Unique Explain Profit And Loss Statement

It tells you how much profit youre making or how much youre losing.

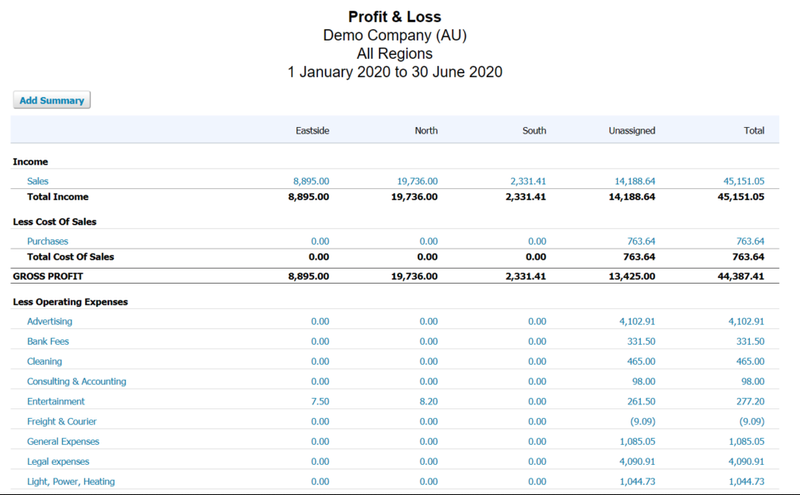

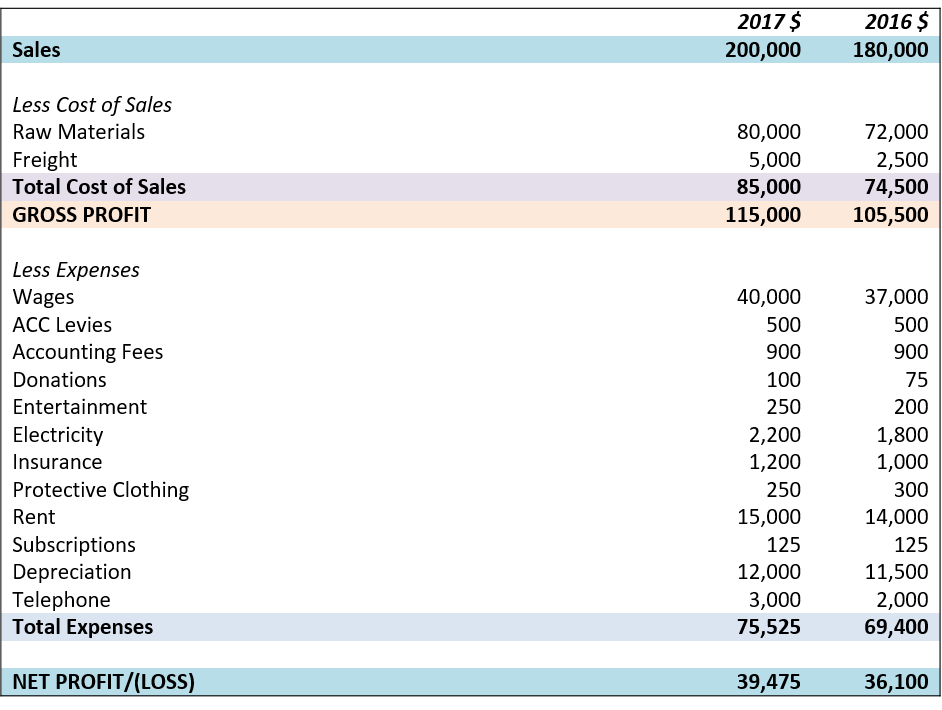

Explain profit and loss statement. It is also known as the income statement or the statement of operations. Profit and loss statement is the financial report of the company which provides a summary of the revenues and expenses of the company over a period of time to arrive at profit or loss for the period. Use your profit and loss statement to help develop sales targets and an appropriate price for your goods or services.

Accountants generally assess the PL at the end of a fiscal year or a quarter. A profit and loss or income statement lists your sales and expenses. After you find your total cash inflows such as from sales.

The profit and loss statement also referred to as an income statement in some business circles provides a clear illustration of the revenues and expenses that your company has recognized during a. These records display a companys ability to generate profit. The profit and loss statement starts with any cash inflows that you have.

What is a Profit and Loss PL Statement. The profit and loss PL report is a financial statement that summarizes the total income and total expenses of a business in a specific period of time. You usually complete a profit and loss statement every month quarter or year.

This component considers all the indirect expenses and incomes including the gross profitloss to arrive the net profit or loss. The two others are the balance sheet and the cash flow statement. These statements show the income for the period and the different expenses resulting in a bottom line net income.

This might be quarterly semi-annually or annually depending on the period for which you want to create the. A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a companys revenues expenses and profitslosses over a given period of time. It really is that simple.

.png)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)