Peerless Short Term Borrowings In Cash Flow Statement

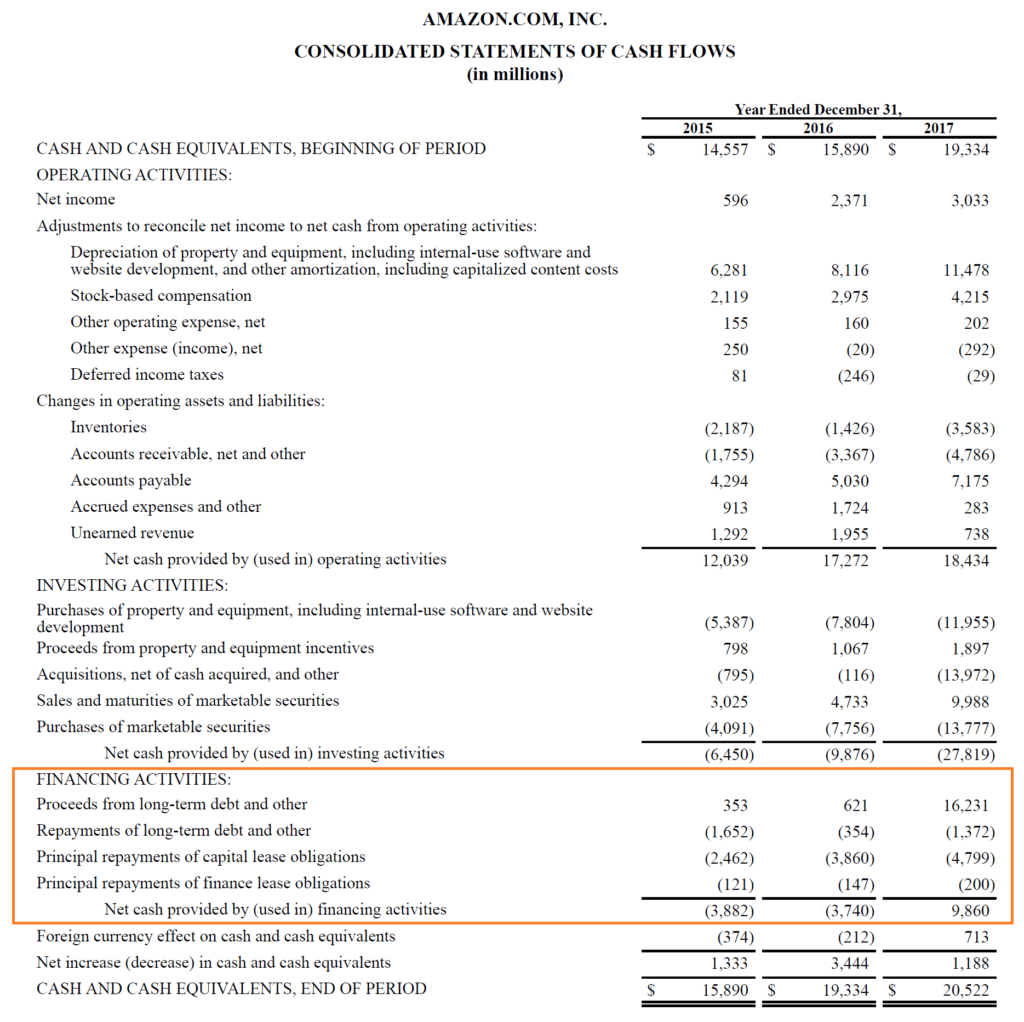

A firm engages in financing activities when it obtains resources from owners returns resources to owners borrows resources from creditors and repays amounts borrowed.

Short term borrowings in cash flow statement. The main purpose of the statement of cash flows is to report on the cash receipts and cash disbursements of an entity during an accounting period. In some cases businesses may record short-term notes payable in the cash from operating activities section of the cash flow statement. Cash inflows proceeds from capital financing activities include.

The financing section of the cash flow statement may have a separate notes payable section to capture this information. Grossing up non-cash settlements. This amount is found by adding the total of all borrowings and subtracting cash on hand.

Receipts from capital grants awarded to the governmental enterprise. The statement deals with the provisions of information about the changes in cash and cash. Receipts from proceeds of issuing or refunding bonds and other short or long-term borrowings used to acquire construct or improve capital assets.

The interest paid on short-term bank loans is included in the operating activities section of the statement of cash flows. Cash equivalents are short-term highly liquid investments that are readily convertible to known amounts of cash and that are subject to an insignificant risk of changes in value. Long term borrowings.

Balance in Statement of Profit and Loss 400000 100000 400000 100000 2. Reporting Short-Term Bank Loans on the Statement of Cash Flows. This amount shows the outstanding debts the company would owe if all cash on hand was used to pay all debts owed.

Purposes of the statement of cash flows. As per AS-3 Revised the objective of cash flow statement is to provide information about cash flows of an enterprise which is useful in providing the users of financial statements with a basis to assess the ability of an enterprise to generate cash and cash equivalents to utilize those cash flows. Cash comprises cash on hand and demand deposits.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)