Ideal Contingent Liabilities Note Disclosure Example

Disclosure of Contingent Liabilities.

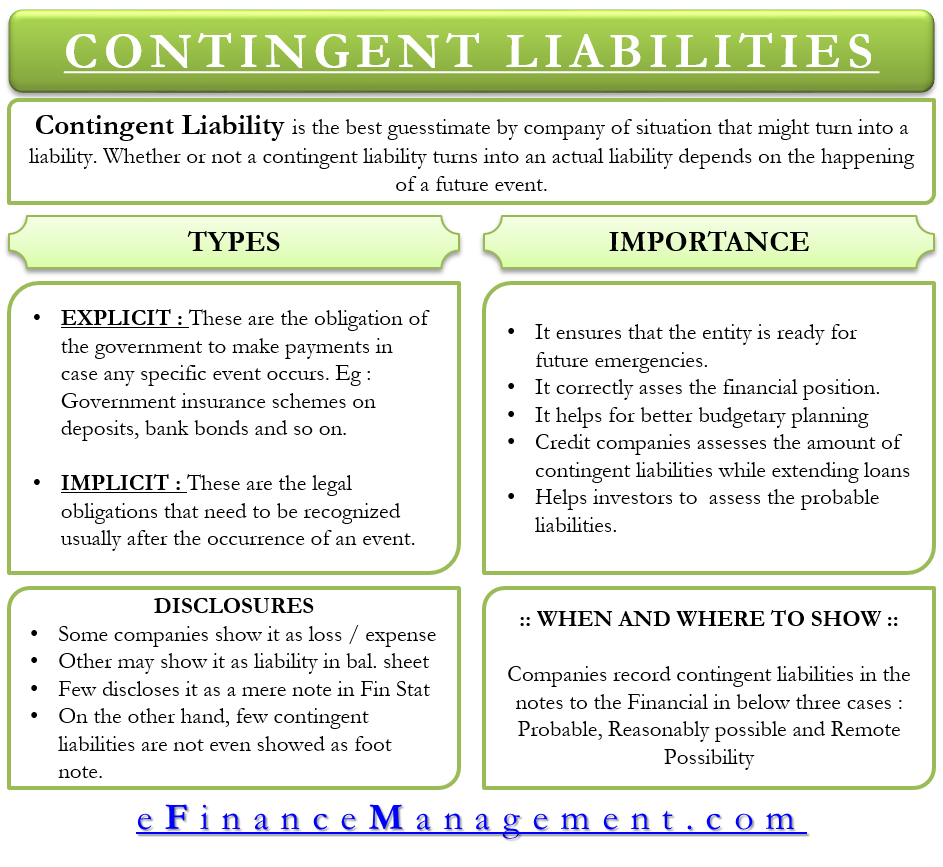

Contingent liabilities note disclosure example. Although these estimates are based on managements best knowledge of current events and actions actual results may ultimately differ from those estimates. In the case of product warranty liability it is recorded at the time the product is sold. A a possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity.

