Sensational Disney Cash Flow Analysis

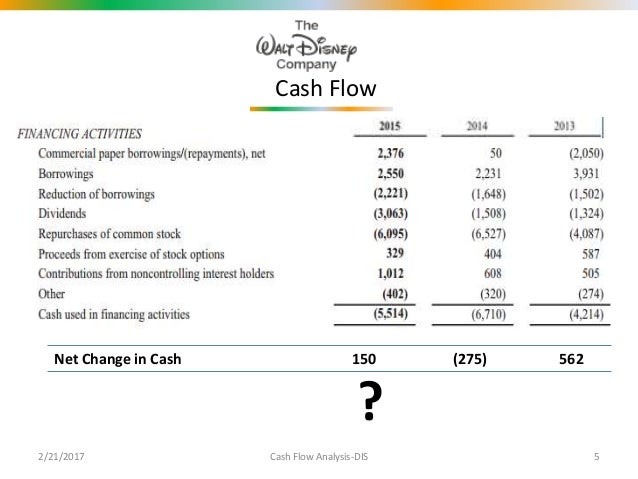

During the past 3 years the average Free Cash Flow per Share Growth Rate was -2890 per year.

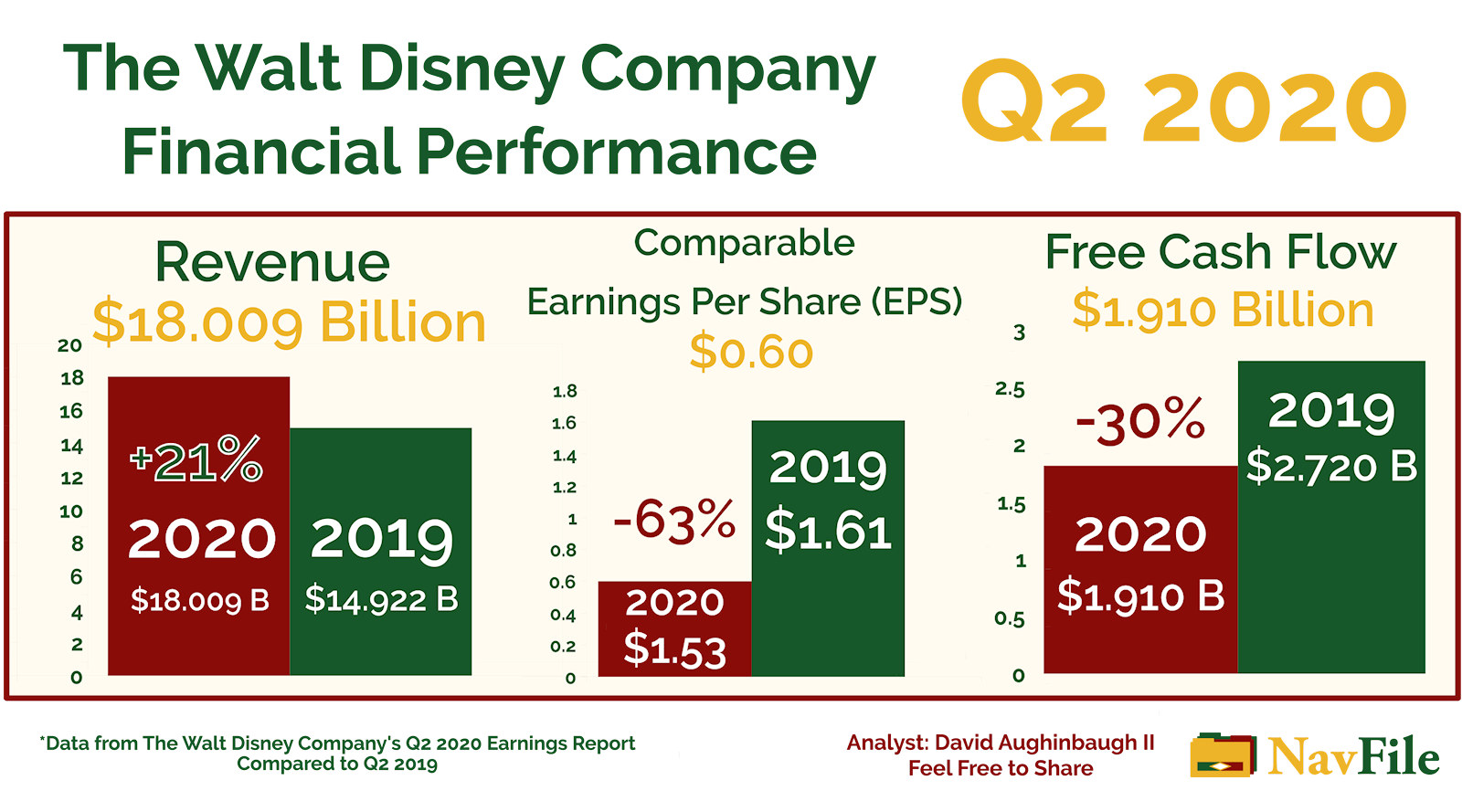

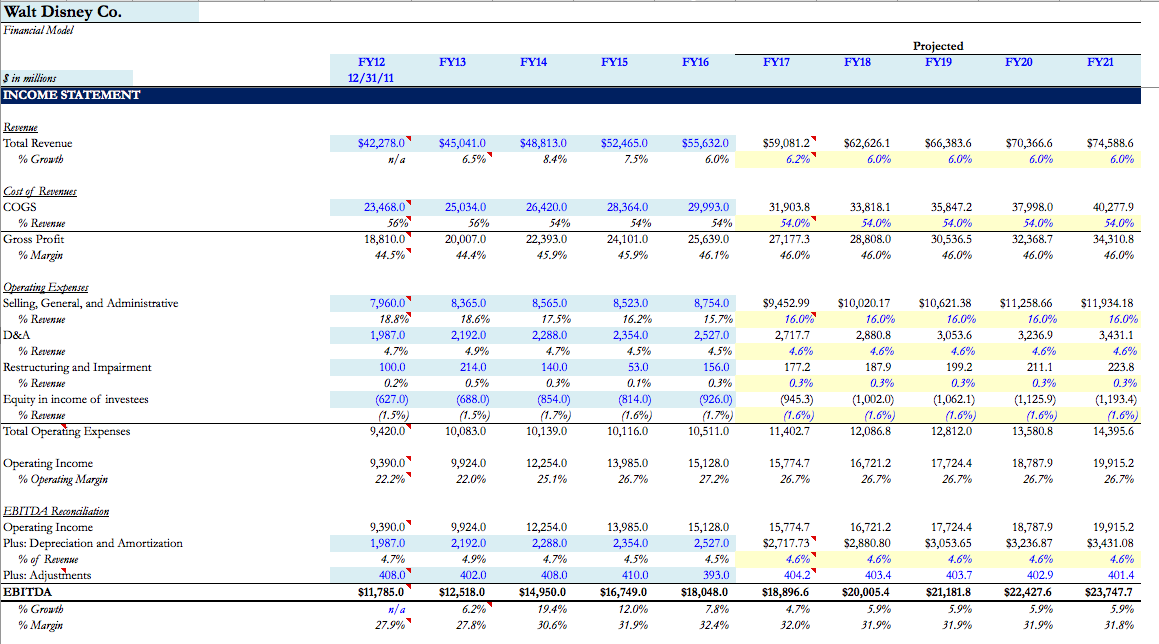

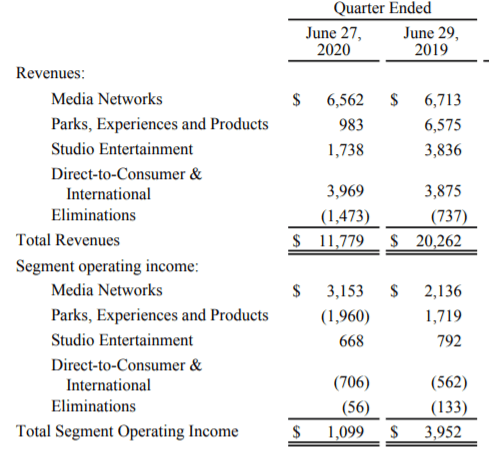

Disney cash flow analysis. Annual free cash flow declined by 89 to 111 billion. Borrowings excluding current portion. Present Value of Terminal Value.

Shareholders have seen better annual cash flow results thats for sure. Its free cash flow per share for the trailing twelve months TTM ended in Mar. Interest expense after tax and dividends.

