Best Change In Stockholders Equity Formula

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

A statement of cash flows uses information from the income statement and balance sheet to identify how a company receives and uses cash.

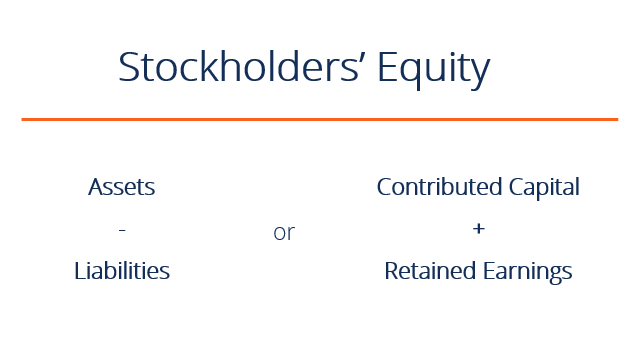

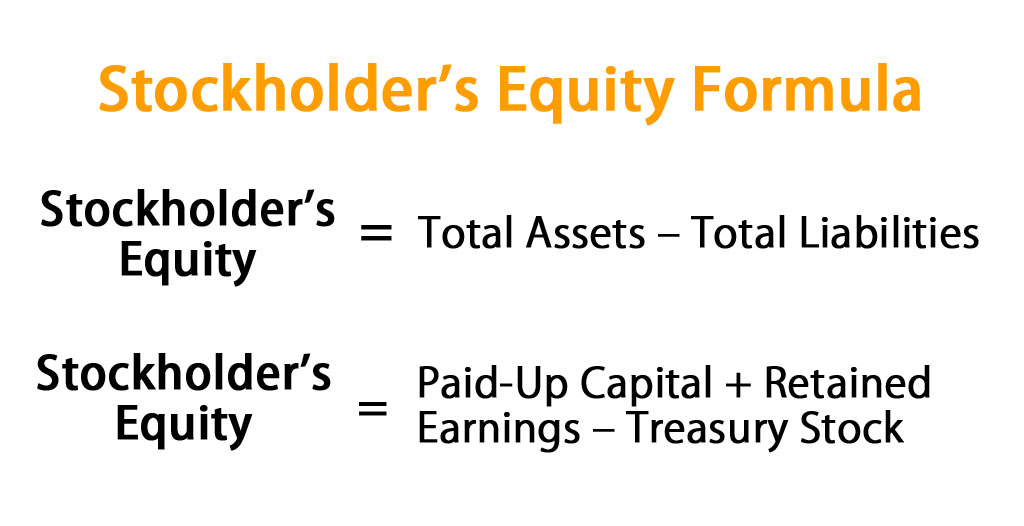

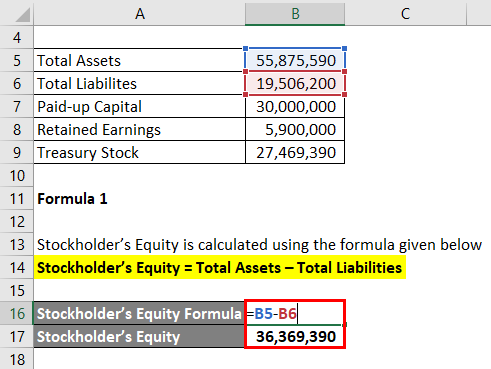

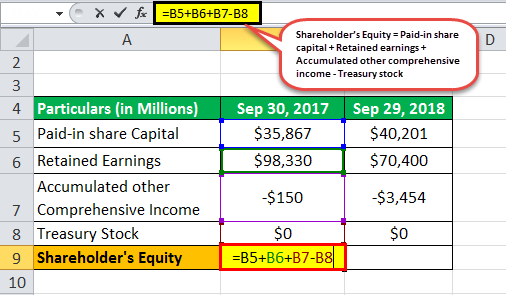

Change in stockholders equity formula. GAAP details the change in owners equity over an accounting period by presenting the movement in reserves comprising the shareholders equity. Stockholders Equity Assets Liabilities. Step 1 Firstly determine the value of the equity at the beginning of the reporting period which is the same as the value at the end of the last reporting periodIt is the opening balance of equity.

