Beautiful Warranty Liabilities On Balance Sheet

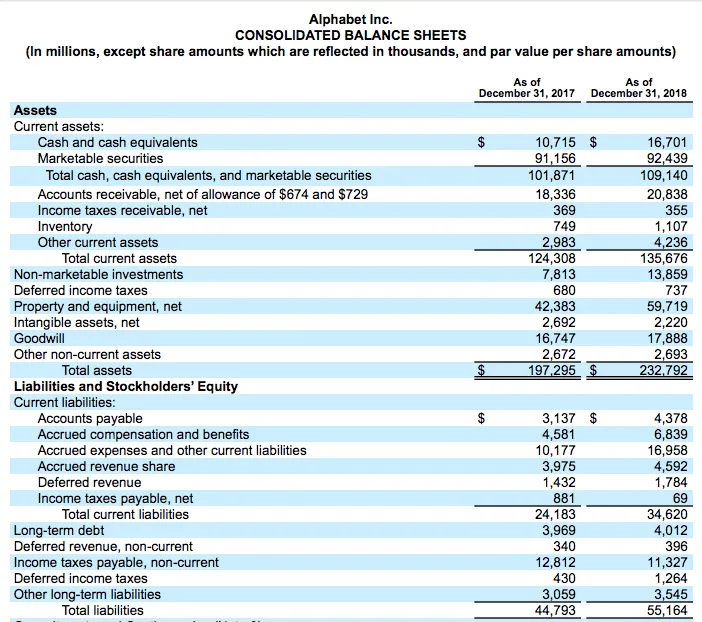

They appear on a companys balance sheet and are recognized according to certain criteria of the IFRS.

Warranty liabilities on balance sheet. Why are warranty liabilities usually recognized on the balance sheet as liabilities even when they are uncertain. As an example General Electric reported on its December 31 2008 balance sheet a liability for product warranties totaling over 168 billion. Example of a Provision.

Thus the income statement is impacted by the full amount of warranty expense when a sale is recorded even if there are no warranty claims in that period. In many cases the after-cost involves a liability whether it. In the notes to the financial statements the company explains We provide for estimated product warranty expenses when we sell the related products.