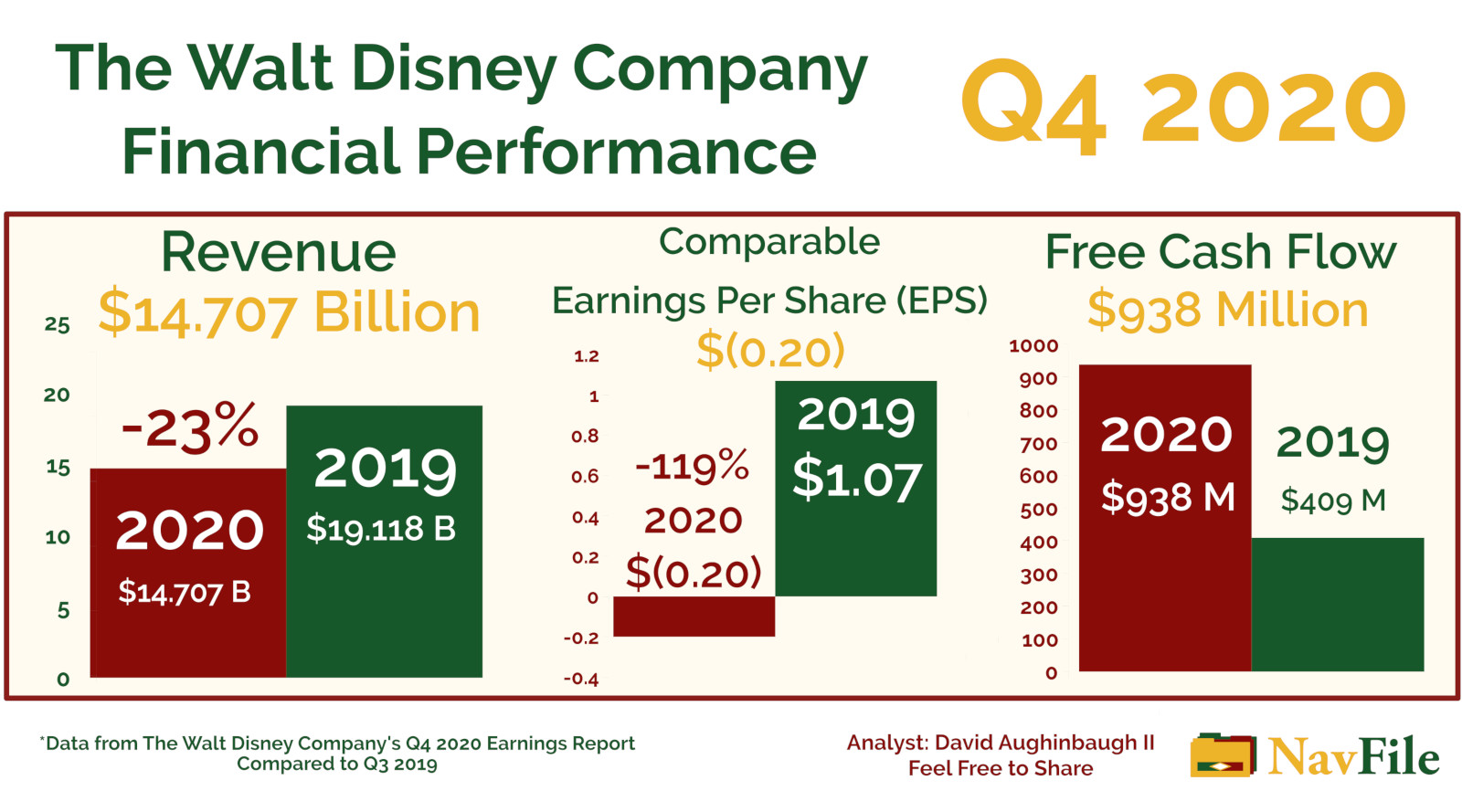

In terms of cash coming in analysts have fiscal 2020 EBITDA pegged at around 20B and free cash flow at 95B. 18342 -023 -013 At close. In this outline the ensuing segments cover the cash flow analysis of the Walt Disney Company.

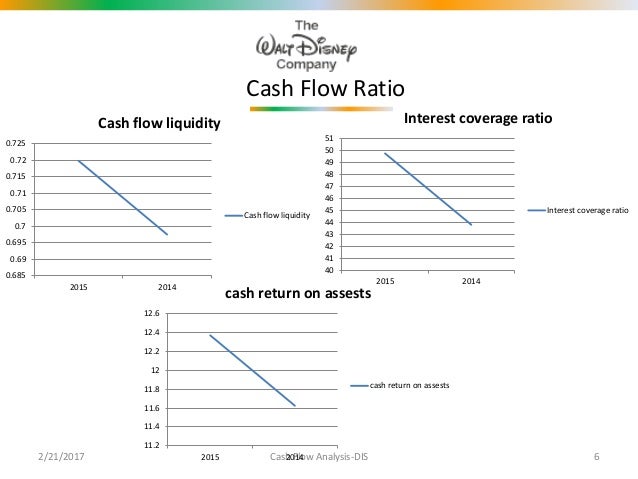

Walt Disney Cash Flow Analysis. Ten years of annual cash flow statements for Disney DIS. The companys dividend payment.

