Perfect Pro Forma Balance Sheet Definition

In financial accounting pro forma refers to a report of the companys earnings that excludes unusual or nonrecurring transactions.

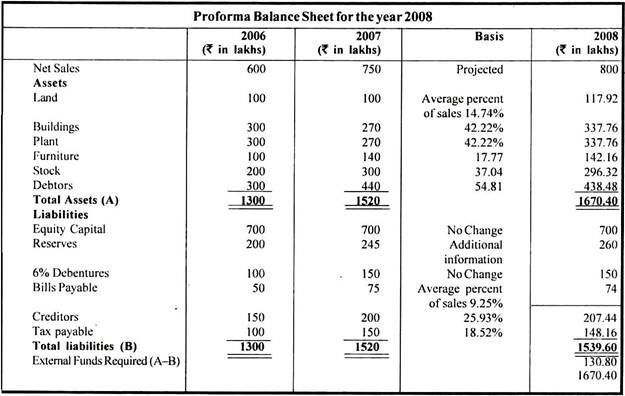

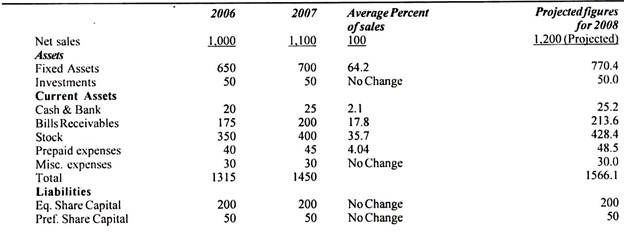

Pro forma balance sheet definition. A balance sheet containing imaginary accounts or figures for illustrative purposes. If the liabilities exceed. Pro Forma Balance Sheet A companys balance sheet shows a companys financial position and its made up of assets liabilities and equity.