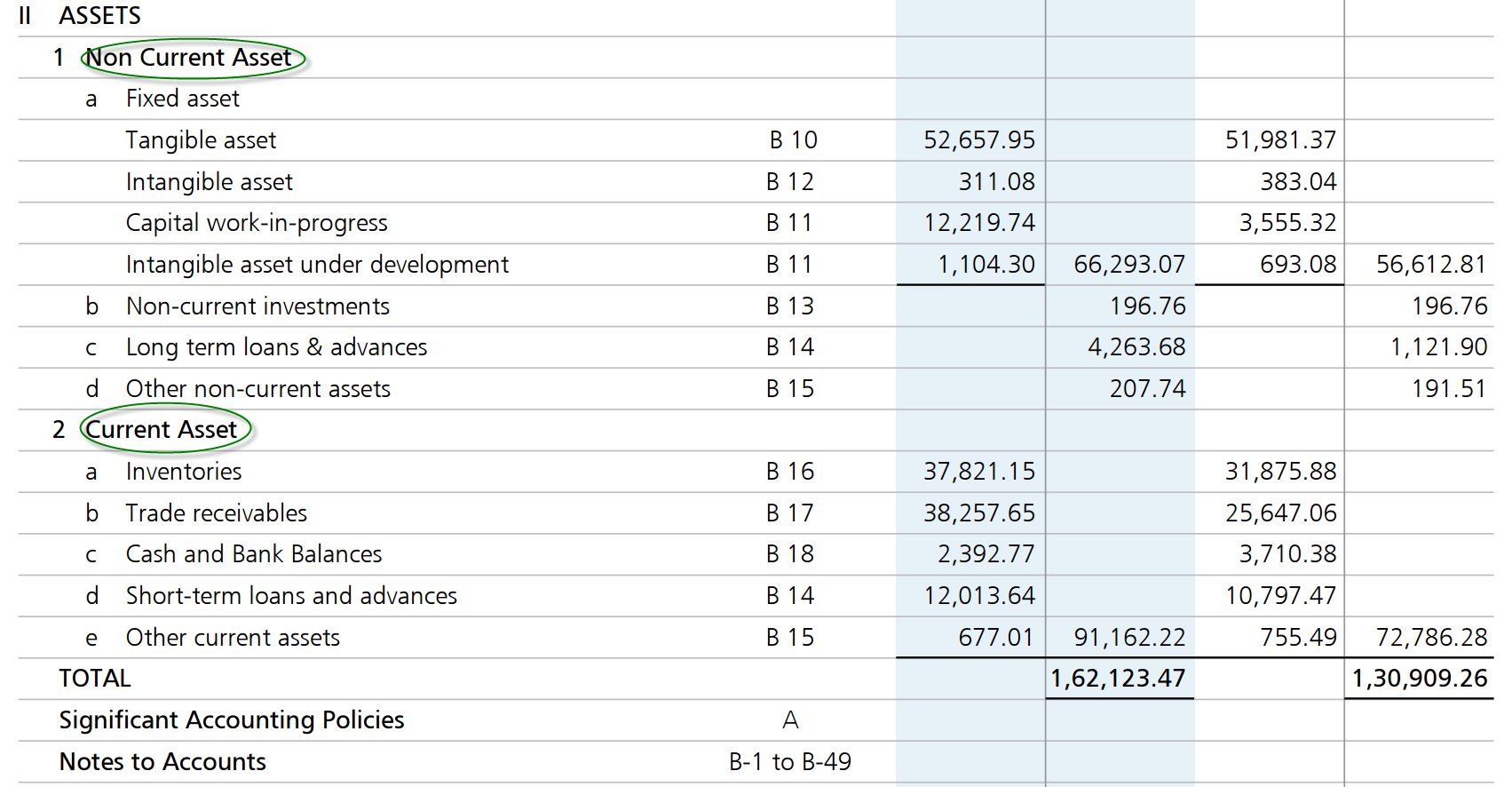

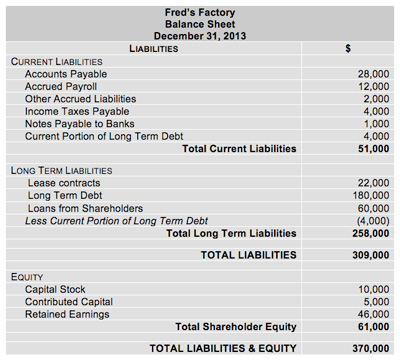

A warranty goes on the liability section of a balance sheet. To record the warranty expense we need to know three things. Recorded on the right side of the balance sheet liabilities include loans accounts payable mortgages deferred revenues bonds warranties and accrued expenses.

