Peerless Types Of Operating Expenses On Income Statement

:max_bytes(150000):strip_icc()/Apple10K-97033366f9974bb6990acbe1b3e2c277.jpg)

Gross Profit Net Sales - Cost of Goods Sold.

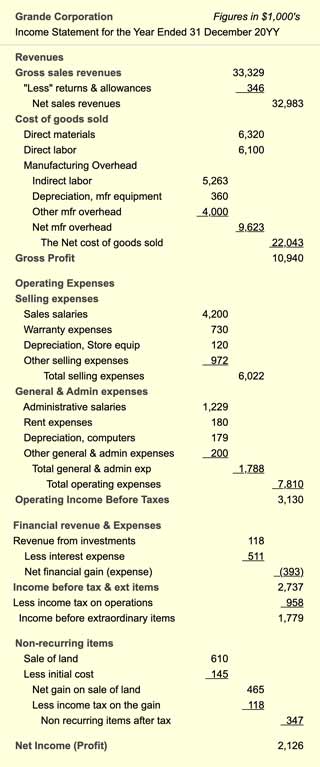

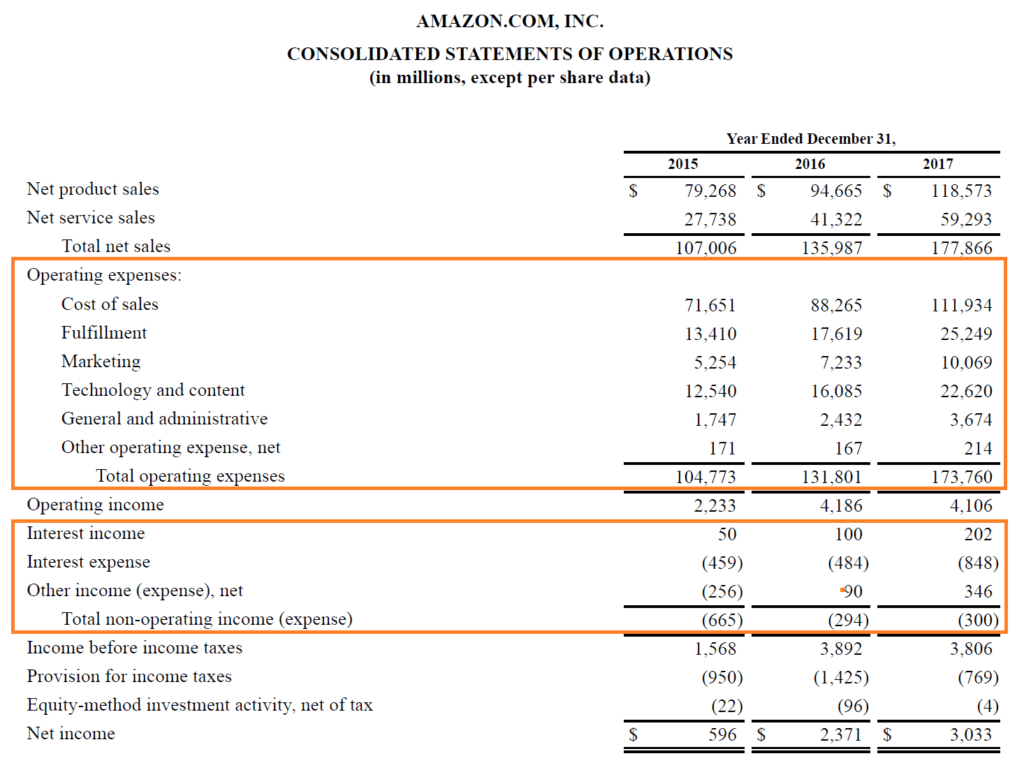

Types of operating expenses on income statement. Most often the biggest is known as Selling General and Administrative Expense SGA. As you can see Amazon separates its costs into two categories. It includes expenses such as rent advertising marketing wages rent and utility costs.

The cost of goods sold is the cost or expenses a company incurs while. The three accounting equations that are used to arrive at the net income are stated below. Operating income Total Revenue Direct Costs Indirect Costs.

The specific costs for hiring labor to produce a product is calculated separately under cost of goods sold and are not operating expenses. Below is an example of Amazons 2017 income statement statement of operation which lists their main categories of expense. With Odoo Expenses youll always have a clear overview of your teams expenses.

Operating expenses consist of the cost of sales fulfillment marketing technology and content general and administrative and others. Operating income Gross Profit Operating Expenses Depreciation Amortization. This statement will show the profit for the year.

This profit will be forward to another statement called the Others comprehensive statement which reported and presented non-operating income and expenses during the period. Companies that prepare their income statement using the multi-step approach will typically breakdown their revenues and expenses into operating and non-operating business activities. The list of operating expenses is divided into two broad categories ie.

The cost of the merchandise that is sold is being matched with the revenues from selling the goods. The primary types of operating expenses include payments that are related to compensation sales and marketing office supplies and non-facility fees. Administrative expenses such as full time staff salaries or hourly wages are considered operating expenses for a business.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/Apple10K-97033366f9974bb6990acbe1b3e2c277.jpg)