Divine Unrealised Gains And Losses Accounting Treatment

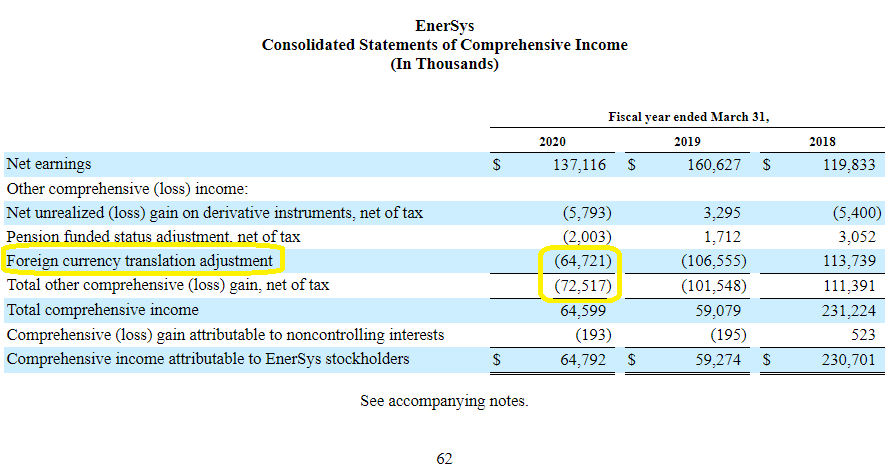

IAS 2133 Also the accounting should not depend on which entity within the group conducts a transaction with the foreign operation.

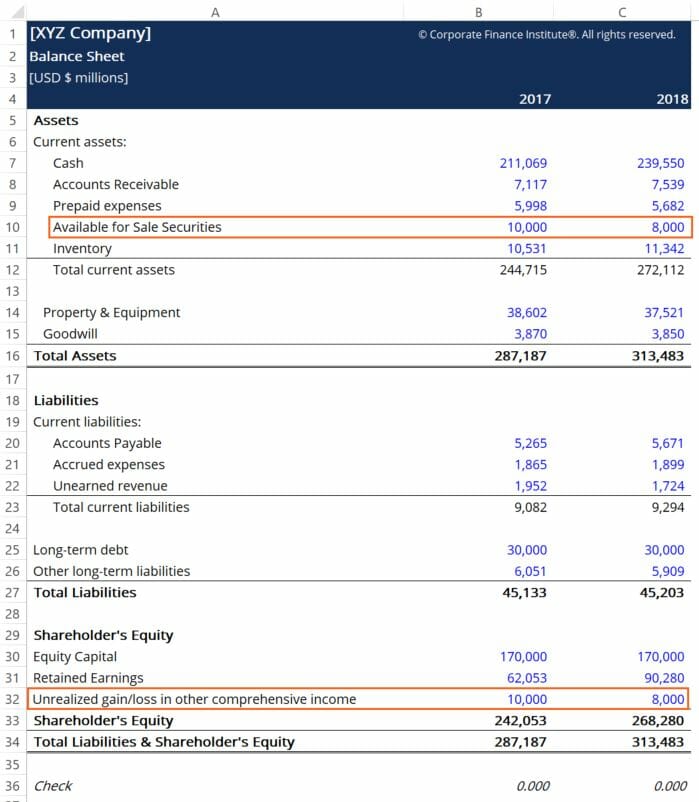

Unrealised gains and losses accounting treatment. There is no requirement to move the unrealised gains to a separate reserve but many accountants would. An unrealized loss is. IAS 2115A If a gain or loss on a non-monetary item is recognised in other comprehensive income for example a property revaluation under IAS 16 any foreign exchange component of that gain or loss is also recognised in other comprehensive income.