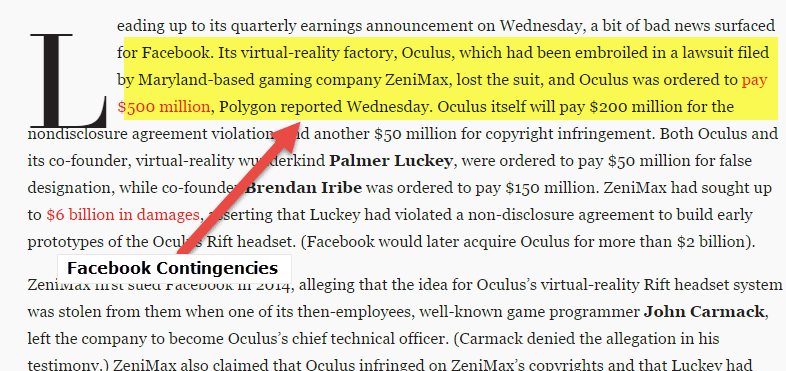

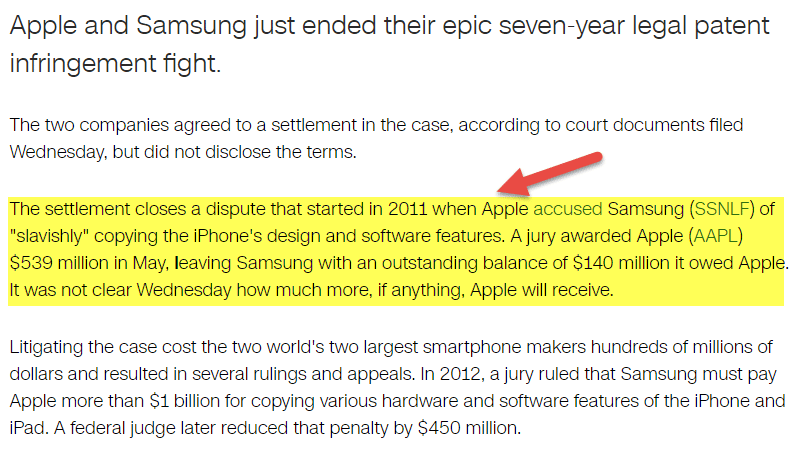

The claim seeks damages of 50000 and the Company is defending the action. KPMG International - KPMG Global. Contingent Liabilities Two classic examples of contingent liabilities include a company warranty and a lawsuit against the company.

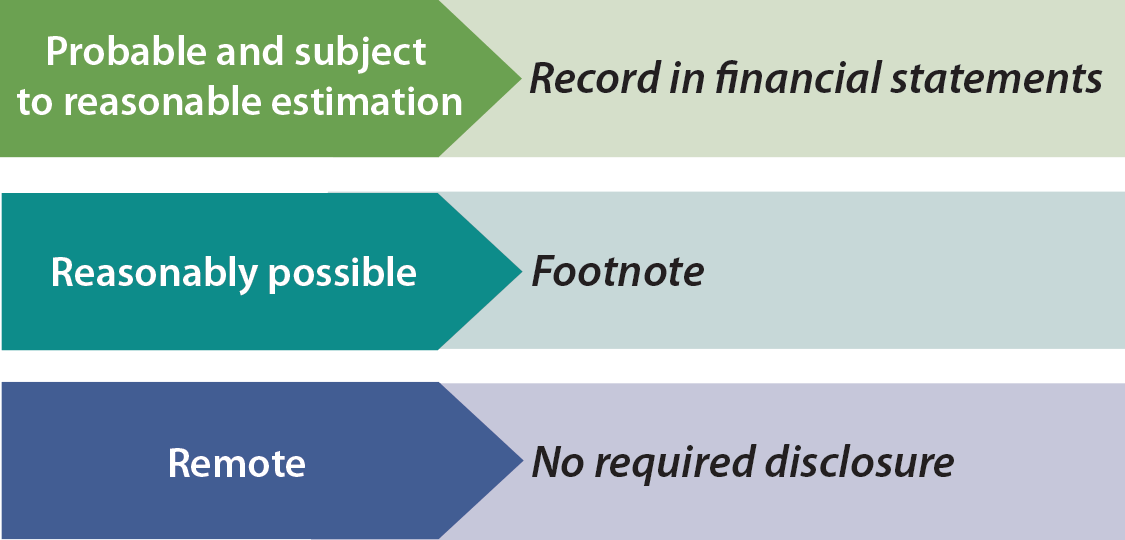

Contingent liabilities IN18 The Standard defines a contingent liability as. This study uses a sample of employment discrimination cases to provide evidence on the extent to which current contingent legal liability disclosures provide useful contingency evaluations. Contingent Liability During the year the Company received a claim for an alleged product deficiency.

