Great Tesla Income Statement Analysis

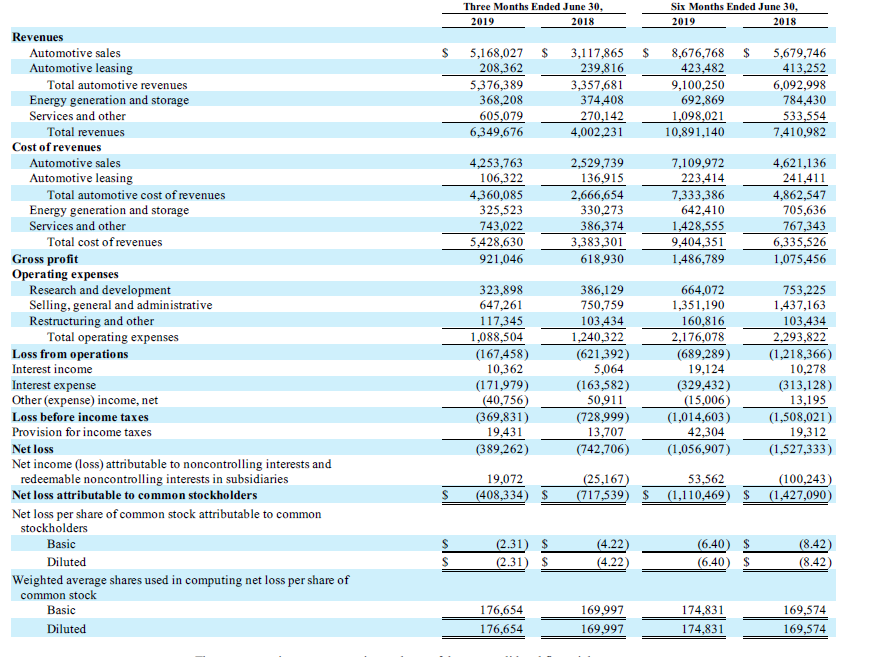

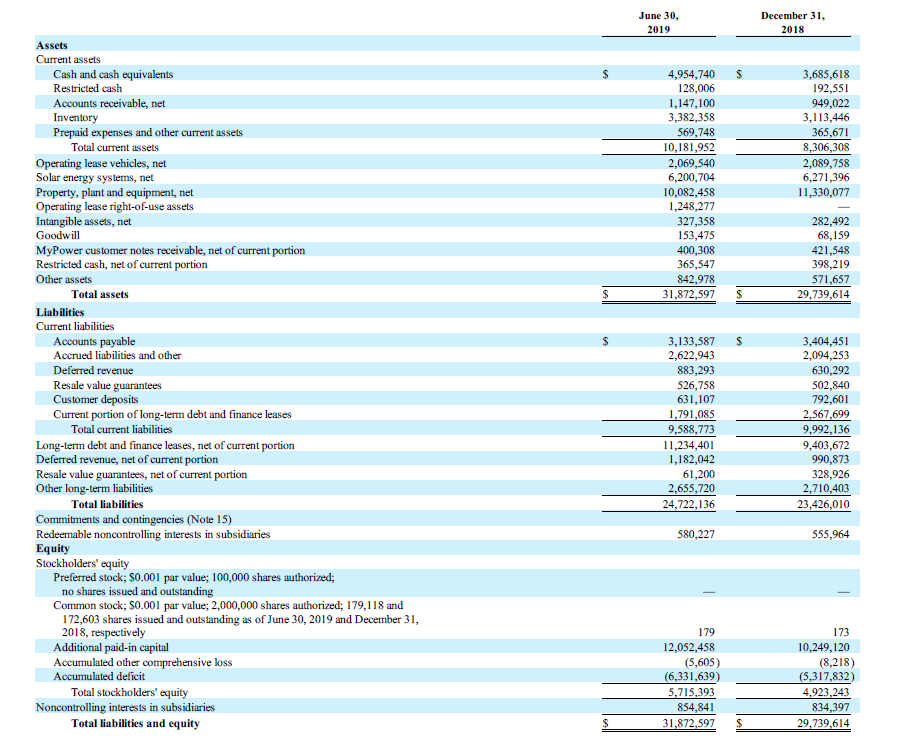

Similarly the total operating expenses decreased from 3238 in 2016 to 1623 in 2019.

