Best Pro Forma Income Contingent Asset Example

Financial statements will vary significantly post-merger.

Pro forma income contingent asset example. It does not currently exist but may arise in the near future. For example XYZ Company is a publicly-traded maker of widget presses. Contingent asset is a possible asset of the company that may arise in the future on the basis of happening or non happening of any contingent event which is beyond the control of the company and will be recorded in the balance only if it becomes certain that the economic benefit will flow to the company.

In simple words A Contingent asset is. During the transit the truck carrying the jute for delivery. Types of Assets Common types of assets include current non-current physical intangible operating and non-operating.

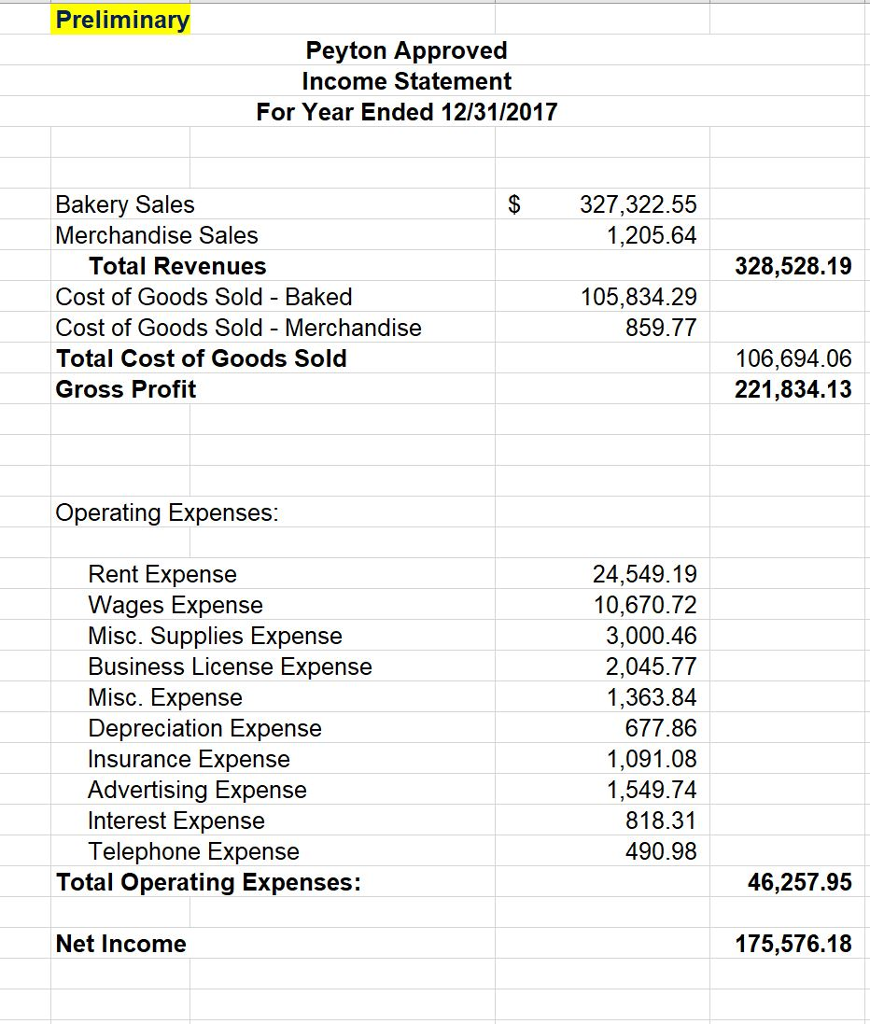

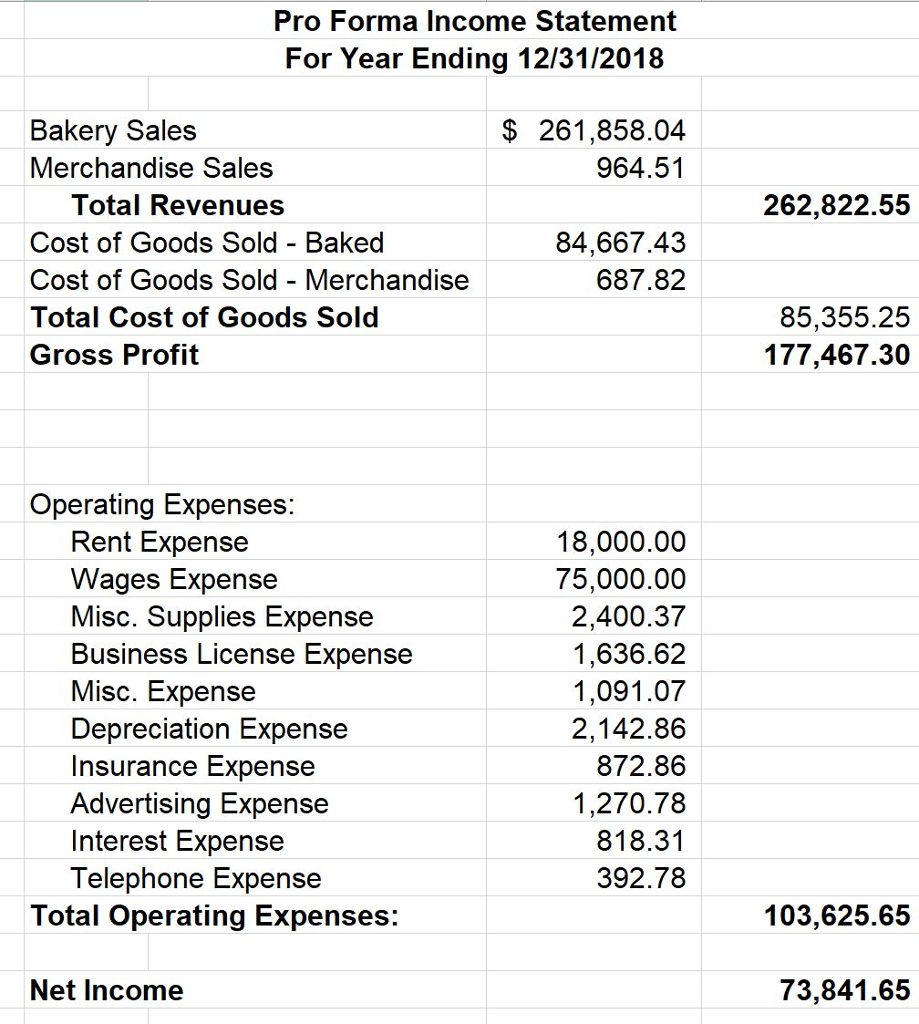

Simply put its a future or projected income statement or it can even be used to restate financial books in an unofficial way. AA54 Form 8-K Reporting Acquisition of Assets That Meets the Definition of a Business for SEC Reporting Purposes 25 AA55 Form and Content of Financial Statements for an Asset or a Group of Assets That Meets the Definition of a Business for SEC Reporting Purposes 26 AA56 Pro Forma Financial Information 27. 1663 Effect of Indirect Ownership on the Asset Test 56 1664 Deleted 57 1665 Effect of Working Capital Assets Not Acquired on the Asset Test 57 1666 Performing the Asset Test When Only Abbreviated Financial Information Is Available 58 167 Income.

