Nice Loan To Subsidiary In Cash Flow Statement

The worksheet entries produce correct balances for the consolidated statement of cash flows.

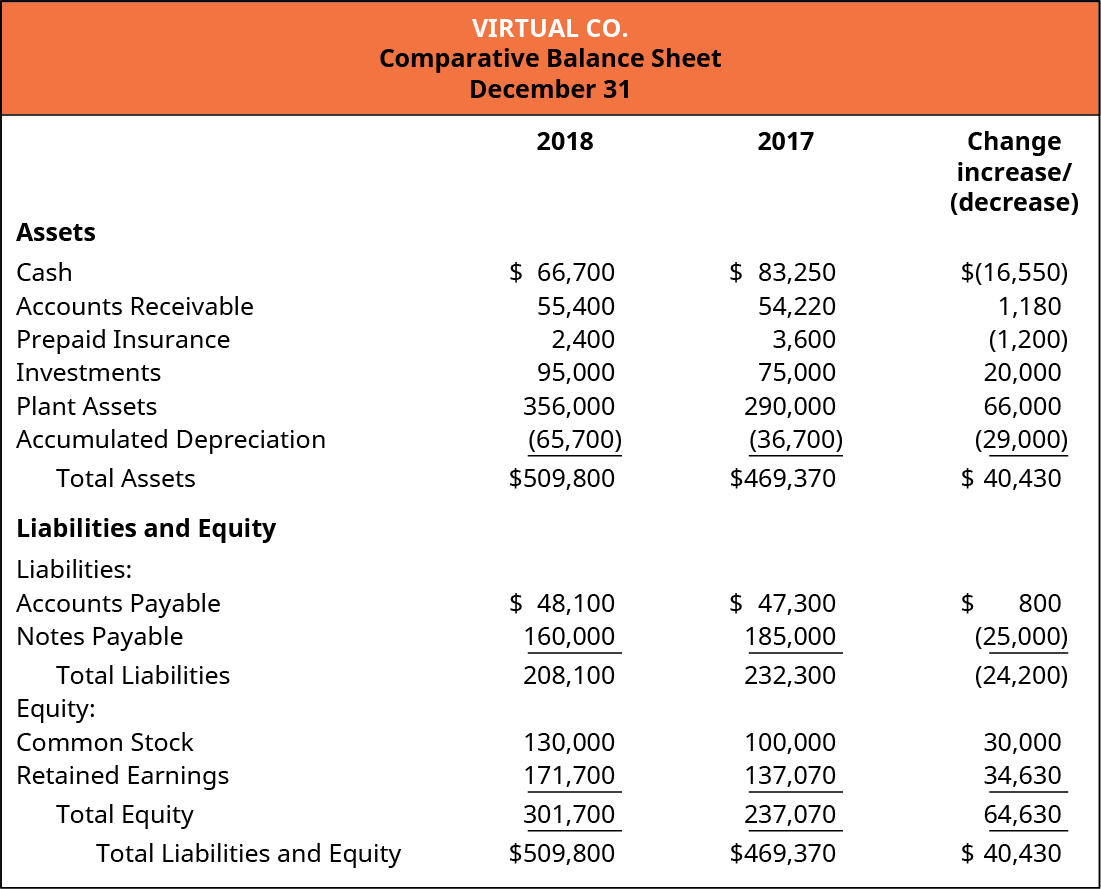

Loan to subsidiary in cash flow statement. 2014 2013 000 000 Fixed assets 21352 67643 Investment properties - 133420. Under IFRS IAS 7 Statement of Cash Flows deals with principles underlying the preparation of such a financial statement. Students attempting financial reporting papers will need an awareness of the concept of the statement of cash flows.