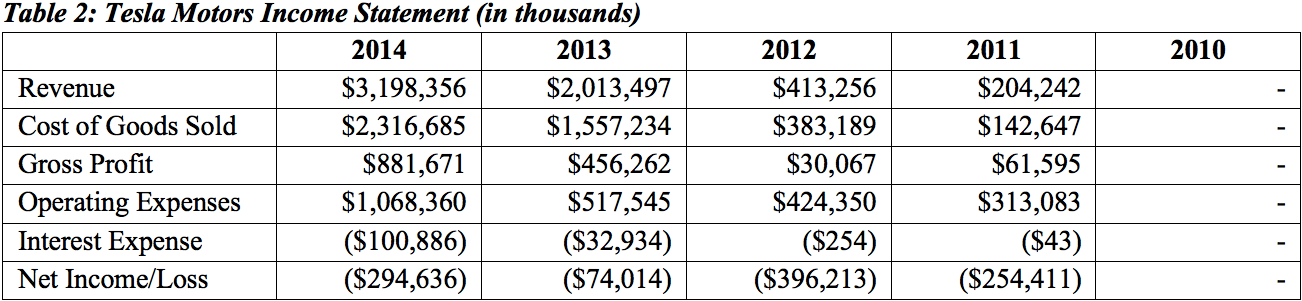

Tesla income statement analysis. Net income declined from 964 to 351 in 2019. Get the detailed quarterlyannual income statement for Tesla Inc. Net Income Before Taxes.

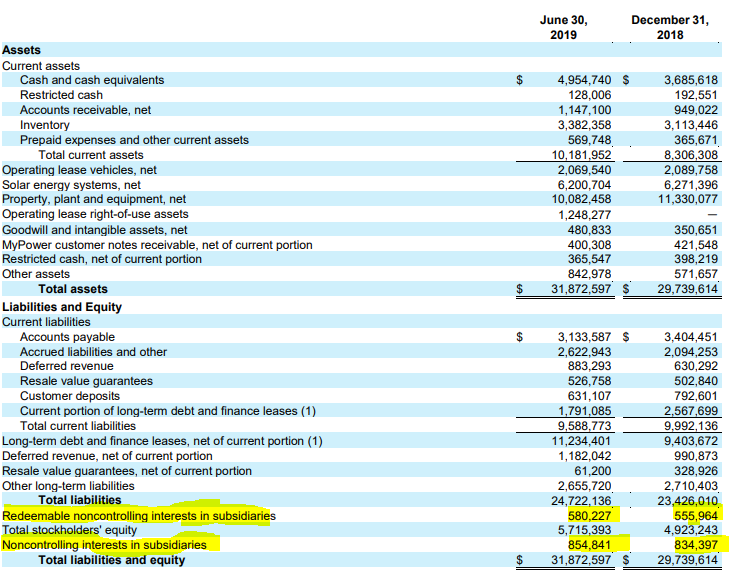

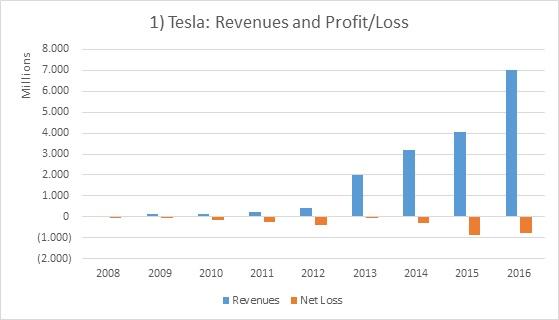

The information is derived from the 10-K and 10-Q reports submitted to the SEC in XBRL eXtensible Business Reporting Language format and presented according to the US GAAP Taxonomy. Interest Income Expense Net Non-Operating-87-498-51-143. On average this is an average annual growth rate for revenues of approximately 468.

