Breathtaking Operating Investing Financing Change In Tax Rate Deferred Tax Example

Overview of the guide 1 Section 1.

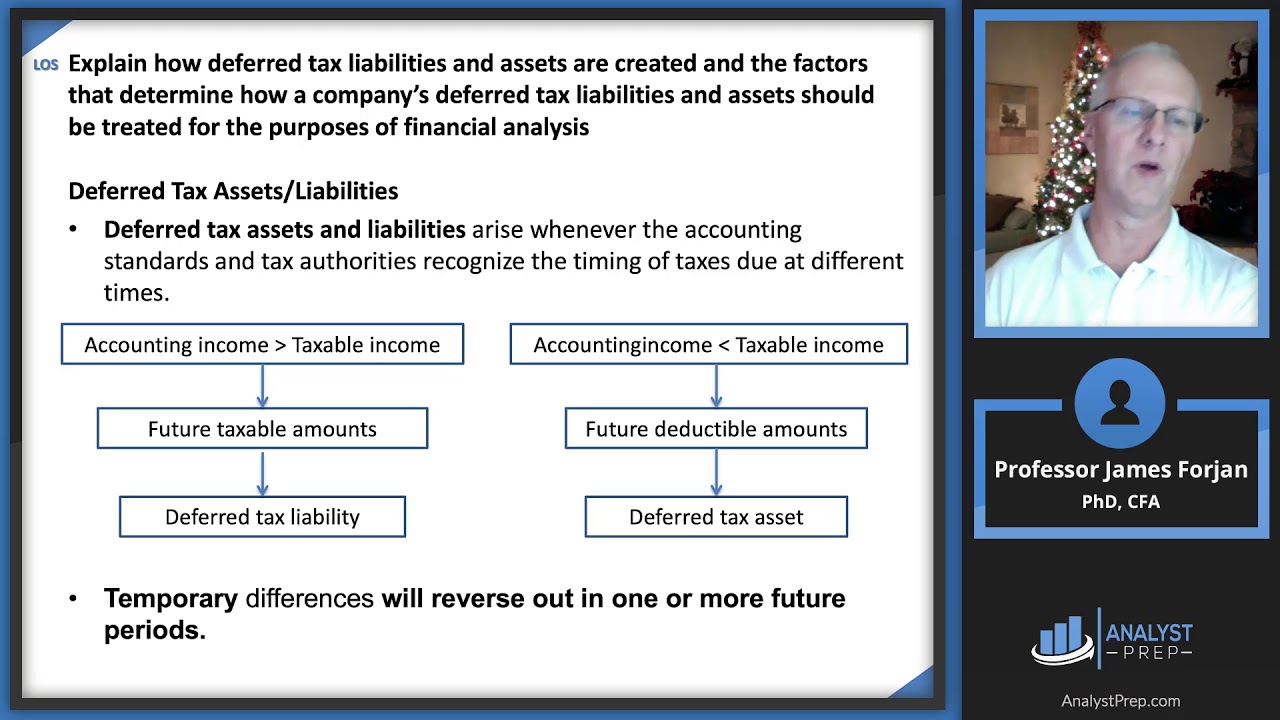

Operating investing financing change in tax rate deferred tax example. However FRS 102 also requires deferred tax to be accounted for in respect of assets other than goodwill and liabilities recognised as a result of a business combination. However the company can recognize 250000 as a deferred tax asset on its balance sheet. If the tax rate for the company is 30 the difference of 18 60 x 30 between the taxes payable in the income statement and the actual taxes paid to the tax authorities is a deferred tax asset.

