First Class Tdscpc Form 26as

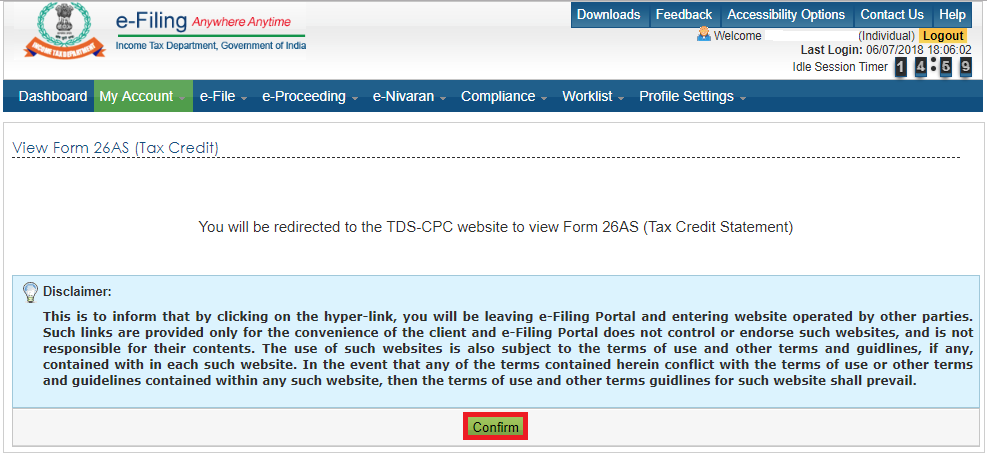

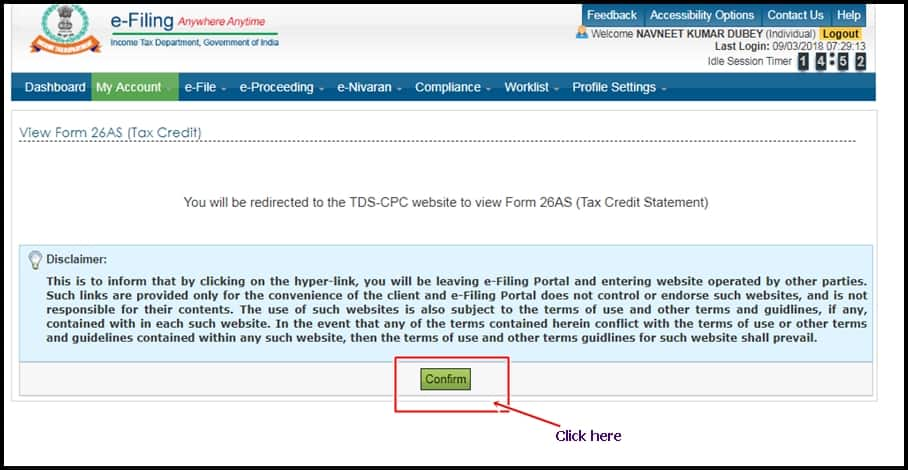

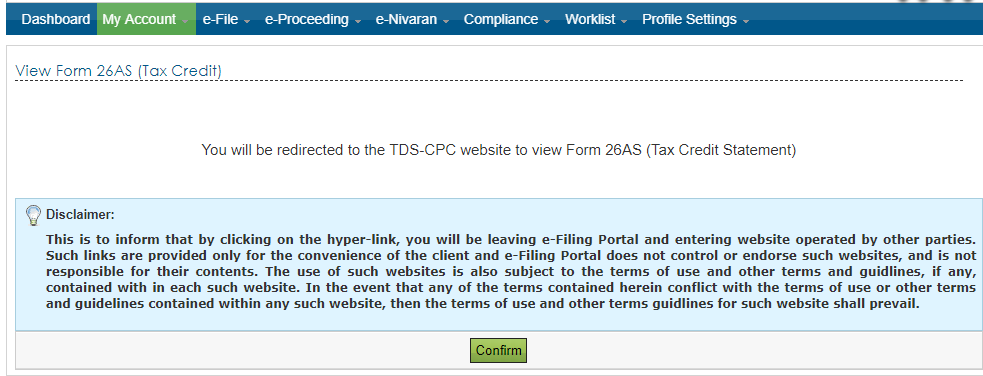

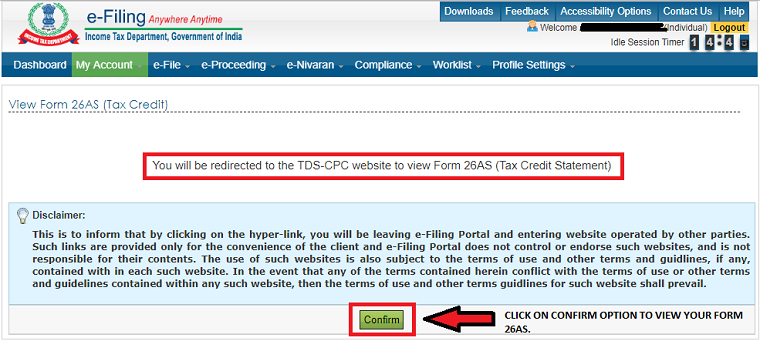

Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal.

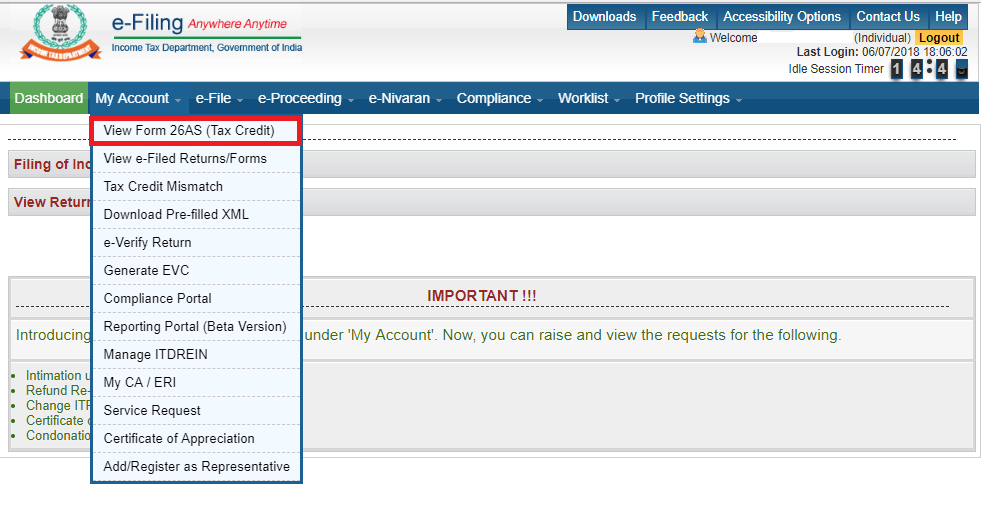

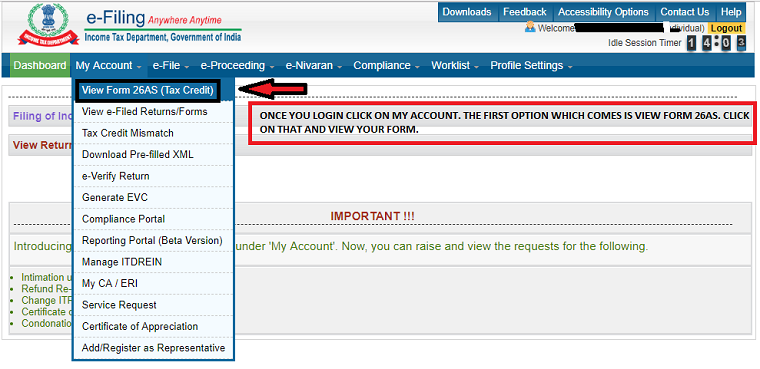

Tdscpc form 26as. Or income tax website httpsincometaxindiaefilinggovin and then click on 26AS. Form 26AS is a consolidated statement which reflects all the advance tax paid by you personally or through TDS way. It contains tax credit information of each Taxpayer against his PAN.

