Brilliant Gross Accounts Receivable Balance Sheet

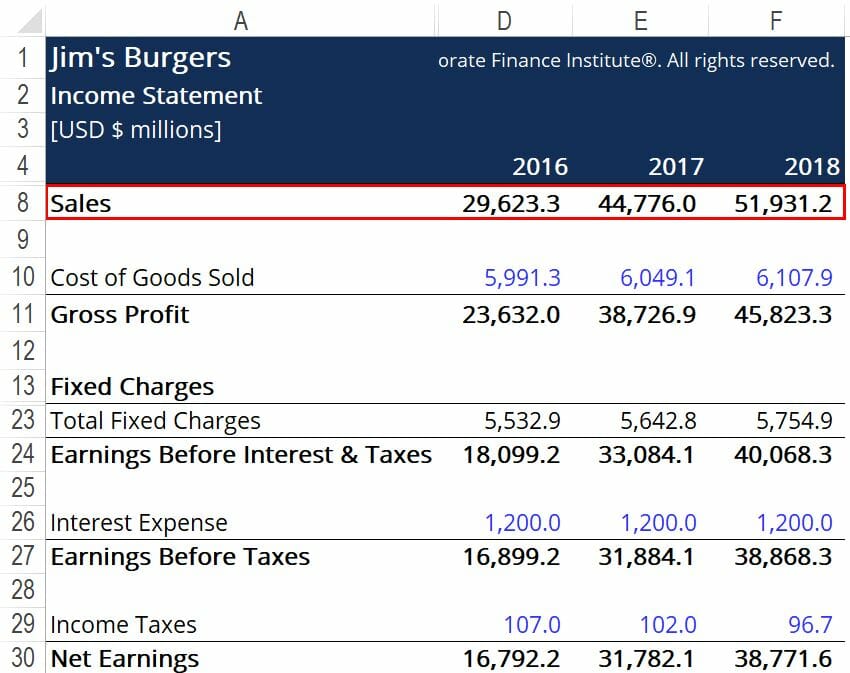

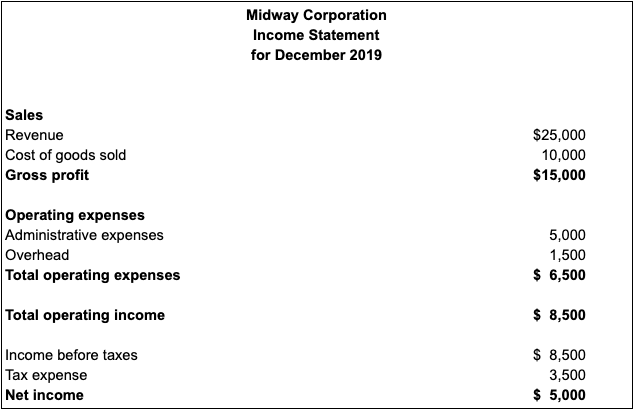

Financial ratios are created with the use of numerical values taken from financial statements.