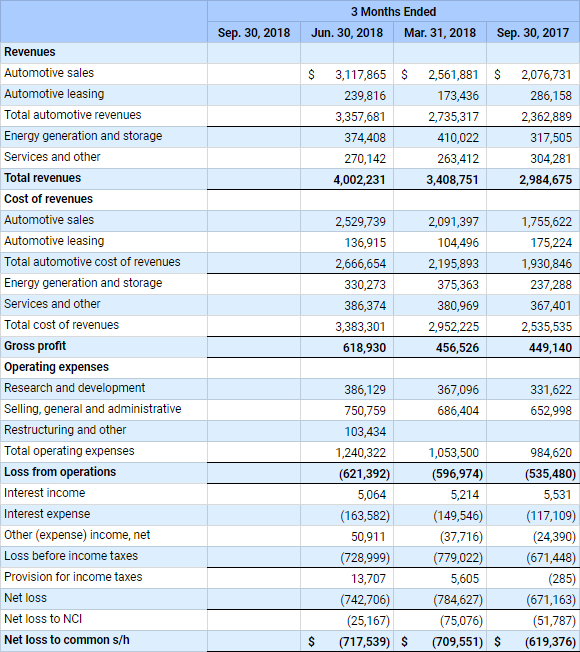

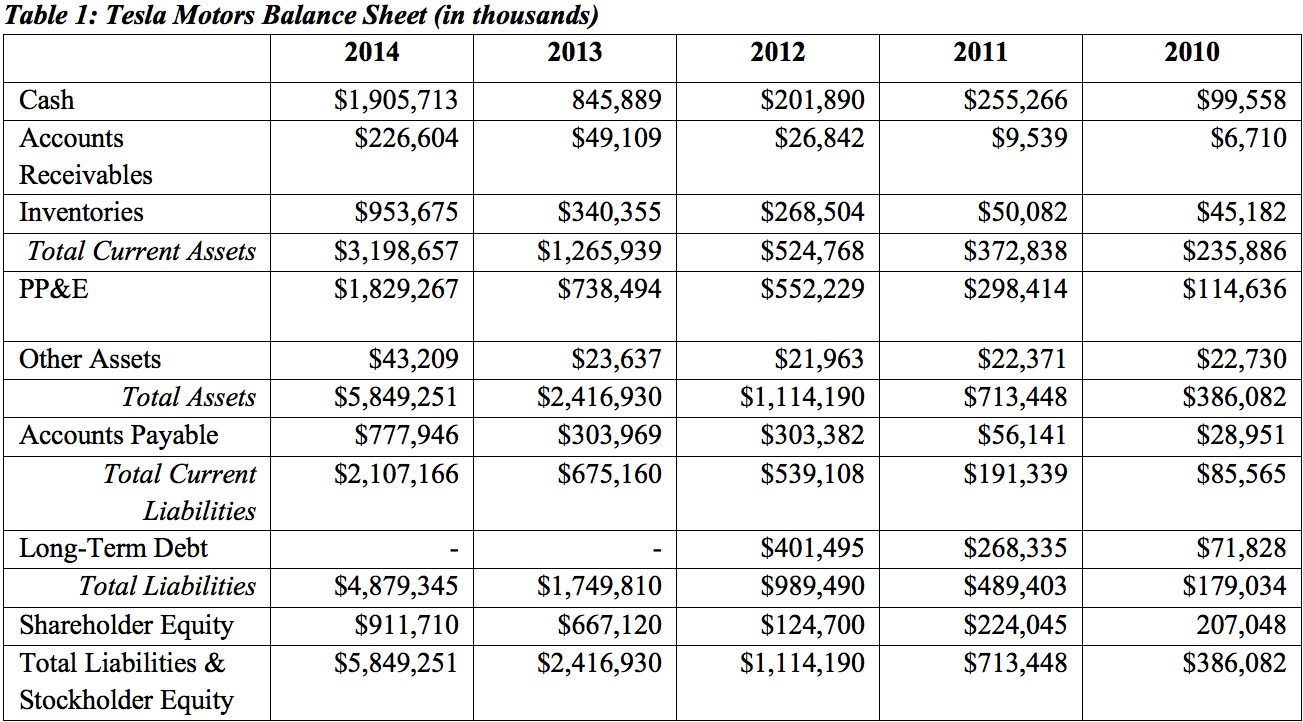

About Tesla Income Statement Analysis Tesla Inc Income Statement consists of revenues and expenses along with the resulting net income or loss. 30 rows Operating Income. APPENDIX C-1 Vertical Analysis - Tesla Ford Income Statements Tesla Inc.

