Ace Profit And Loss Terms

Profit stands for gain advantage or benefits whereas loss is the opposite of profit that involves expenditure as compared to gain.

Profit and loss terms. Subtract your total spending away from your total income. I In case of profit selling price cost price and in case of loss selling price cost price. The formula for the profit and loss percentage is.

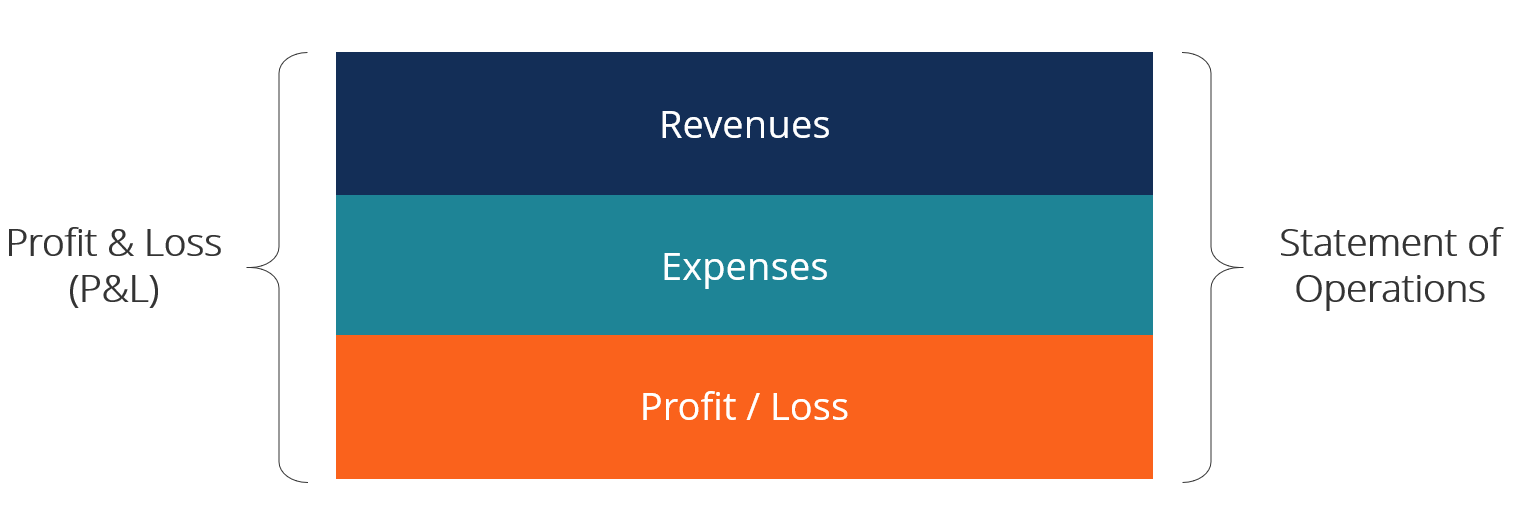

