Exemplary Balance Sheet Leverage Formula

The Formula and Logic for Degree of Total Leverage.

Balance sheet leverage formula. Balance Sheet Leverage Ratio means as of any day the ratio of i the consolidated Indebtedness minus the aggregate amount outstanding pursuant to the CMGI Notes to ii consolidated Tangible Capital Funds. As can be seen in the formulas below the degree of financial leverage can be calculated from the income statement alone. The formula for Operating Leverage can be calculated by using the following steps.

The formula of financial leverage is as follow. In most companies operating income is available as a separate line item in any companys income statement. A ratio of 1 would imply that creditors and investors are on equal footing in the companys assets.

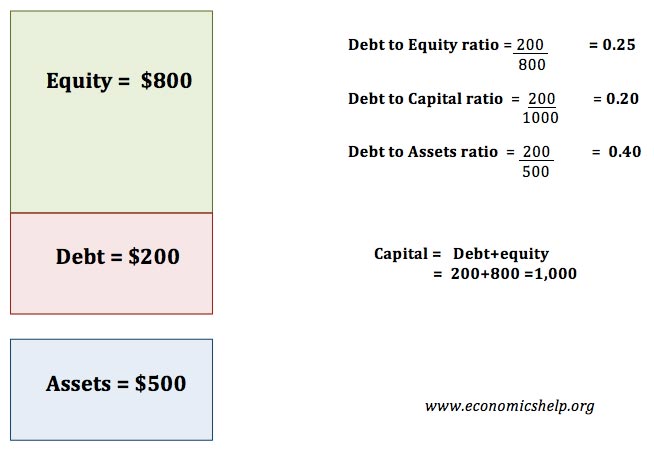

To find a companys cash flow leverage divide operating cash flow by total debt. Formula to Calculate Financial Leverage Financial leverage tells us how much the company is dependent on borrowing and how the company is generating revenue out of its debt or borrowing and the formula to calculate this is a simple ratio of Total Debt to Shareholders Equity. These ratios compare the total debt obligation to either the assets or equity of a business.

A debt ratio of 05 or less is good anything greater than 1 means your company has more liabilities than assets which puts your company in a high financial risk category and can challenging for you to acquire financing. Leverage ratios are used to determine the relative level of debt load that a business has incurred. FL Debt Total Assets.

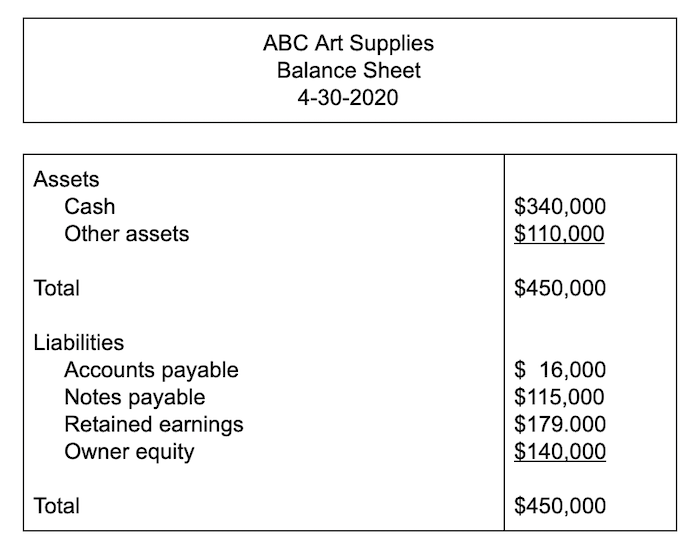

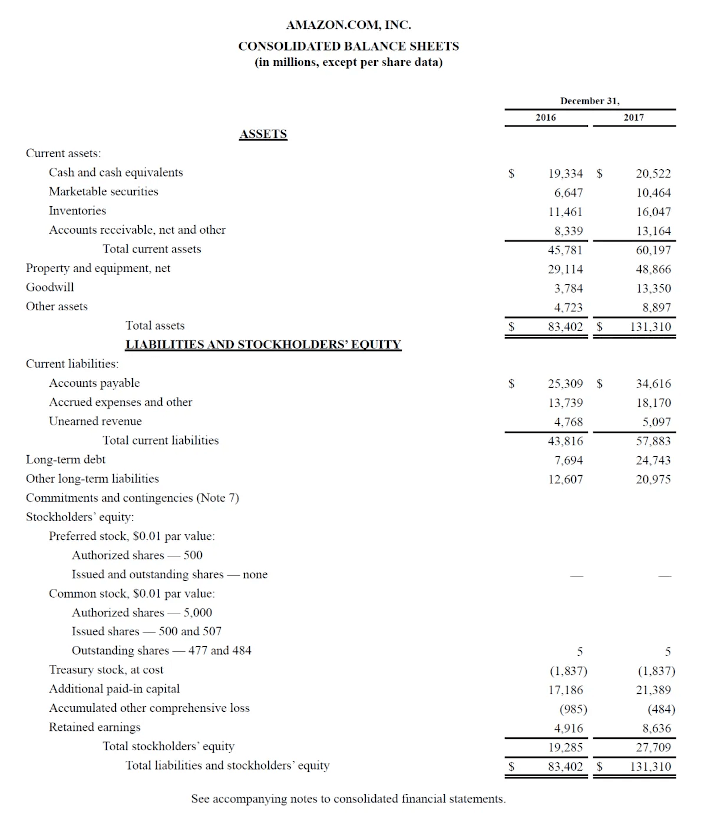

If we want to be a growing business in the future some of those earnings must be reinvested. For example if operating cash flow is 500000 and total debt is 1000000 the company has a cash flow leverage ratio of 05. Presented are the contents of the balance sheet in the rearranged format that structures the equation of Assets what we have Liabilities what we owe Equity what we own to more clearly recognize how the enterprise is financed.

Financial Leverage Formula Total Debt Shareholders Equity. The formula is total debt divided by total assets. This means that for every dollar in equity the firm has 42 cents in leverage.