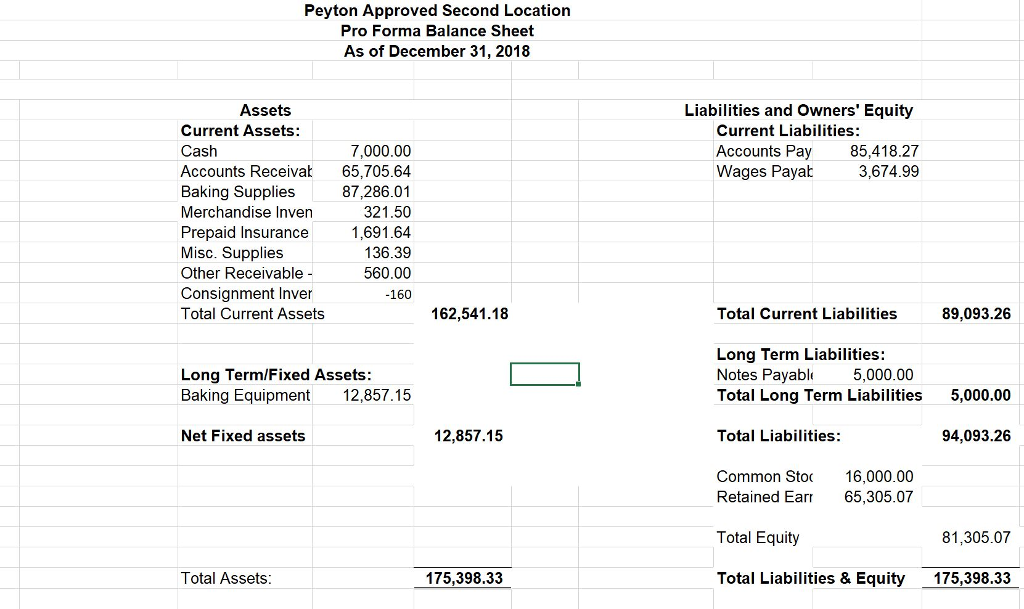

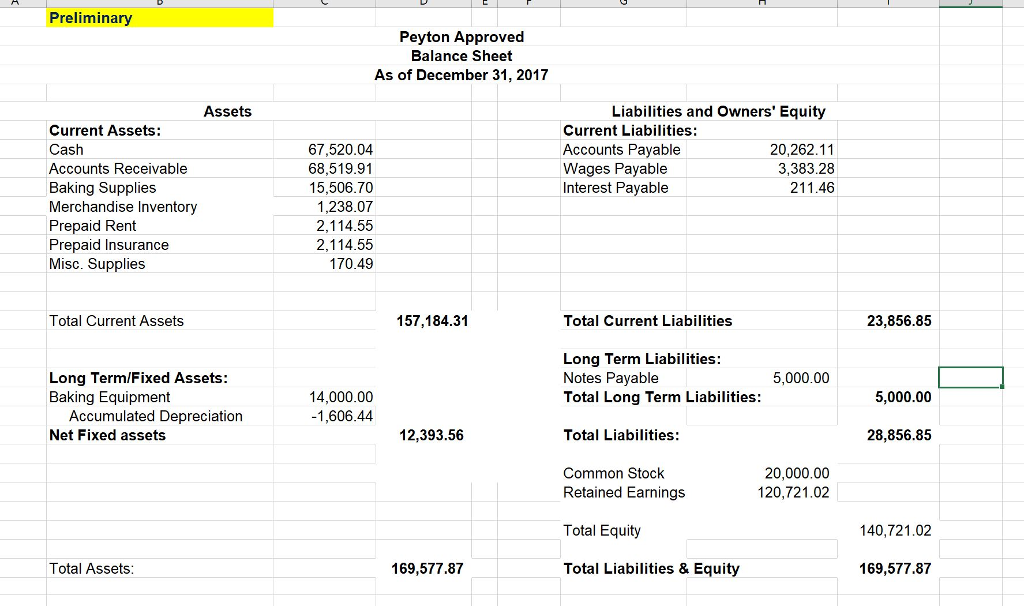

Pro Forma Financial Statements Reference Guide December 2018. The most common example of a contingent liability is a product warranty. A contingent asset is a potential asset or economic benefit for a company.

Pro forma financial information under the legacy rules. The occurrence of such a contingent asset depends on the occurrence or the non-occurrence of a particular set of events over which the company itself does not have full control. Overview ofthe ProForma Income Statement Current Market Environment Deal StructuresComponentsand Examples Asset Vs.

STATEMENT OF ASSETS AND LIABILITIES December 31 20XX See Notes to Financial Statements 2. Types of Liabilities There are three primary types of liabilities. For example a business may use a pro forma financial statement to show what a businesses profit was if it sold off an arm of the company.