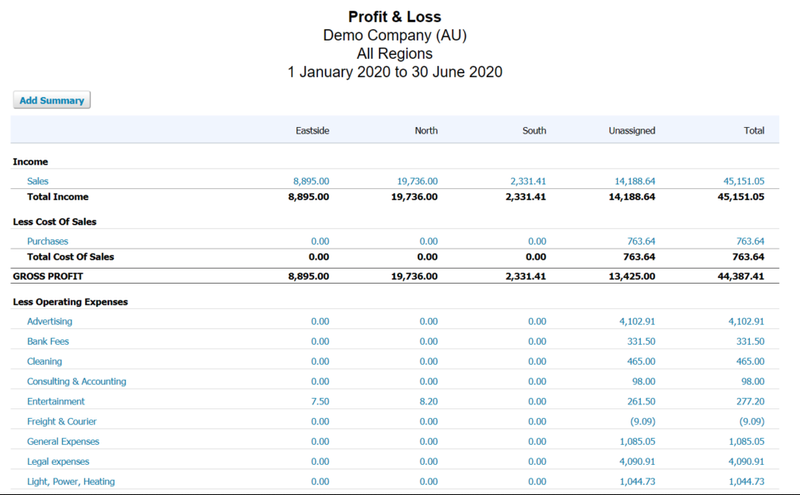

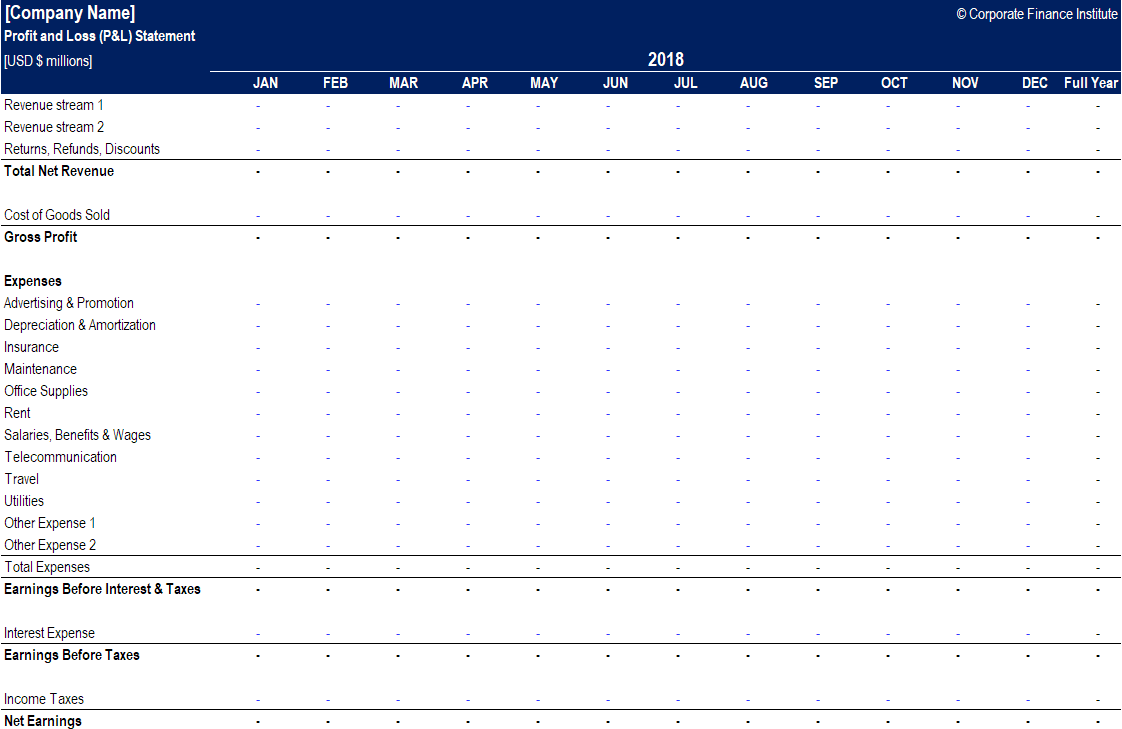

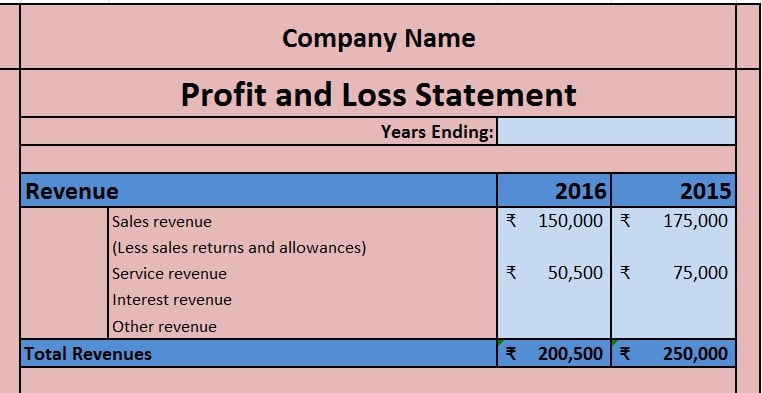

Profit and loss total revenue total expenses If the resulting figure is negative you have made a loss. Net profit is made when the total revenues exceed the total expenses. If the resulting figure known as net income is negative the company has made a loss and if it is positive the company has made a profit.