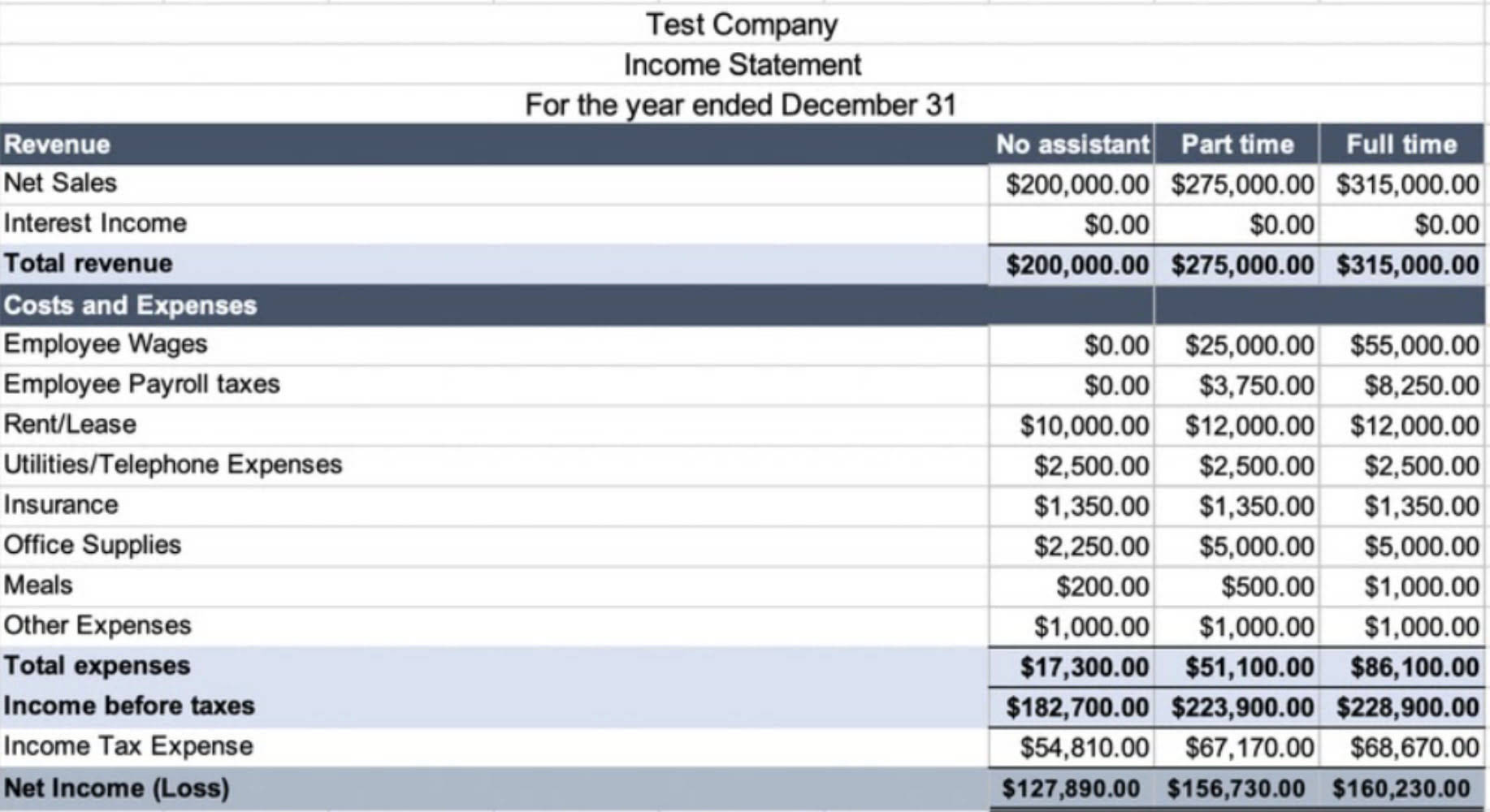

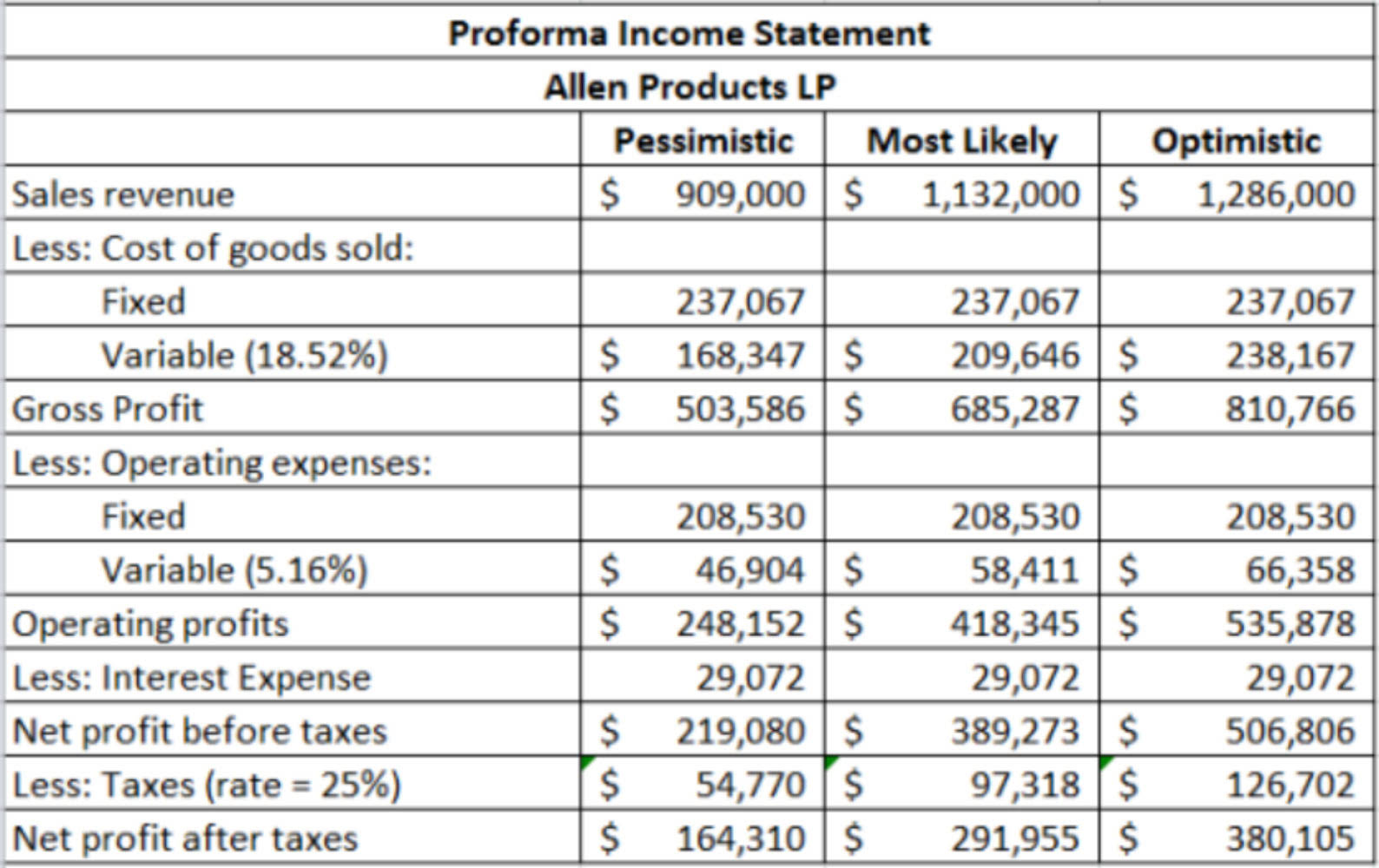

Pro forma is actually a Latin term meaning for form or today we might say for the sake of form as a matter of form. Pro Forma Cash Flow Statements Another of the pro forma reports you should know about is the cash flow statement. A pro-forma forecast is a financial forecast based on pro-forma income statements balance sheets and cash flow statements.

Pro forma financial statement definition. For example if a company is considering acquiring another it may prepare a pro forma financial statement to estimate what effect the acquisition would. Sample 1 Sample 2.

It remains same in proforma balance sheet. Pro-forma forecasts are usually created from pro-forma financial. These are to be changed only if some additional information is given.

