Simple The Primary Purpose Of A Cash Budget Is To

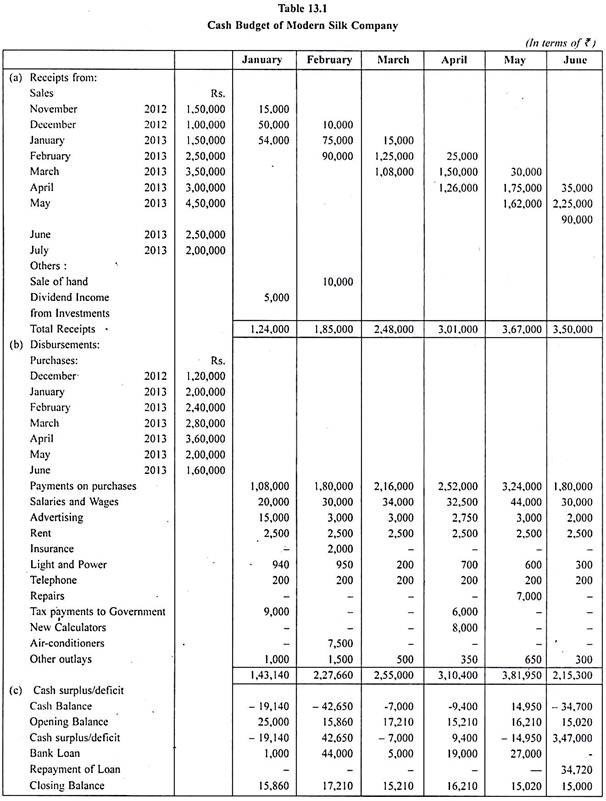

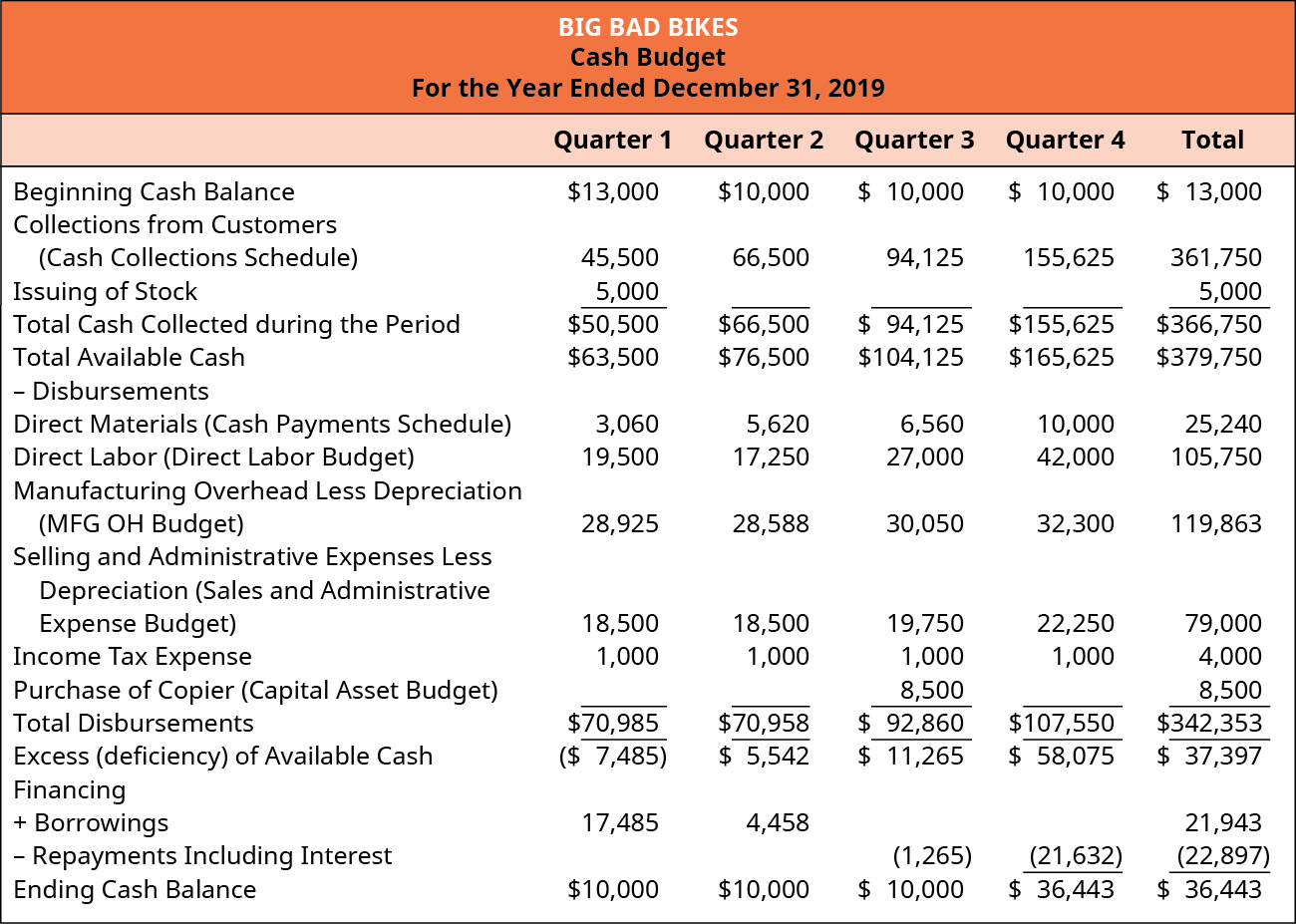

Estimate the amount and timing of future borrowing needs and the ability of the business to repay loans.

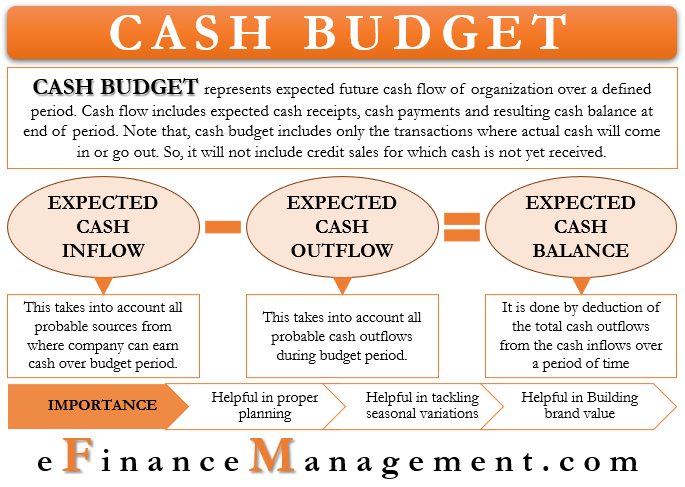

The primary purpose of a cash budget is to. This budget takes into account all the probable sources from where the company can earn cash over the budget period. A firms cash borrowing needs can be reduced if its inventory turnover rate can be increased. Cash Inflow Forecast.

