Ace Provision For Bad Debts Accounting Standard

Under the new standard hospitals can only report bad debt if.

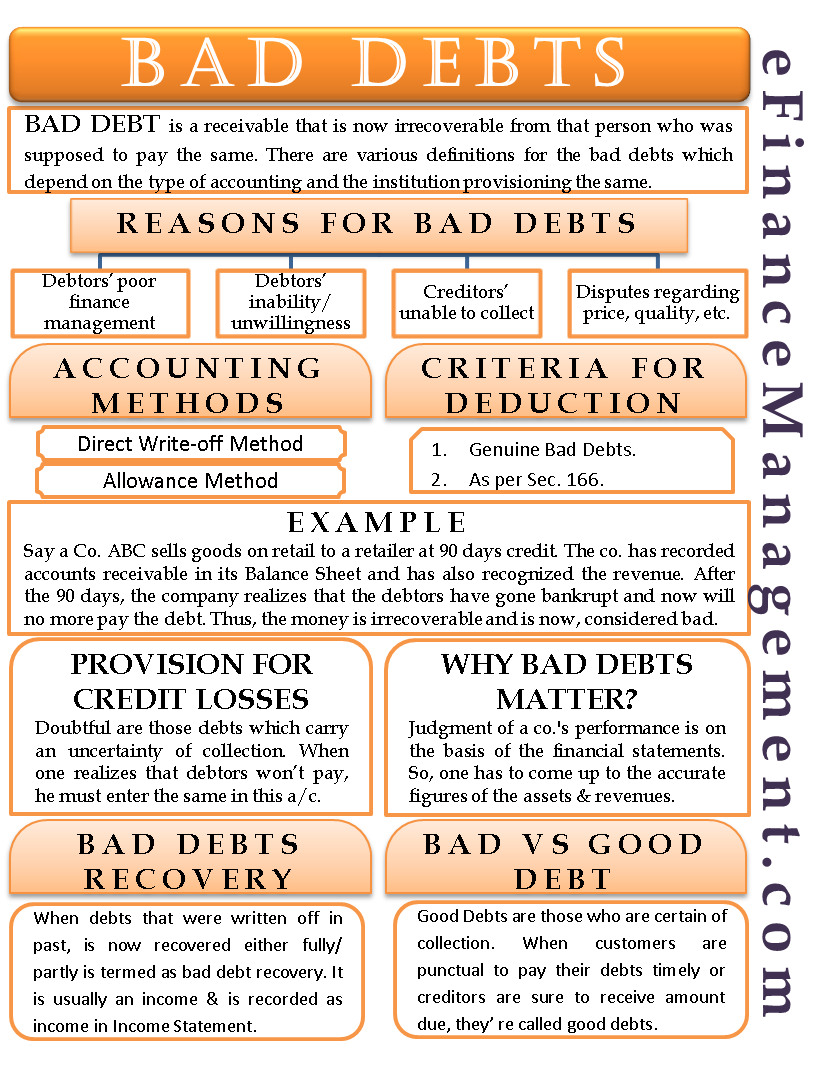

Provision for bad debts accounting standard. Provision for bad debts is the estimated percentage of total doubtful debt that needs to be written off during the next year. 59 A financial asset or a group of financial assets is impaired and impairment losses are incurred if and only if there is objective evidence of impairment as a result of one or more events that occurred after the initial recognition of the asset. The key principle established by the Standard is that a provision should be recognised only when there is a liability ie.

The allowance method or provision method is based on the contingency planning principles of accounting. The exact amount of the bad debts is deducted from the reserve account. Credit The amount owed by the customer is still 500 and remains as a debit on the debtors control account.

The provision is used under accrual basis accounting so that an expense is recognized for probable bad debts as soon as invoices are issued to customers rather than waiting several months to find out exactly which invoices turned out to be uncollectible. On the contrary bad debt is normally recognized in full. The Standard thus aims to ensure that only genuine obligations are dealt with in the financial statements planned future expenditure even where authorised by the board of directors or equivalent governing body is.

The provision for the bad debt is an expense for the business and a charge is made to the income statements through the bad debt expense account. A bad debt provision is made where there is some reasonable expectation that a trade debtors may not pay their debt either in part of full. The matching principle states that every entity must book its.

As the debt has not been paid and there is assurance that this debt would not be collected so a reduction of this provision by such bad debt will be recorded and accordingly the provision will be reduced by such bad debt. A bad debt provision allows the full amount of the invoice sent to the customer to remain on the trade debtors control account since no formal agreement has been made in regards to how much of it will be paid no credit note has been raised and the. Definition of Provision for Bad Debts.

In Y2019 we recognise a specific bad debt provision and we exclude this debtors balance from the calculations for the IFRS9 provision Y2019. It is done on the reason that the amount of loss is impossible to ascertain until it is proved bad. The provision is supposed to show the likely size of the future bad debts.