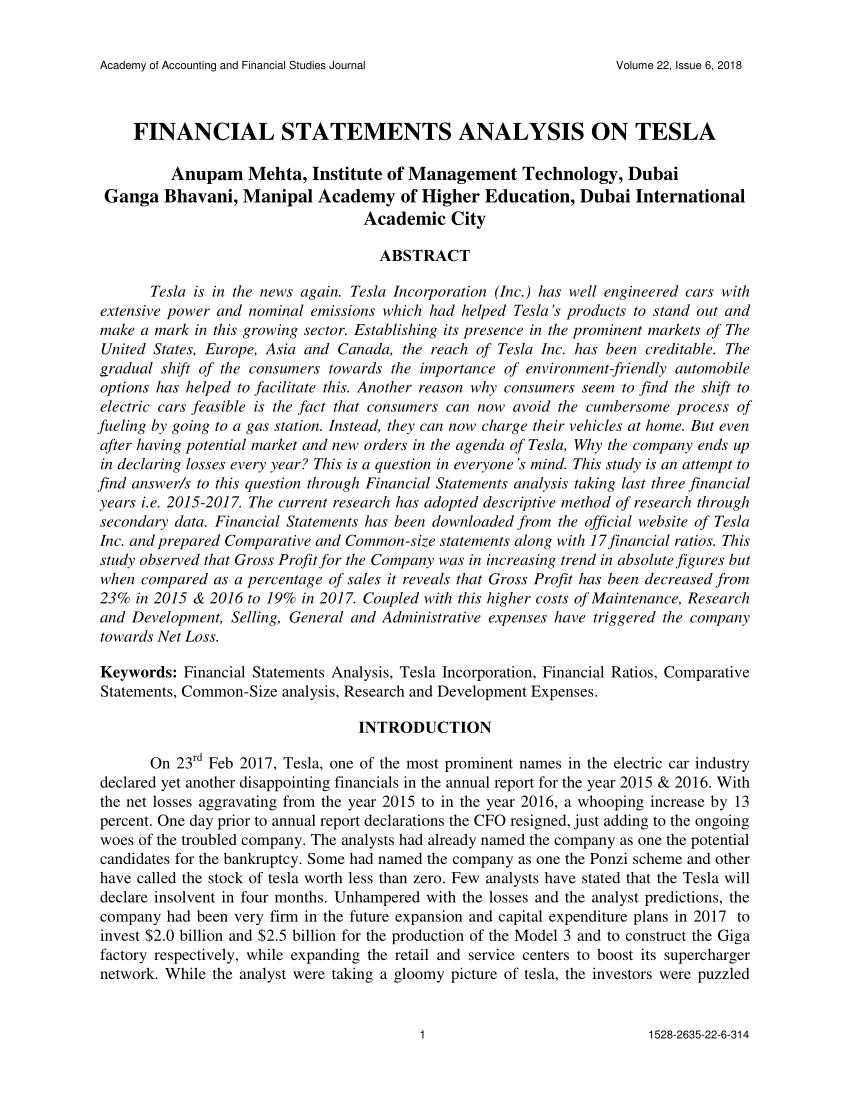

During a period from transactions and other events and circumstances from non-owners sources. Find out the revenue expenses and profit or loss over the last fiscal year. Income Statement Seeking Alpha TSLA - Tesla Inc.

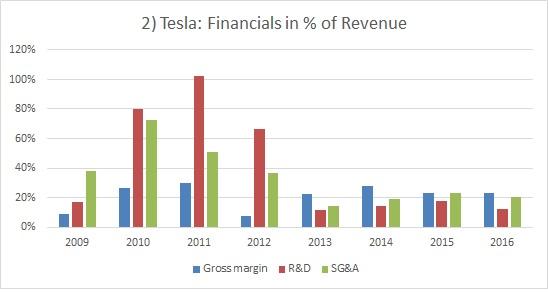

Hereafter the Company for the year 2020 submitted to the US. Its financial strength comes almost exclusively from its stock offerings. By looking at the vertical analysis of Tesla income statements nit is evident that the gross profit has been decreasing.

TSLA Ford F Income Statement Income Statement All numbers in thousands All numbers in thousands Revenue 12312017 12312016 12312015 12312017 12312016 12312015 Total Revenue 1000 1000 1000 1000 1000 1000 Cost of Revenue 811 772 772 894 887 879. Gain Loss on Sale of Assets----Other Net. This information may help you make smarter investment decisions.