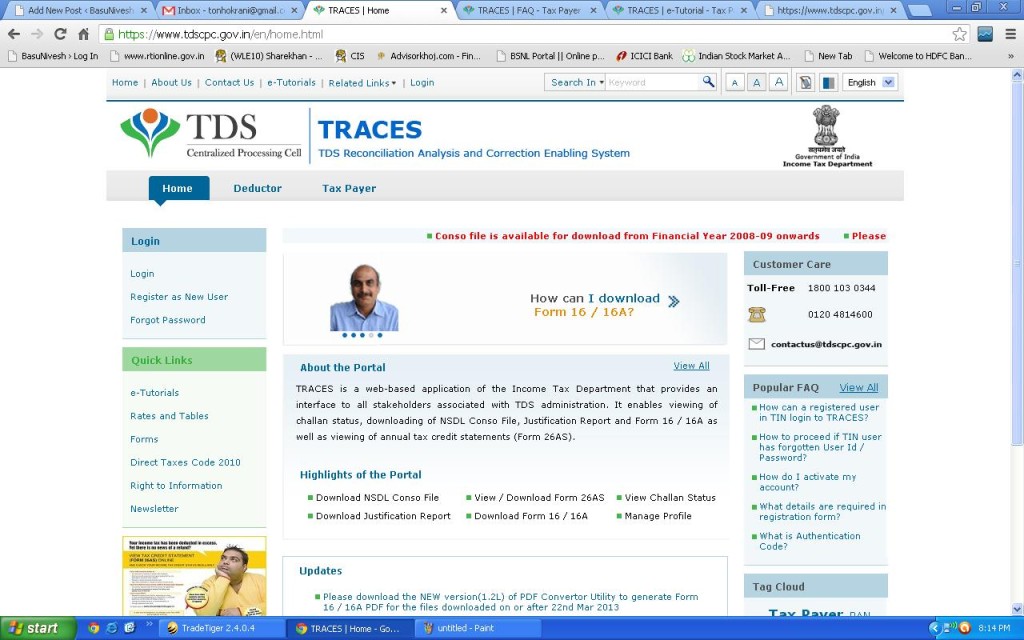

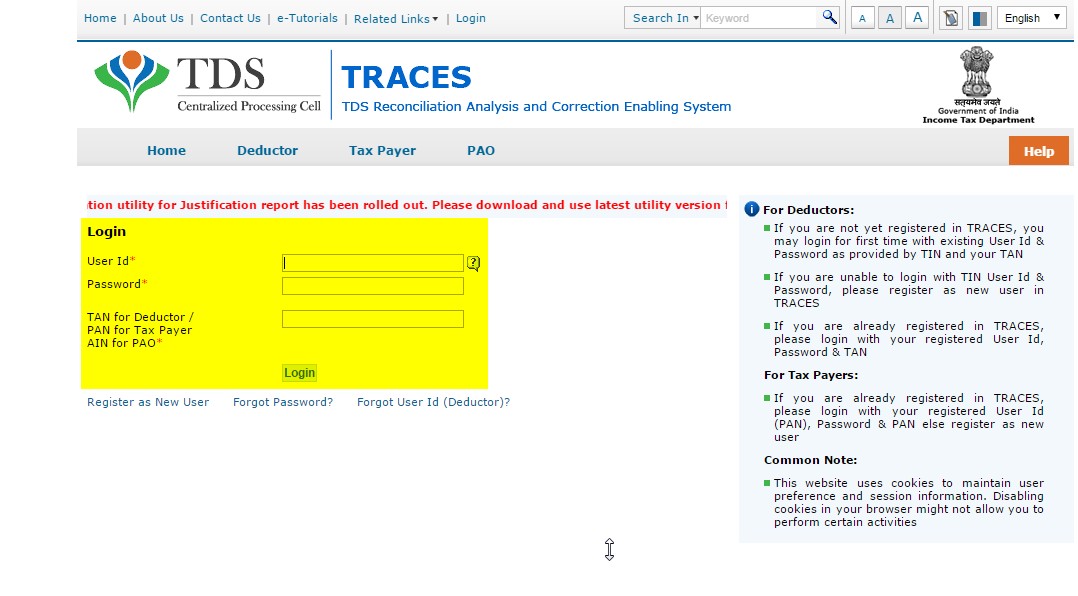

From the bank website after you login to your account. TRACES is a web-based application of the Income Tax Department that provides an interface to all stakeholders associated with TDS administration. The statement provides details such as the name of the deductee PAN of deductee details of the deductor the TDS amount the amount of TDS deposited with the Government by the deductor etc.