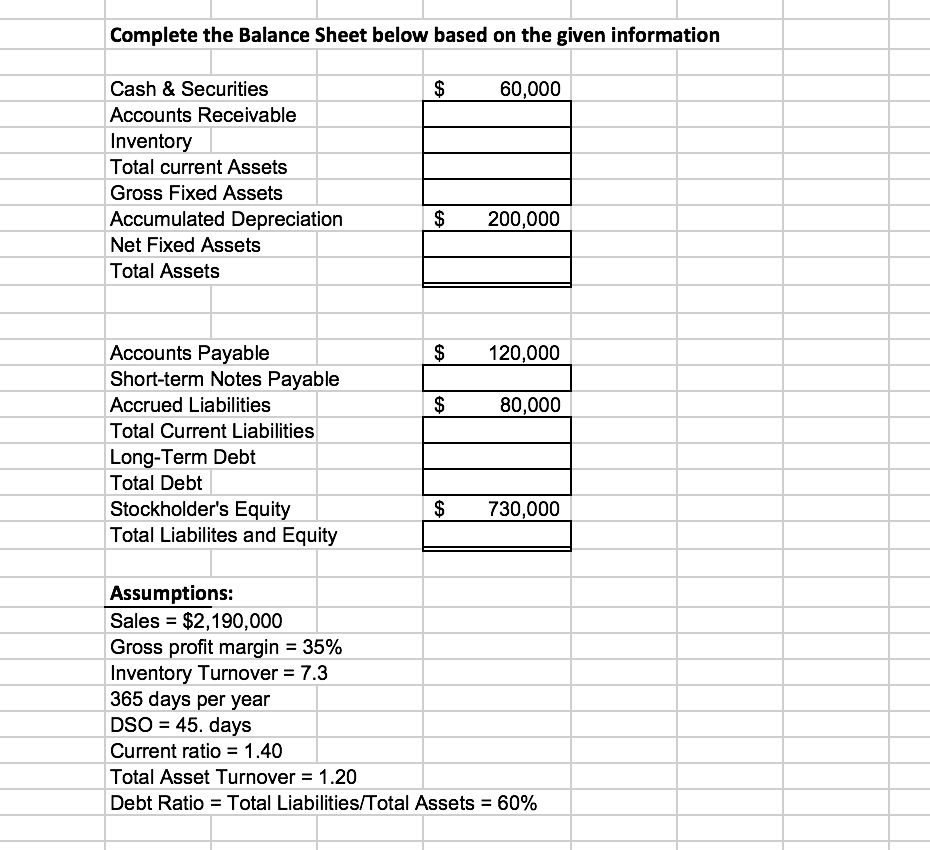

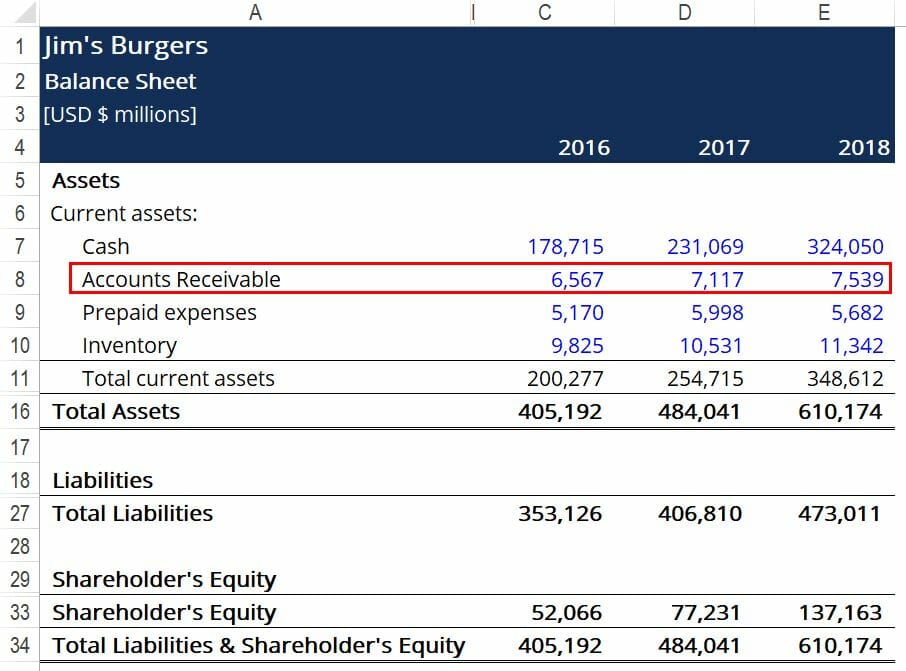

Gross accounts receivable balance sheet. The two sides must balancehence the name balance sheet. However if a receivable is expected to be collected in longer than 12 months then it is instead classified as a long-term asset on the balance sheet. It is the quickest asset to convert to cash.

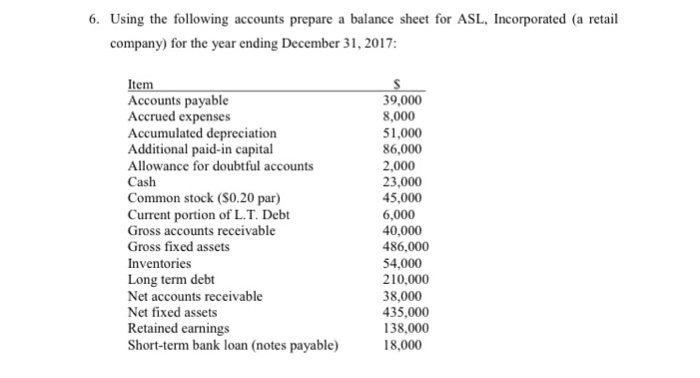

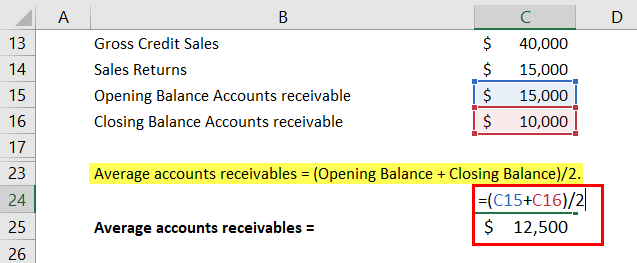

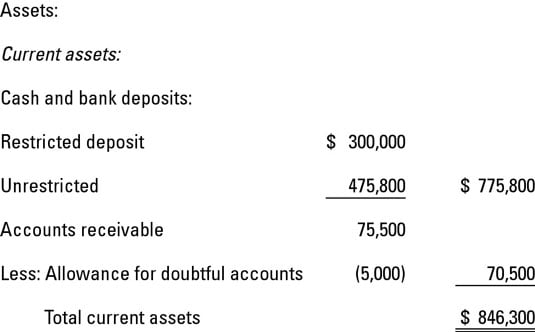

The net receivables is the amount that the company actually believes it will collect. Add net receivables to the allowance for doubtful accounts to calculate gross receivables. Assets Liabilities Owners Equity Assets go on one side liabilities plus equity go on the other.

During the year accounts receivable of 35000 were written off and 18000 were recovered. Presentation of Gross Accounts Receivable The gross receivable figure is usually classified as a current asset on the balance sheet. Here is how to calculate gross accounts receivable.

For example credit-card companies are in the business of extending credit to consumers. On December 31 Year 3 Red Rocks balance sheet showed gross accounts receivable of 922000 and Red Rocks income statement reported credit sales of 3000000. A company keeps track of its AR as a current asset on whats called a balance sheet which shows how much money a company has the assets and how much it owes the liabilities.

However if a receivable is expected to be collected in longer than 12 months then it is instead classified as a long-term asset on the balance sheet. A liability is an obligation arising out of past transactions and not anticipated future transactions. The gross receivable figure is usually classified as a current asset on the balance sheet.

Find the companys net receivables on the balance sheet. Then find allowance for doubtful accounts or allowance for bad debt on the balance sheet. Gross Accounts Receivable The gross accounts receivable account represents an asset to the company on the balance sheet.