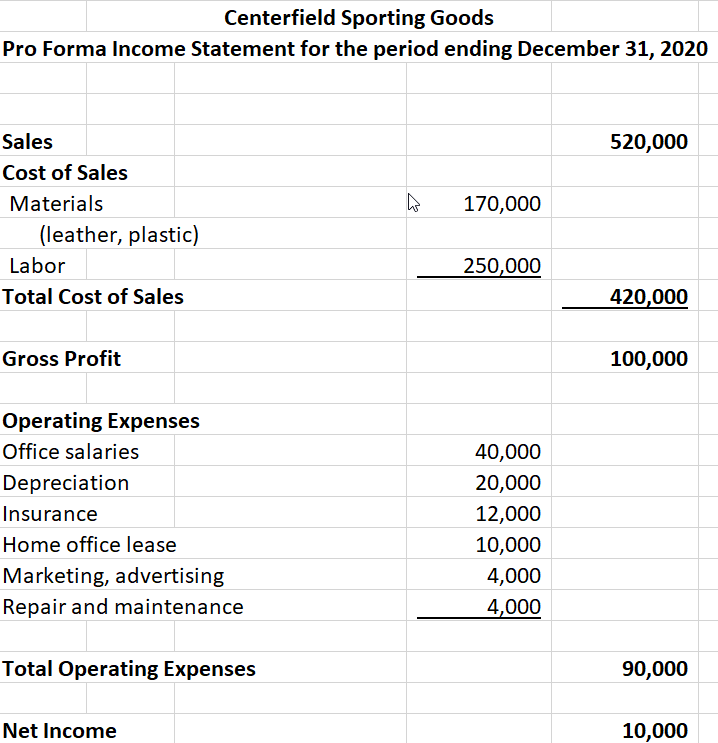

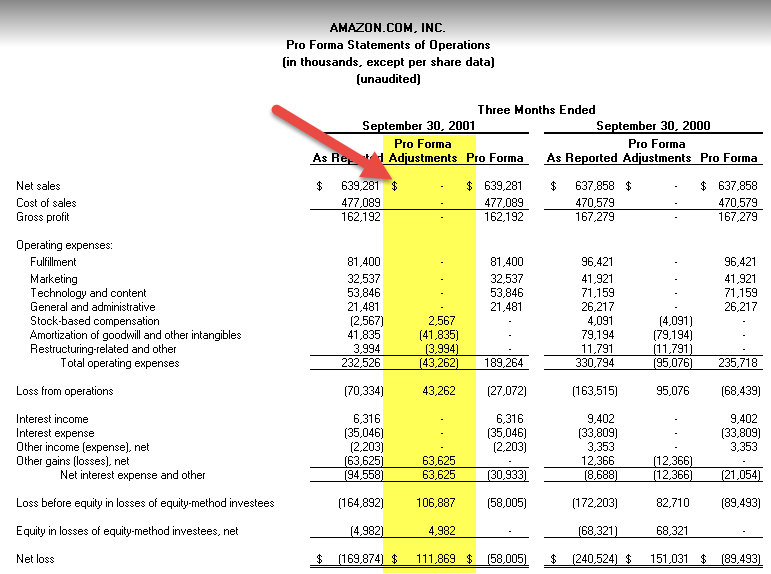

Pro forma definition accounting. Essentially pro forma financial statements are financial reports based on hypothetical scenarios that utilize assumptions or financial projections. Pro forma definition. Pro forma financial information pro formas presents historical balance sheet and income statement information adjusted as if a transaction had occurred at an earlier time.

Pro forma is actually a Latin term meaning for form or today we might say for the sake of form as a matter of form. Pro forma financial statements are preliminary financials that show the effects of proposed transactions as if they actually occurred. Pro forma statements are useful for presenting possible financial results but must be viewed with caution if the underlying assumptions are not valid or not likely.

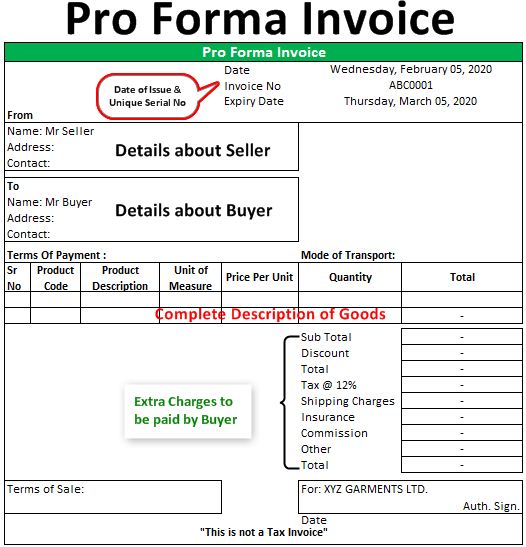

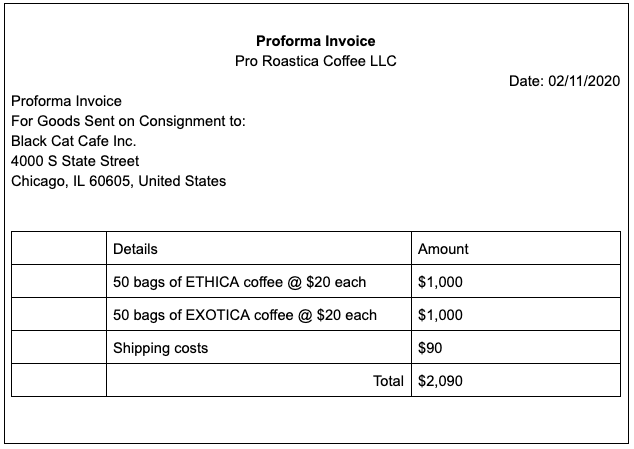

Certificate - Debits and Credits. A Pro-forma invoice is a preliminary document that states all the relevant information about a future potential purchase. It provides the particulars of the goods and services yet to be delivered.

Pro forma refers to a set of financial statements that incorporate assumptions or hypothetical conditions regarding past or future events. A pro forma financial statement is one based on certain assumptions and projections as opposed to the typical financial statement based on actual past transactions. In Latin the term pro forma is roughly translated as for form or as a matter of form So what is a pro forma statement.

In accounting pro-forma financial statements are hypothetical financial reports that show either forecasts of. Pro Forma Balance Sheets. In other words it is a preview of the actual invoice if the sale transaction is completed.

Home Accounting Dictionary What is a Pro-forma Invoice. The pro forma balance sheet looks at a forecast after a change like financing or acquisition. According to Merriam-Webster pro forma means.

/pro-forma-invoice--1053078376-3fb3269f97f84b93832c203f105ac972.jpg)