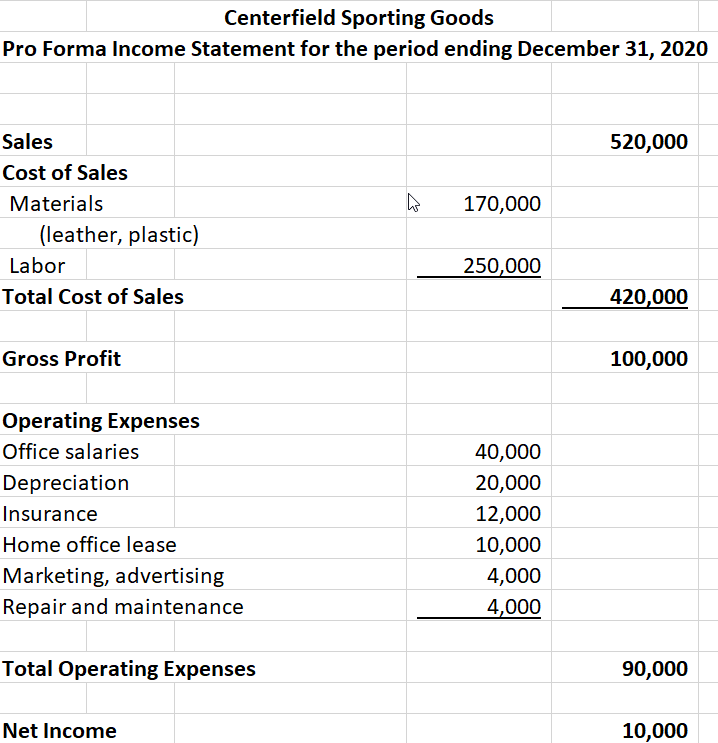

The pro forma balance sheet provides a firm a sense of how its activities will affect its ability to meet its short-term liabilities and how its finances will evolve over time. It can also quickly show how much of a firms money will be tied up in accounts-receivable inventory and equipment. A balance sheet that gives retroactive effect to new financing combination or other change in the status of a business concern or concerns.

It is considered more of a balance sheet projection. It includes assets and liabilities as well as accounts receivable cash and cash equivalents accounts payable and inventories. Essentially pro forma financial statements are financial reports based on hypothetical scenarios that utilize assumptions or financial projections.