Stunning Procter And Gamble Financial Ratios

Cash Flow to Assets.

Procter and gamble financial ratios. Procter Gamble Co. Moreover PG will analysis the activity ratios that include inventory turnover and also total assets turnover. The EVEBITDA NTM ratio of The Procter Gamble Company is significantly higher than the average of its sector Nondurable Household Products.

Latest key Financial Ratios Easy analysis of PROCTER AND GAMBLE to know overall fundamental strength of the company before investing. Per Share Ratios. Procter Gamble current ratio for the three months ending March 31 2021 was 071.

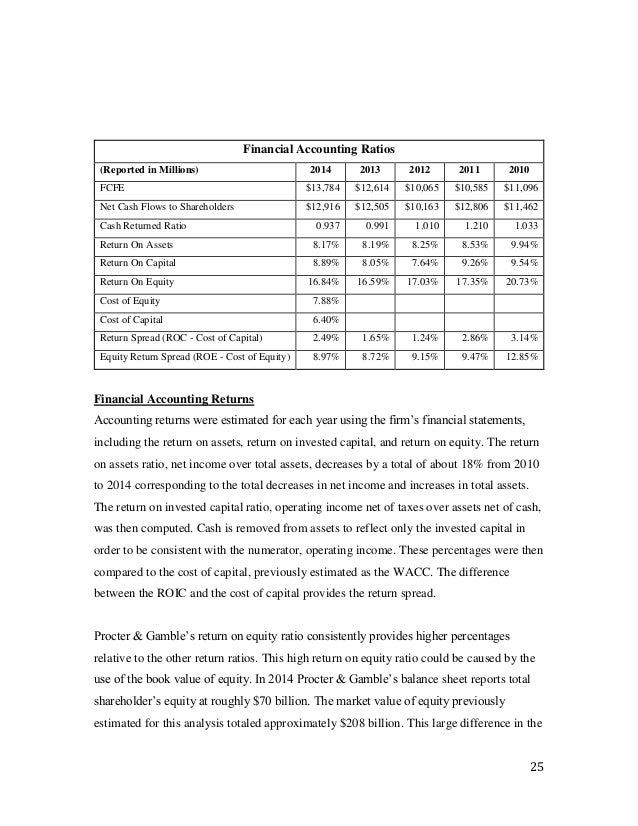

In order to give you a more in depth analysis of Proctor Gambles financial position we used several ratios. Procter Gamb Procter Gamble Health Ltd. Basic EPS Rs 13342.

Interest Coverage Ratio. Balance sheet income statement cash flow earnings estimates ratio and margins. These ratios measure whether a company is able to convert account within their balance sheet into cash.

View PG financial statements in full. -1 between the first and the second quartile. Each ratio value is given a score ranging from -2 and 2 depending on its position relative to the quartiles -2 below the first quartile.

According to these financial ratios The Procter Gamble Companys valuation is way above the market valuation of its sector. The debt-to-total assets ratio in June 2008 is 05174 the debt-to-equity ratio is 10720 and the long-term debt-to-equity ratios is 01883. Current and historical current ratio for Procter Gamble PG from 2006 to 2021.

/CPGmargins2-4ff366775c70472f84f52f4fc96a5ca7.jpg)