Cool Accounting For Debt Issuance Costs Ey

Debt Discounts and Premiums.

Accounting for debt issuance costs ey. Under current guidance ie ASC 835-30-45-3 before the ASU an entity reports debt issuance costs in the balance sheet as deferred charges ie as an asset. To record the amortization. This publication is designed to provide you with a roadmap to help you analyze the accounting for the issuance of debt and equity instruments including specific transactions.

Separate accounting is still required in certain cases. The accounting for the debt modification depends on whether it considered to be substantial or non-substantial. This refinance is deemed to be an extinguishment.

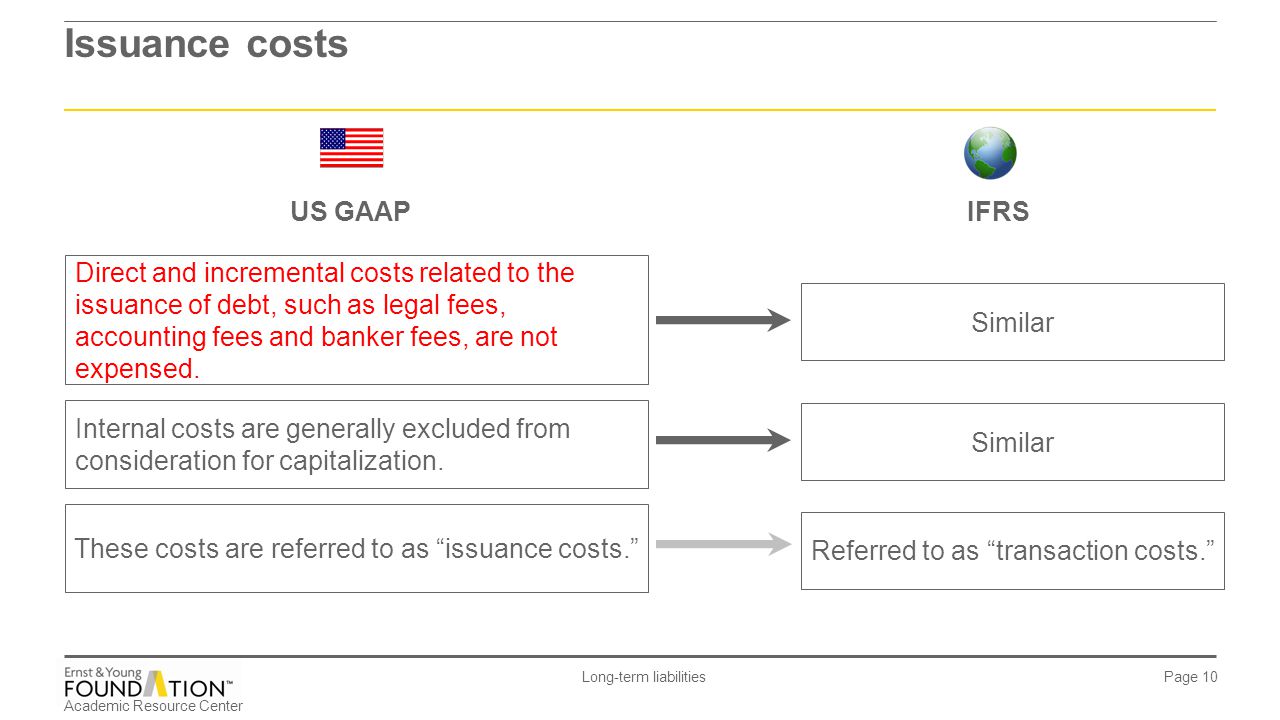

The accounting guidance for the issuance modification conversion and repurchase of debt and equity securities has developed over many years into a complex set of rules. 1 That debt issuance costs are not to be reported as an asset but rather a deduction to the carrying amount of the debt. Refer to Appendix F of the publication for a summary of the updates.

The borrower will usually incur costs in a debt restructuring and other fees might also be paid or received. The proper accounting for these debt issuance costs is to initially recognize them as an asset and then charge them to expense over the life of the bonds. To point 1 above it is a little confusing as to why costs incurred to issue debt should reduce the carrying value.

The final guidance issued by the FASB for convertible instruments eliminates two of the three models in ASC 470-20 that require separate accounting for embedded conversion features. A adjust the carrying amount of the loan b change the amount of interest expense recognized in the income statement on a going-forward basis or recognize a gain or loss in the income statement and or c expense some of the costs incurred to execute the changes and or defer and amortize other costs. 2 The amortization of the debt issuance costs would be classified to interest expense.

The debt issuance costs should be amortized over the period of the bond using the straight-line method. In the past these costs have usually been capitalized as an asset account called debt issuance costs also sometimes called financing costs loan costs prepaid finance charges or prepaid loan fees and then amortized over the term of the loan through an income statement account called amortization expense. Requiring presentation of debt issuance costs as a direct reduction of the related debt liability rather than as an asset is consistent with the presentation of debt discounts under US.