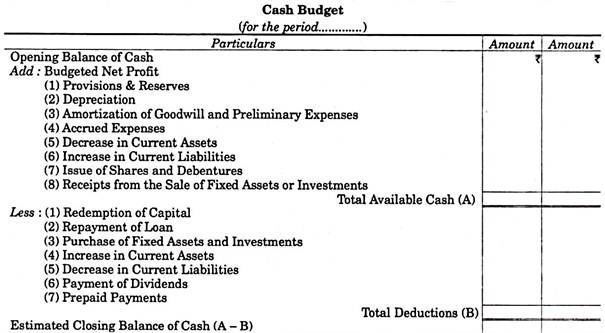

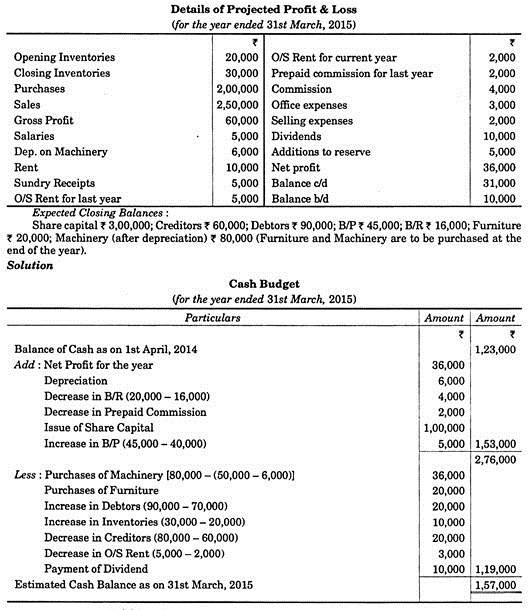

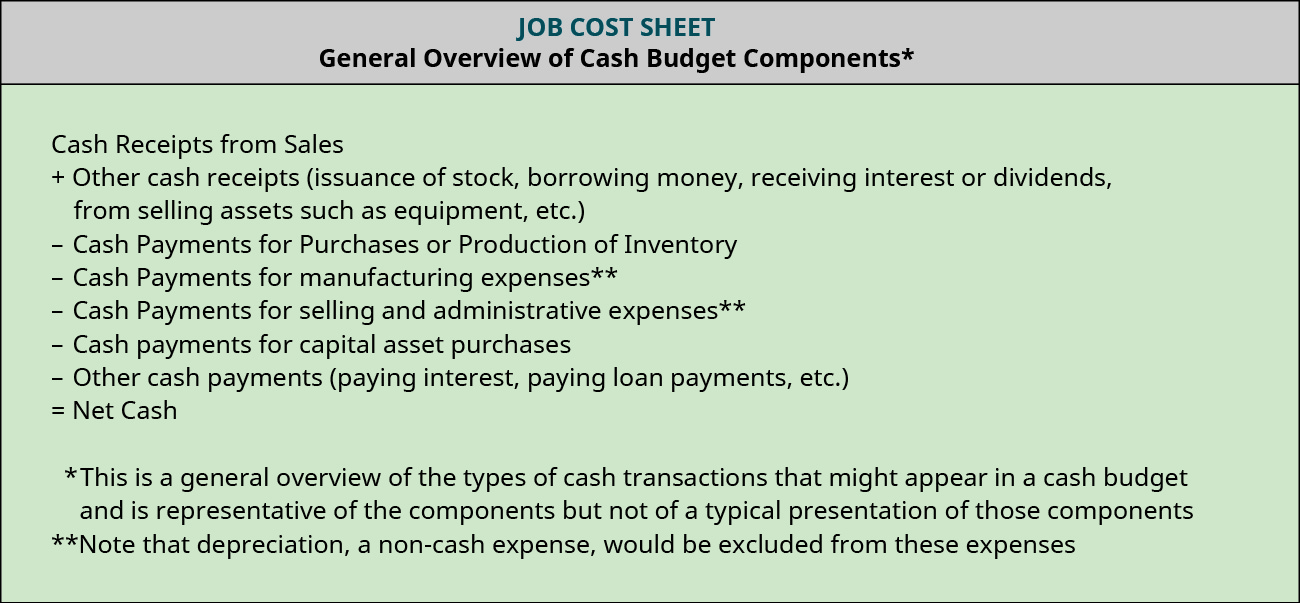

All cash inflows not just revenue and expenses. A cash budget details a companys cash inflow and outflow during a specified budget period such as a. This can occur even if your revenue far exceeds your expenses due to the timing of payments.