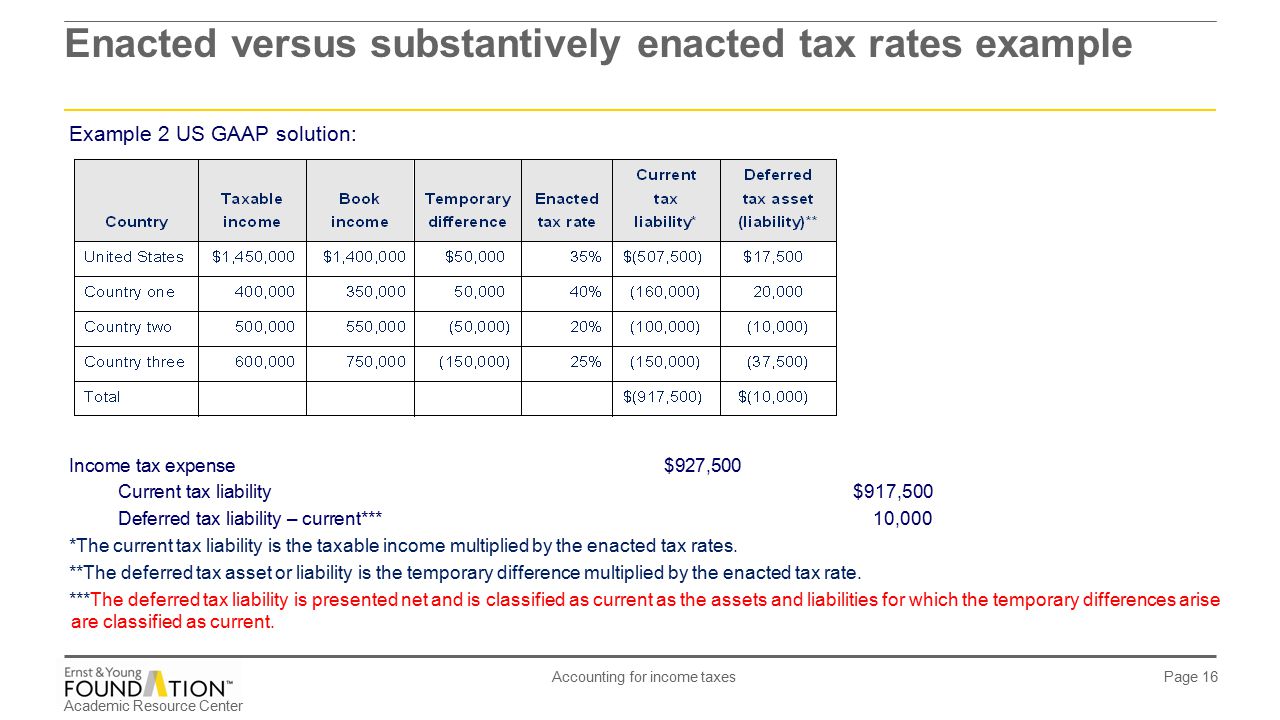

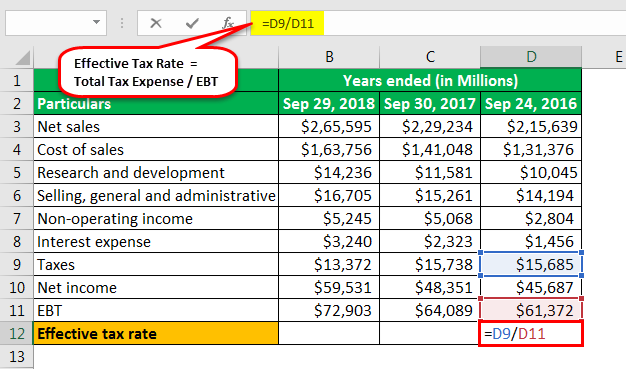

Calculating a deferred tax balance the basics 3 Section 2. Suppose taxable income is 5000. Changes in tax laws and rates may affect recorded deferred tax assets and liabilities and our effective tax rate in the future.

When recognised the tax effect will usually be measured using the tax rates. As a result of the 14 percent change in the effective tax rate the deferred tax asset would be credited by 140 with an offsetting debit to income tax expense from continuing operations. Consider the following example.

As always the offset to the change in deferred tax assets and liabilities is either additional tax expense or an income tax benefit. Company ABC owns a factory building the value of the land is considered to be insignificant and must be ignored a depreciable asset which is leased out under an operating lease to a third party. While taxes shouldnt necessarily drive your investment decisions they should be considered.

This is a deferred tax asset because your carrying amount is lower than the tax base. The tax rate is 30. Nevertheless there are losers from tax reform namely those companies with large net deferred tax.

But with this change in the rate the same 10 million NOL would be reduced to just 21 million within the same entitys balance sheet. Because a change in tax law is accounted for in the period of enactment. Recognising deferred tax on leases.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)