Unique Bny Mellon Financial Statements

To pursue these goals the fund normally invests at least 80 of its net assets in common stock.

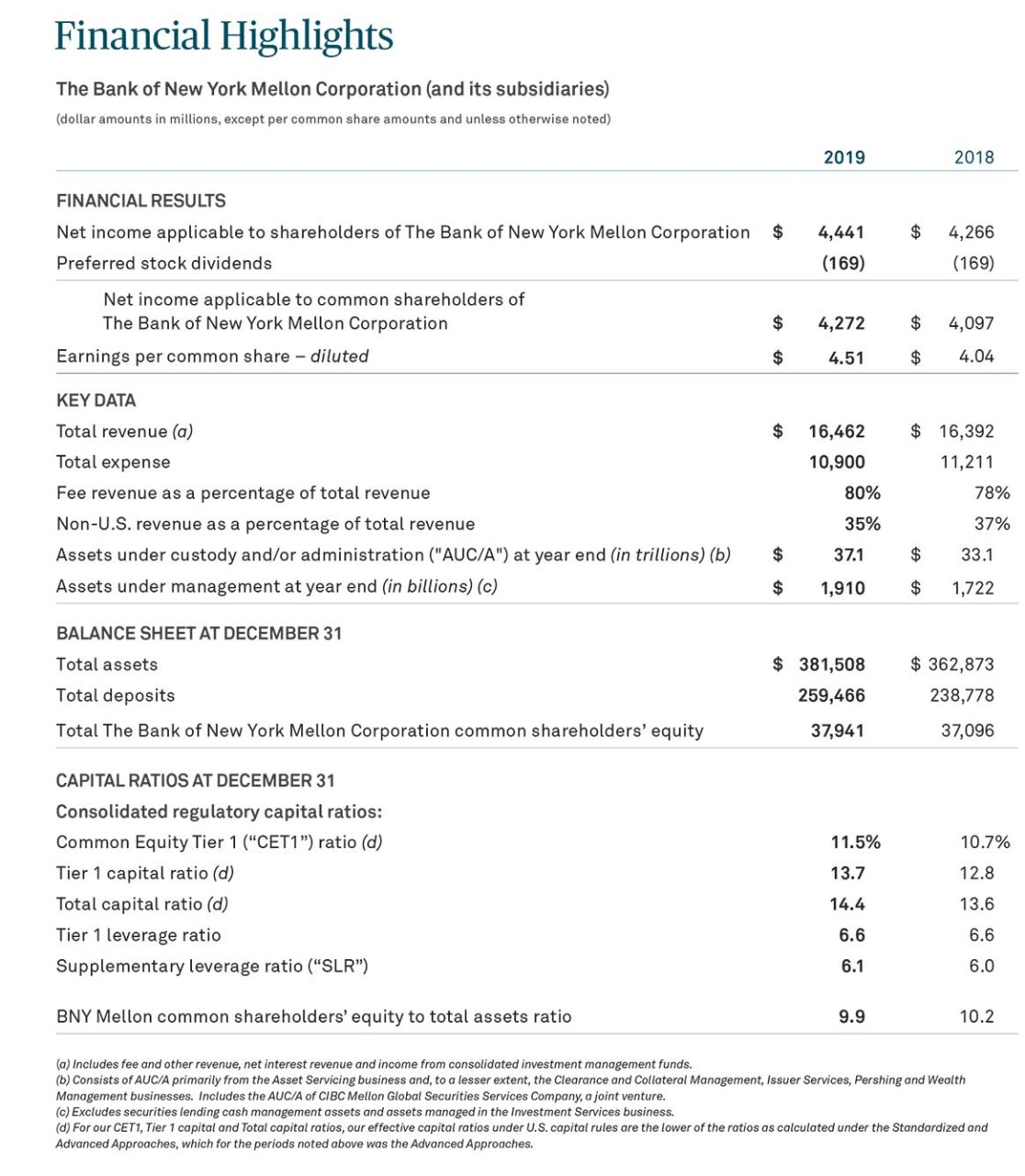

Bny mellon financial statements. Effective January 2 2019 the combined firm was renamed Mellon Investments Corporation. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre The Exchange. This material is intended for Professional Clients only and no other person should act upon it.

2019 Annual Report - Financial Section PDF Proxy Statement. An Indirect Wholly Owned Subsidiary of BNY Mellon Notes to Statement of Financial Condition December 31 2020 2 1 Organization BNY Mellon Capital Markets LLC the Company is a wholly owned subsidiary of BNY Capital Markets Holdings Inc. Mellon was formed on January 31 2018 through the merger of The Boston Company and Standish into Mellon Capital.

See notes to financial statements. IWM revenue millions 2712 2851 1Q20 4Q20 1Q21 2760 5 161 204 1Q20 4Q20 1Q21 130 426 bps IS revenue Adj. All of BNY Mellons financial statements are interrelated with each one affecting the others.

BNY Mellon Investment Management encompasses BNY Mellons affiliated investment management firms wealth management services and global. Choose Your Region or. Companies with total market capitalizations of more than 5 billion at the time of purchase including multinational companies.

Whether providing financial services for institutions corporations or individual investors BNY Mellon delivers informed investment and wealth management and investment services in 35 countries. Mellon is a multi-asset investment adviser providing clients with a wide range of investment solutions. Due to BNY Mellon Investment Adviser Inc.

Its secondary goal is current income. Because of this it is necessary to analyze all of BNY Mellon. The fund seeks long-term capital appreciation consistent with the preservation of capital.