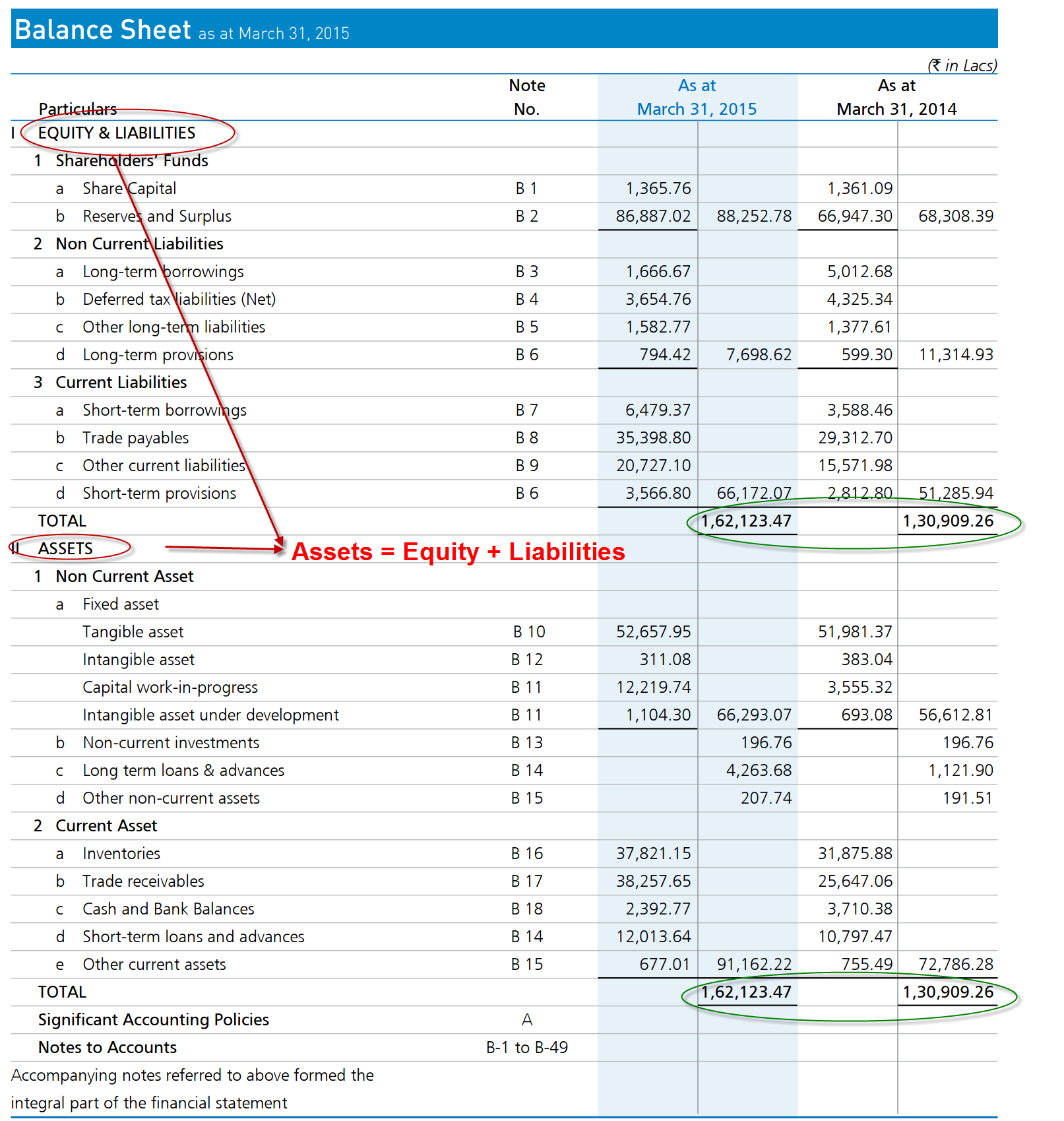

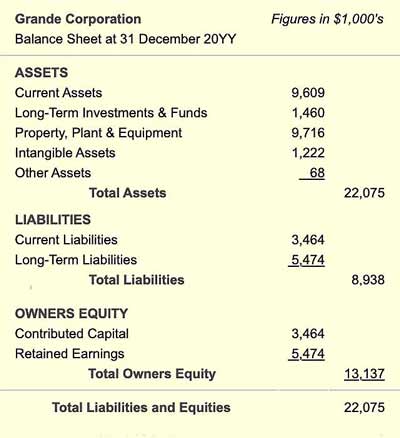

In this example debit the warranty expense account and credit the warranty liability account for 1000. Some liabilities are not as exact as AP and have to be estimated. Balance Sheet Balance sheet is a statement of the financial position of a business that list all the assets liabilities and owners equity and shareholders equity at a particular point of time.

To match costs with revenue properly all after-costs must be considered. When the warranty liability is both probable and can be estimated the accountant will accrue in the period of the sale a liability and an expense for the future warranty work. For example if you must make a 75 warrantied repair on an item you sold debit warranty liability and credit cash for 75.

Units sold the percentage that will be replaced within the warranty period and the cost of replacement. These will occur if the goods suffer a fault while under the companys warranty. However the warranty can fall under current liabilities or long term liabilities sections depending on whether the warranty duration.

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)