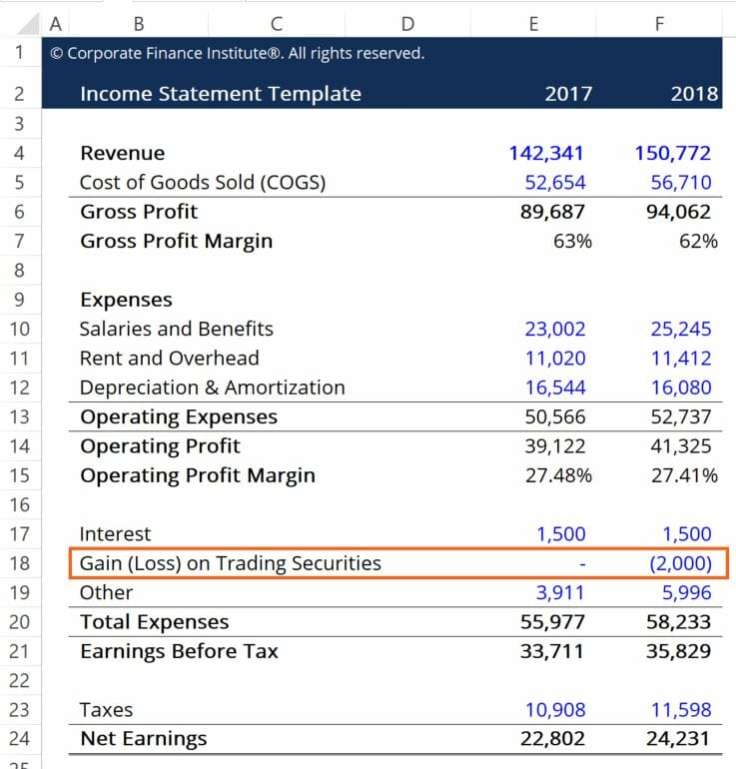

The presence of an unrealized gain may reflect a decision to hold an asset in expectation of further gains rather than converting it to cash now. An unrealized gain is an increase in the value of an asset or investment that an investor holds but has not yet sold for cash such as an open stock position. Accounting treatment adopted by businesses for revenue exchange differences.

In accounting there is a difference between realized and unrealized gains and losses. This is termed an unrealised loss or gain if it went the other way. It is in essence a paper profit When an asset is sold it becomes a realized gain.

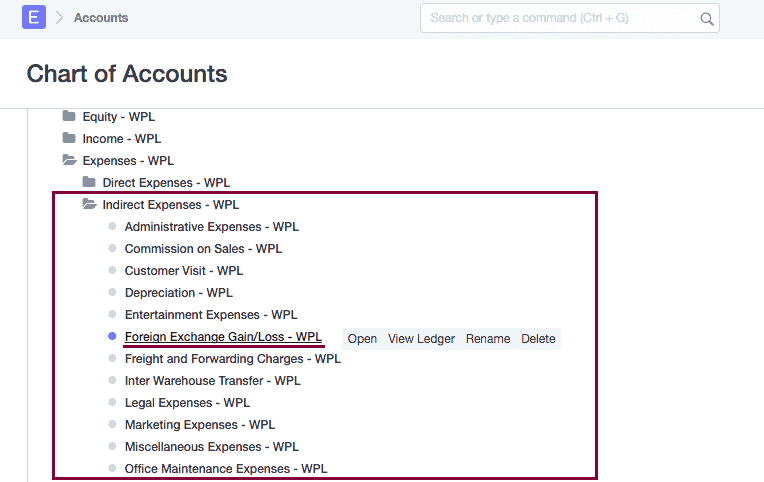

When you change the exchange rate in MoneyWorks a journal is automatically created to account for the unrealised and realised gainslosses. Its 21 - you recognise initially 50. Realized income or losses refer to profits or losses from completed transactions.

In contrast an unrealized gain or loss relates to transactions that are incomplete but for which the underlying value has changed since the last reporting period. Revalue debt to 25 you lose 25. An unrealized gain is an increase in the value of an asset that has not been sold.

As you say they are unrealised and therefore not distributable. The seller calculates the gain or loss that would have been sustained if the customer paid the invoice at the end of the accounting period. Next month its 41.