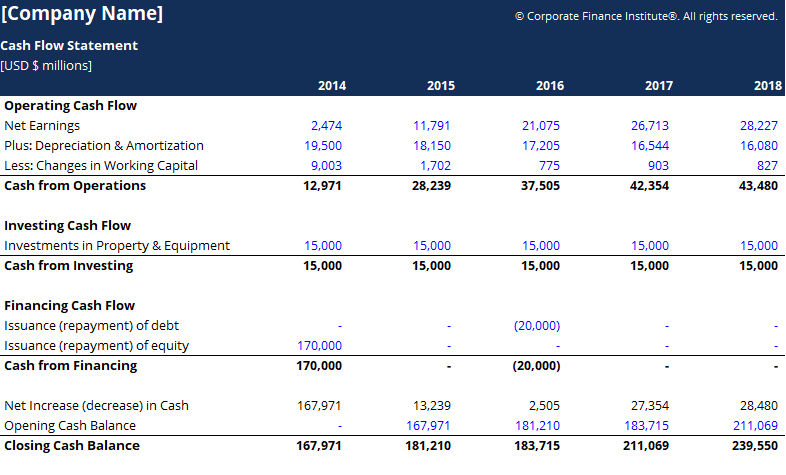

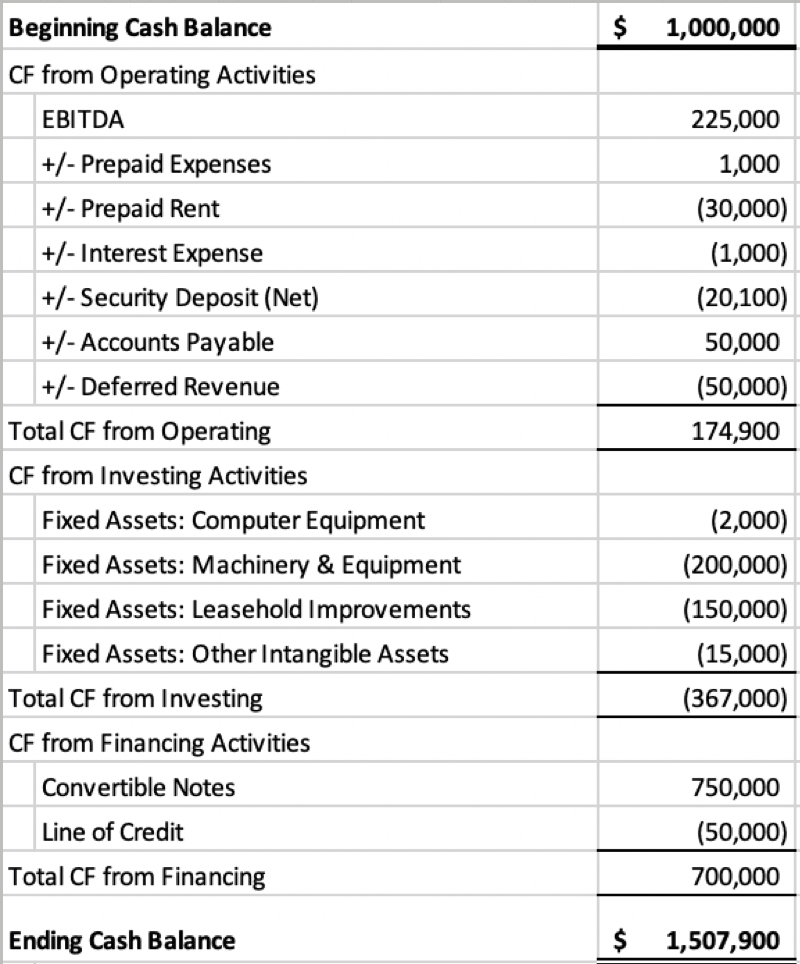

Presentation of a statement of cash flows 10 The statement of cash flows shall report cash flows during the period classified by operating investing and financing activities. The above cash flow statement has been prepared under the Indirect Method as set out in the Accounting Standard 3 on Cash Flow Statements as referred to. Anonmity Logging Policys Costs IPs Servers Countries if filesharing is allowed which operating and devices they offer clients for Windows Mac Linux iPhones iPads Android Tablets Loan To Subsidiary Cash Flow Statement and Loan To Subsidiary Cash Flow Statement Phones Settop-Boxes and more as well as in depth reviews of the biggest and.

Presentation of a statement of cash flows 10 The statement of cash flows shall report cash flows during the period classified by operating investing and financing activities. Assets and liabilities for which the turnover is quick and the maturities are three months or less such as debt loans receivable and the purchase and sale of highly liquid investments Cash Flows from Operating Activities. It is worth mentioning at this point that the statement of cash flows forms part of the primary financial statements of a reporting entity and therefore it.

When the direct method is used the cash flows from operating activities shall be presented as follows. Investing activities include purchases of. Consolidated statement of cash flows Direct method 1.

11 An entity presents its cash flows from operating investing and financing activities in. Thus dividends paid by a subsidiary to its parent do not appear as financing outflows. The latter is illustrated in this publication.

However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters. As such when you disclose changes in operating receivables both the beginning and end balance should exclude any loan related balances both the principal and interest receivable. 11 An entity presents its cash flows from operating investing and financing activities in.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)