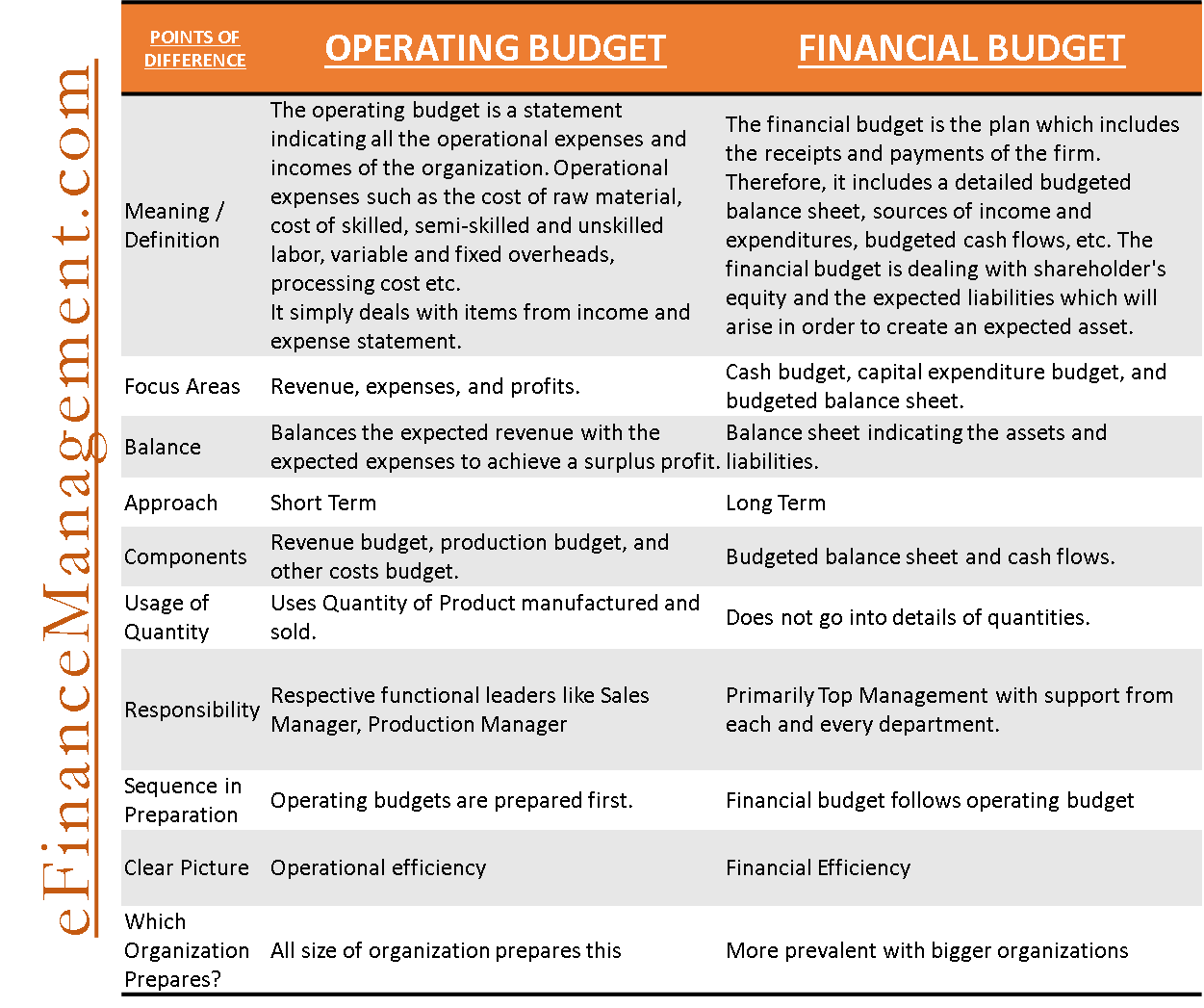

Determine the level of investment in current and. The primary purpose of a cash budget is to. A cash budget is a companys estimation of cash inflows and outflows over a specific period of time which can be weekly monthly quarterly or annually.

The primary purpose of the cash budget is to show the expected cash balance at the end of the budget period. The primary purpose of the cash budget is to forecast income. What Is the Primary Purpose of a Cash Budget.

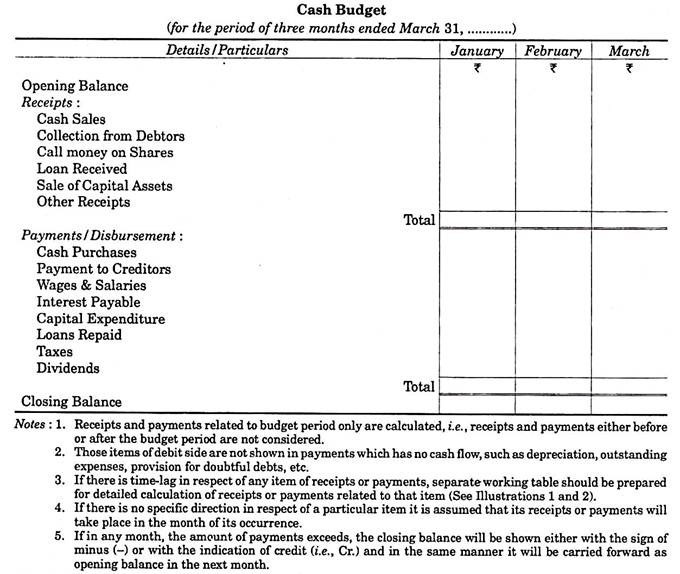

Cash budget is an estimation of a companys cash inflow and outflow it is an accounting device used in monitoring and managing a business operating activities of immediate short term cash flow a forecast of a businesss estimated cash receipts and payment over a period of time usually months and years. The most significant purpose of the cash budget is to plan accounts payable payments. Running out of cash is a serious problem as you may be unable to pay things such as salary rent taxes and bills on time.

One of the primary purposes of a cash budget is to identify liquidity risks whereby an organization may run out of cash. The master budget encompasses the complete budgeting process including creating a budgeting income statement a budgeted balance sheet and a cash budget. The primary purpose of a cash flow budget is _____.