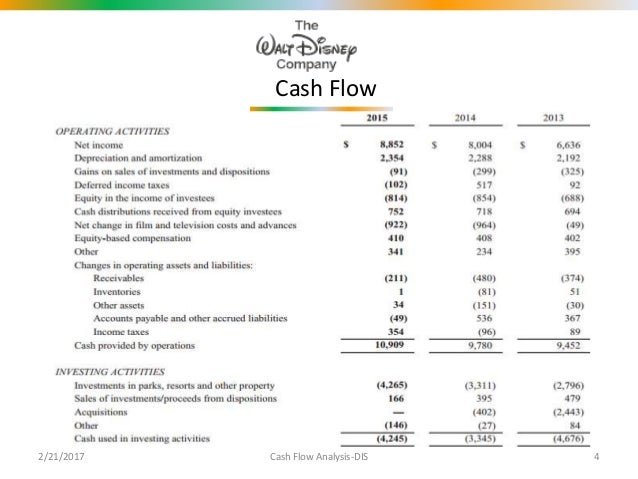

These are the numbers to bear in mind given Disney. The cash flows are grouped into three main categories. Retention rate RR 4.

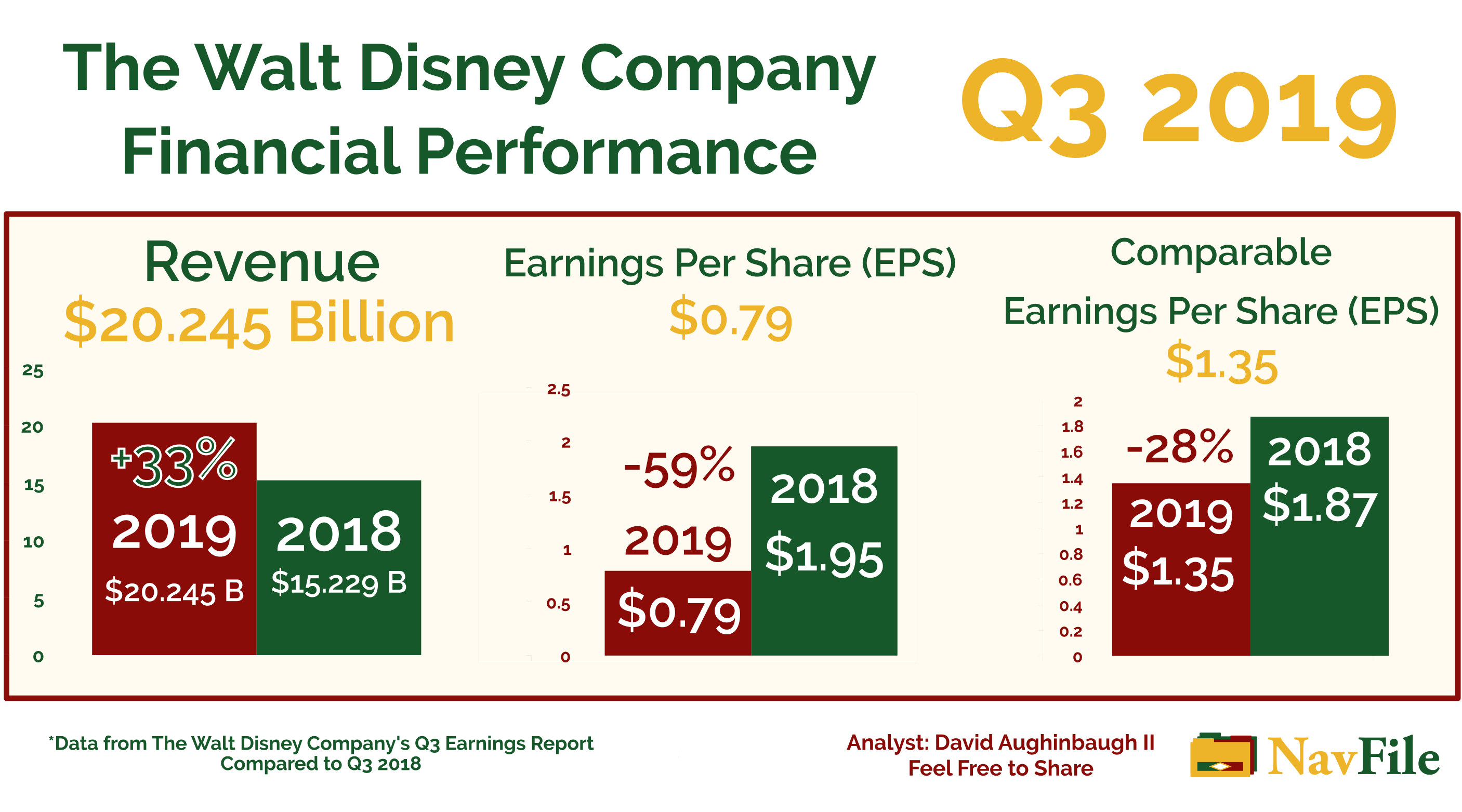

Disney annual free cash flow for 2020 was 3594B a 22437 increase from 2019. Disney annual free cash flow for 2018 was 983B a 1273 increase from 2017. Cash flow from operations cash flow from investing and cash flow.