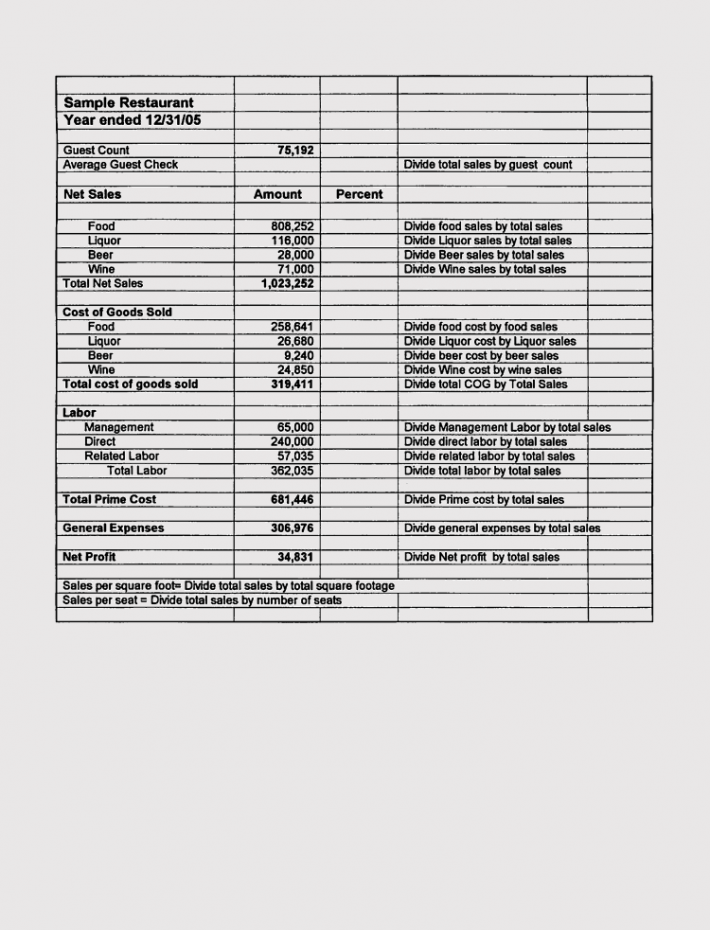

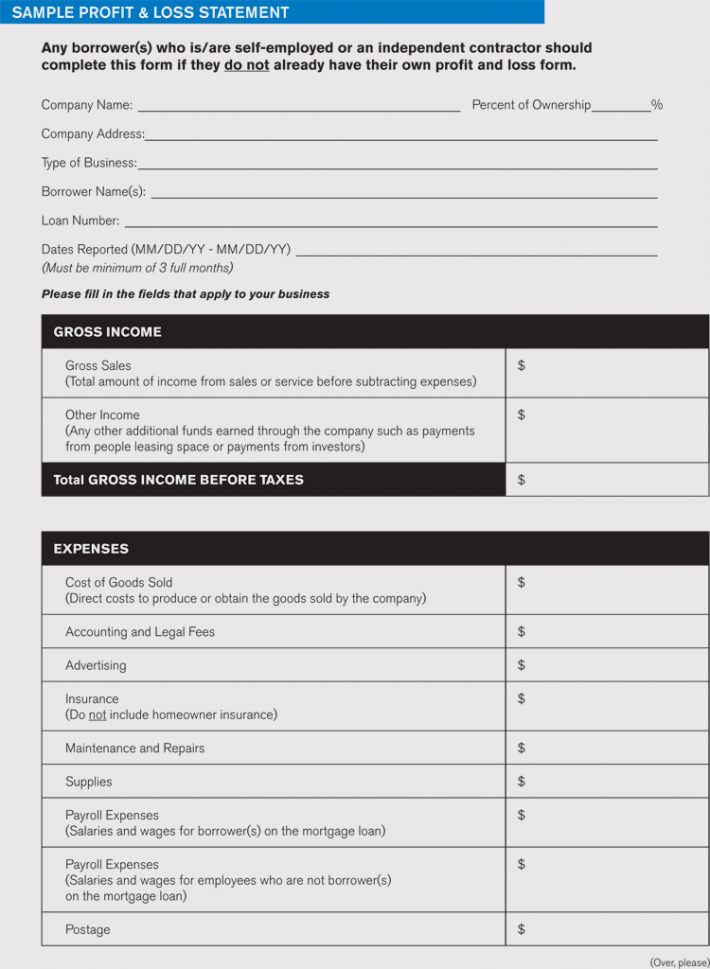

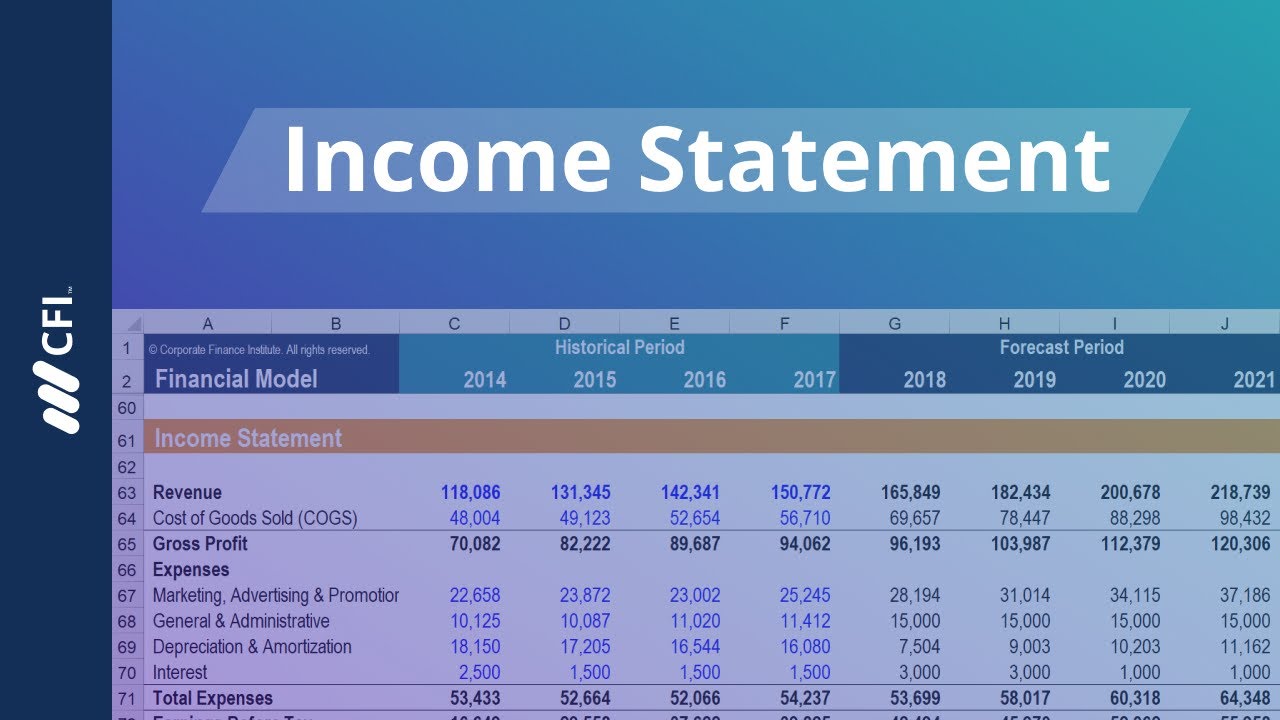

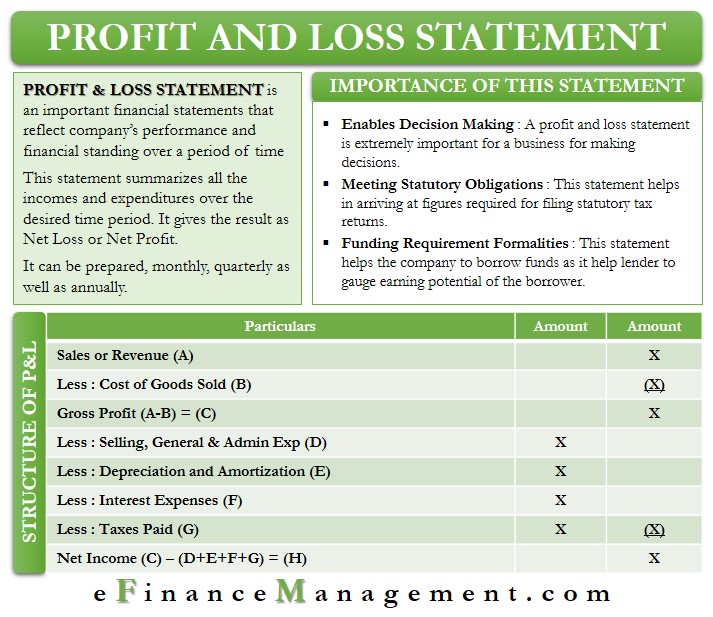

They are also known as income statements. Why is a PL statement important to investors and traders. Sometimes it also includes overhead expenses transportation cost etc.

28 rows The profit and loss statement is a financial statement that summarizes the revenues costs and. In case of loss CP 100 x 100 x P100-m100-n If P and L are equal then P L and loss P 2 100. A positive number means youve made a profit.

The profit made when a product is sold for more than its cost price. Profit and loss Put simply profit is the surplus left from revenue after paying all costs. This page discusses numerous profit loss and discount suggestions and algorithms.

You can also use accounting software to calculate profit and loss. If the total of revenues is less than the total expenses the net loss is incurred. Profit Loss and Discount is a prominent GMAT topic The number of concepts in these areas is modest and the equations may be used to answer most of the issues.

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)