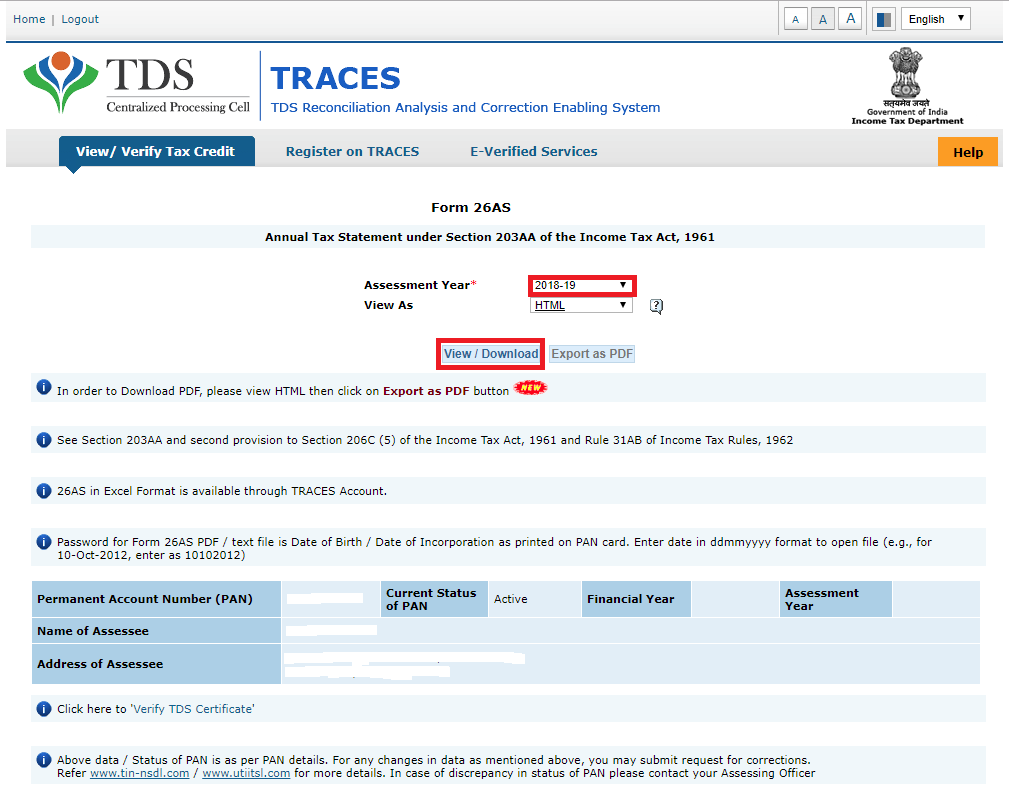

The answer to this question is that Form 26AS is a form that is the statement of all the related information linked to PAN. What is Form 26AS and how to get it. In the TDS-CPC Portal Agree the acceptance of usage.

An annual tax credit statement is generated by the income tax department for a tax payee subjected to TDS deductee in the Form 26AS. Form 26AS is provided to you by the TDS Reconciliation Analysis and Correction Enabling System also known as. Logon to e-Filing Portal wwwincometaxindiaefilinggovin.

26AS TDS form can be accessed online if one is available for your PAN. Give details of NOLow deductions claimed by the taxpayer. Income tax filing website - httpsincometaxindiaefilinggovin.

This facility has been provided to the deductor in order to verify whether the PANs for which user is deducting TDS are getting the credit for the same or not. TRACES website - httpscontentstdscpcgovin. Form 26AS is a document which contains details related to tax deducted collected and submitted.