Divine Bad Debts In Cash Flow

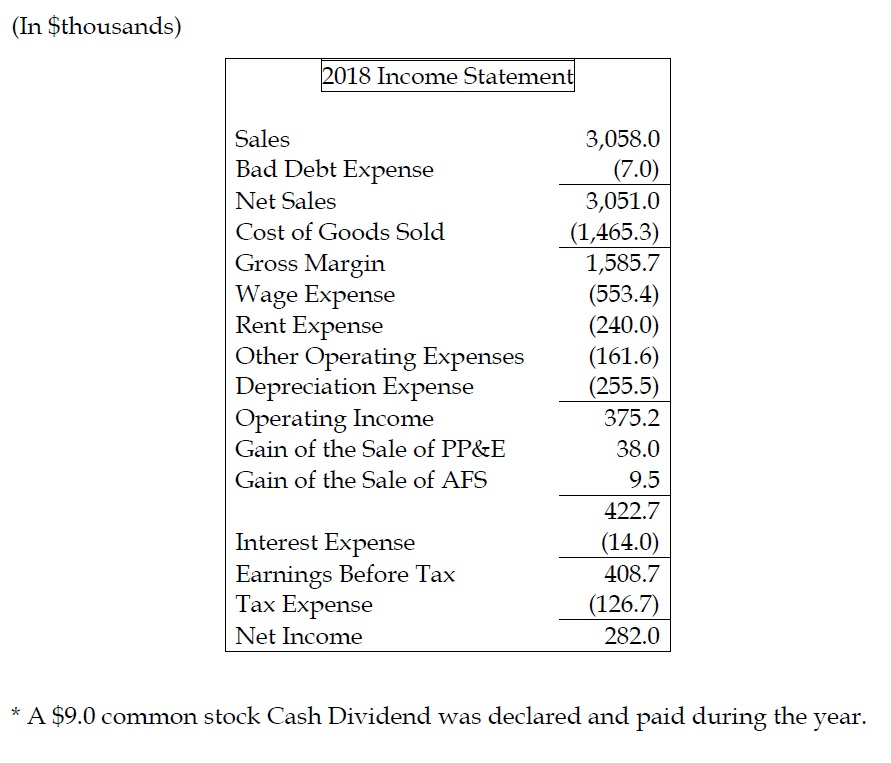

Bad debt expense from a write off is subtracted from Sales Revenues lowering Total Sources of Cash.

Bad debts in cash flow. Bad debts are a direct hit to your bottom line and will lower profits. Net cash flow or the total resultant change in cash and cash equivalents is calculated using either the direct or indirect method. Elimination of non cash expenses eg.

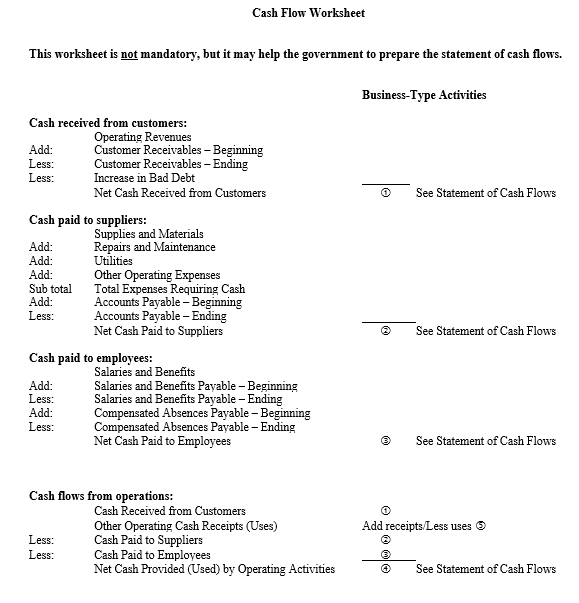

Statement of Changes in Financial Position Cash Flow Statement Bad debt expense also appears as a non-cash expense item on the Statement of changes in financial position Cash flow statement. Allowance 70 120 120 Income Amount Sales 250 Less. Accumulated Depreciation -20000 -25000 5000 Non Current Inventory 100000 50000 50000 Current Accounts Receivable 75000 -.

Especially in difficult economic times cash flow can suffer preventing debt repayment or a decrease in total debt. Interest expense should be classified under financing activities. The income statement considers bad debt as an.

That gives you a more realistic picture of your businesss income than assuming every receivable will be paid in full. The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. Accounts receivable and allowances for doubtful accounts are two corresponding accounts that appear on the balance sheet.

The bad debt provision reduces your accounts receivable to allow for customers who dont pay up. Negative overall cash flow is not always a bad thing if a. Aged Receivables Report or Debtors Ageing.

Remember that bad debts are simply a book entry that you record when you expect someone who owes you debtoraccounts receivable to not pay you in the future. See full answer below. Sale retrunrefund 250 xpenses xpenses om sales Assets 3312019 3312020 Change Land 500000 600000 -100000 Non Current Vehicle 50000 50000 - Non Current Less.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)