The companys CFO has asked you to prepare a statement of changes in equity for the company for the year ended 30 June 2014. The amount of stockholders equity can be calculated in a number of ways including the following. In the above-mentioned formula the equity of the stockholders is the.

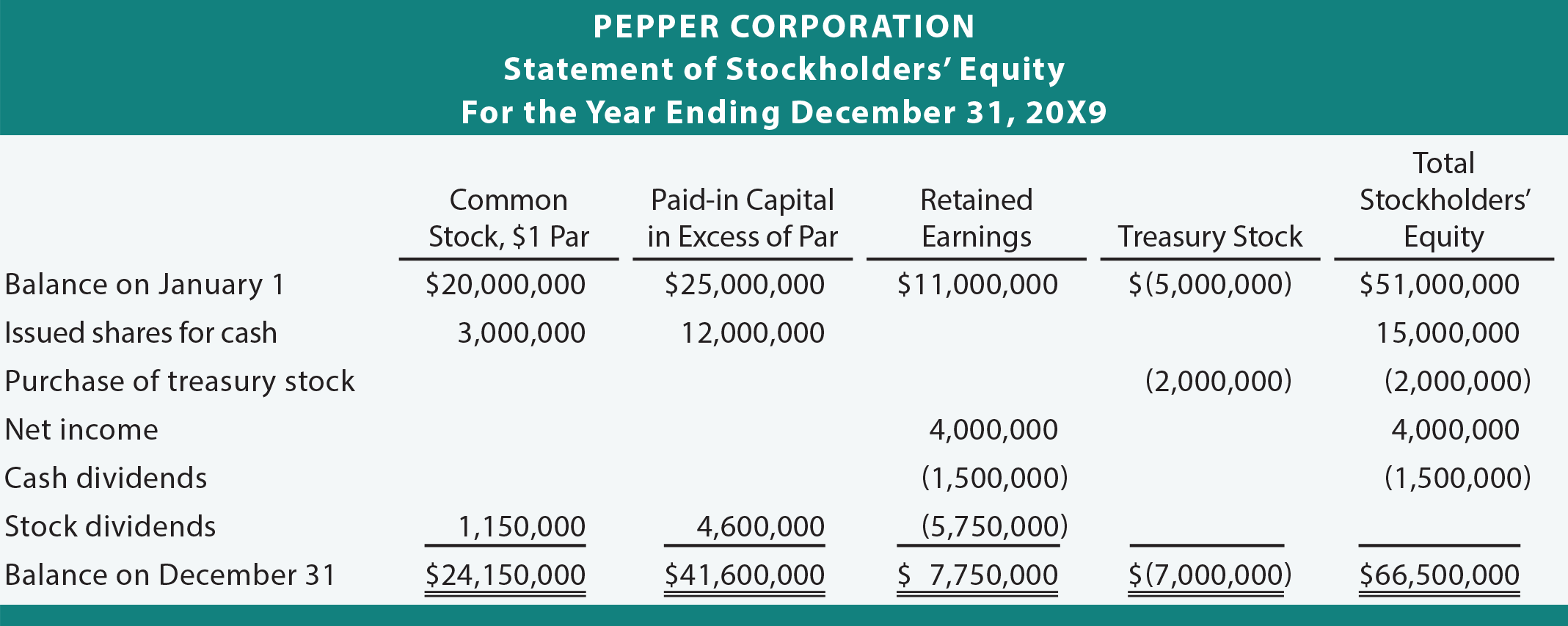

Issuance of stock Change in stockholders equity - net income dividends. This document already aggregates the required information. Following information is available.

Stockholders equity can change because of three fundamental things --. Owners invest in stock and Common Stock is credited and increases. When a company pays cash dividends to its shareholders its stockholders equity is decreased by the total value of all dividends paid.

Is a company engaged in extraction of Aluminum. The statement of stockholders equity is a financial statement that summarizes all of the changes that occurred in the stockholders equity accounts during the accounting year. Changes in stockholders equity can lead to cash inflows or outflows depending on the specific activity.

The stockholders equity also known as shareholders equity represents the residual amount that the business owners would receive after all the assets are liquidated and all the debts are paid. Increase in stockholders equity Insurance of stock revenue-expenses- dividends. 30000 45000 75000.