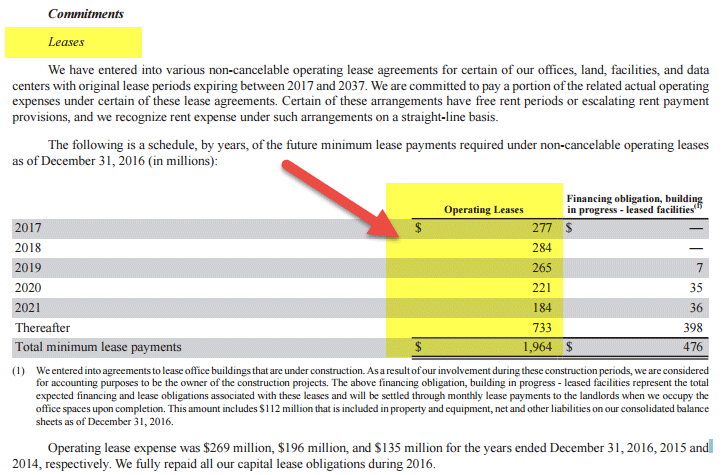

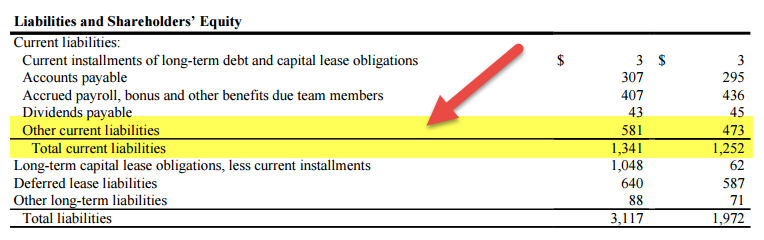

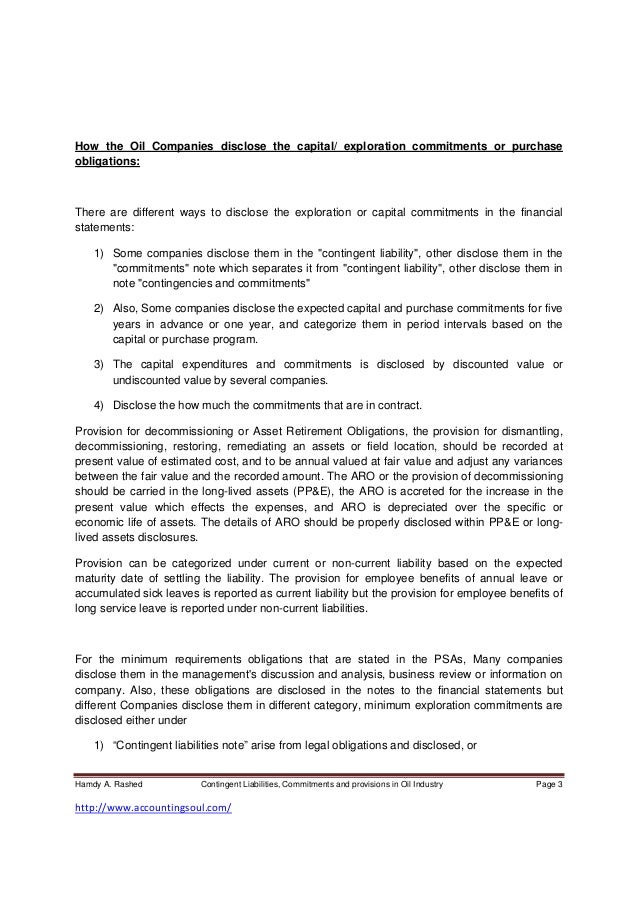

Other examples include guarantees on debts liquidated damages outstanding lawsuits and government probes. Of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the financial year. Both represent possible losses to the company yet both depend on.

A contingent liability is a possible obligation that arises from past events whose existence will be confirmed by the occurrence or non-occurrence of one or more uncertain future events beyond the control of the Group or a present obligation that is not recognised because it is not probable that an outflow of resources will be required to settle the obligation. IAS 3786 Contingent assets. The typical examples of contingent liabilities include warranties on the companys product and services unsettled taxes and lawsuits.

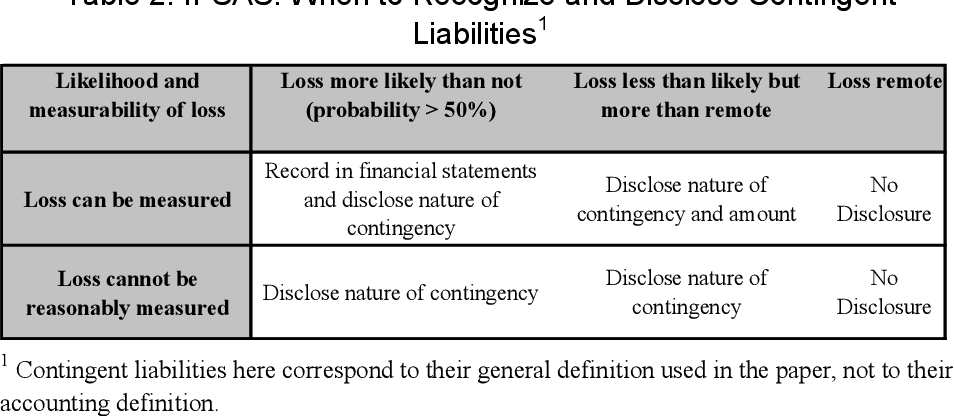

The typical examples of a contingent liabilities include warranties on the companys product and services unsettled taxes and lawsuits. Contractual obligations and contingent liabilities that are material should be reported in a note of disclosure to the consolidated financial statements. It requires that entities should not recognise contingent liabilities but should disclose them unless the possibility of an outflow of economic resources is remote.