Top Notch Retained Earnings Ifrs

Retained earnings may not be burdened or credited with accounts that should be taken into account in the current years income statement.

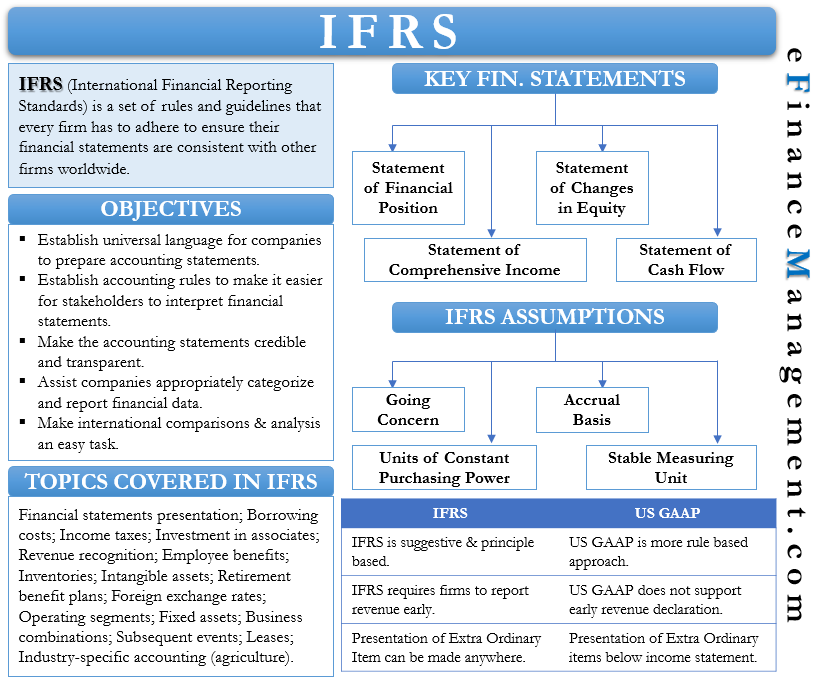

Retained earnings ifrs. Equity retained earnings Version IFRS. The statement of retained earnings reconciles changes in the retained earnings account during a reporting period. It is recorded under shareholders equity on the balance sheet.

Full retrospective application and modified retrospective application. Retained earnings start with the prior year amount plus net income less dividends to arrive at current period retained earnings. For the latter the cumulative effect of adoption is recognised as an adjustment to retained earnings.

Normally these funds are used for working capital and fixed asset purchases capital expenditures or allotted for paying off debt obligations. If the liability component of a compound financial instrument is no longer outstanding at the date of the opening IFRS statement of financial position the entity is not required to reclassify out of retained earnings and into other equity the original equity component of the compound instrument. All retained earnings are considered free to be distributed as dividends unless given an indication of restrictions on retained earnings.

Retained Earnings RE are the accumulated portion of a businesss profits that are not distributed as dividends to shareholders but instead are reserved for reinvestment back into the business. Transition adjustments recognized in retained earnings Disclosures and reconciliation to prior GAAP to explain effect of transition to IFRS. A error of correction related to prior accounting period.

This disclosure has been demonstrated in the above extract of the statement of changes in equity. IFRS Purchase Method and GAAP Acquisition Method Accounting. On adoption IFRS 16 provides lessees with a choice between two transition methods.

IAS 16 outlines the accounting treatment for most types of property plant and equipment. Terms defined in the Glossary are reproduced in bold typethe first time they appear in the text of Section 6. Retained earnings are profits collected after deducting PPH so that this profit may not be charged or credited with accounts that should be taken into account in the calculation of current years profit and loss.