Glory Investment In Associates In Balance Sheet

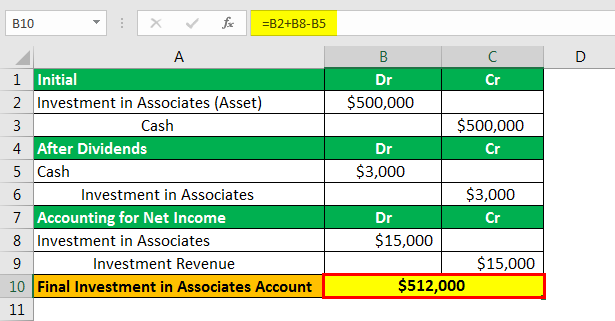

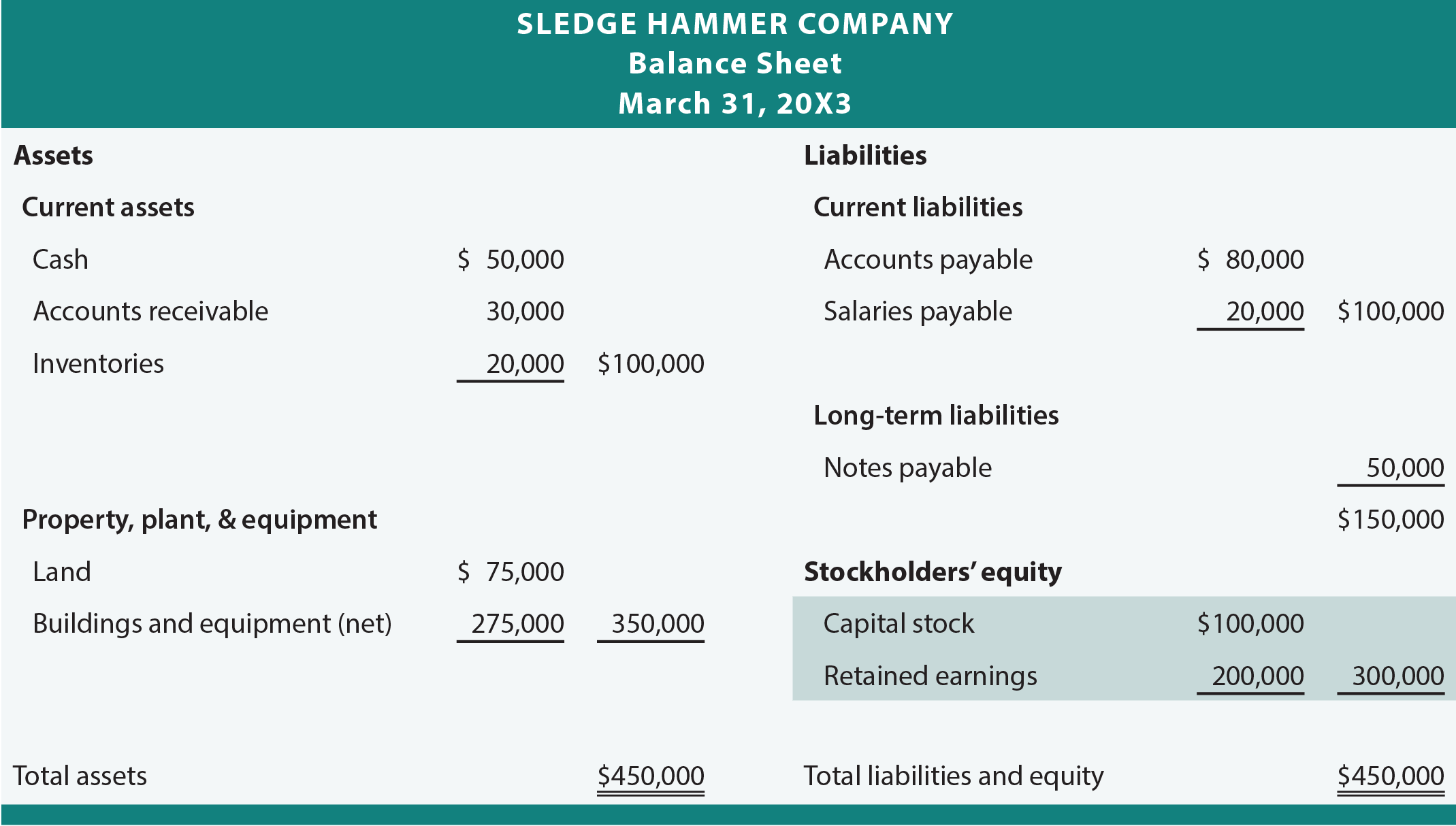

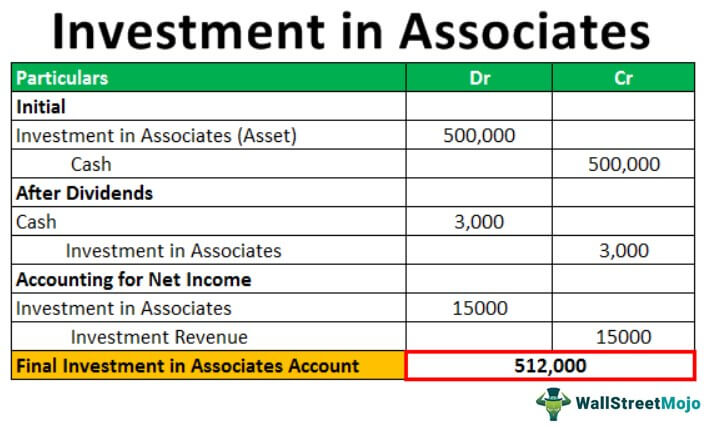

Adjust the Investments line Subtract from Investments under Parent the original cost of investment in the Assoc.

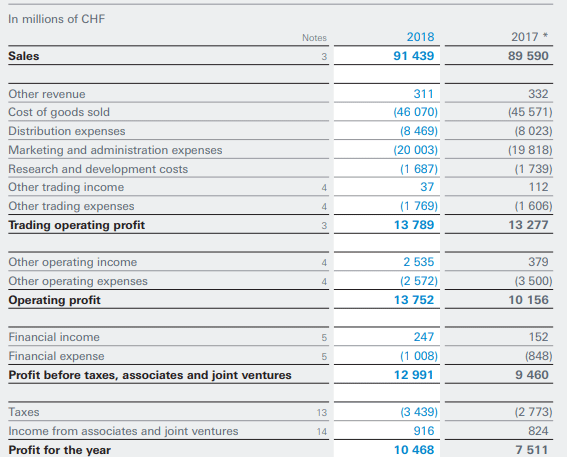

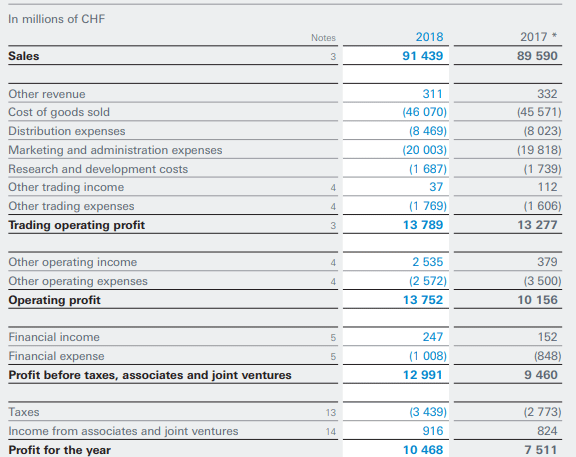

Investment in associates in balance sheet. Investments can include stocks bonds real estate held for sale and part ownership of other businesses. In PL it would be the associate result effect. 51 When an investment in an associate is acquired the investment must be recognised at its cost of acquisition.

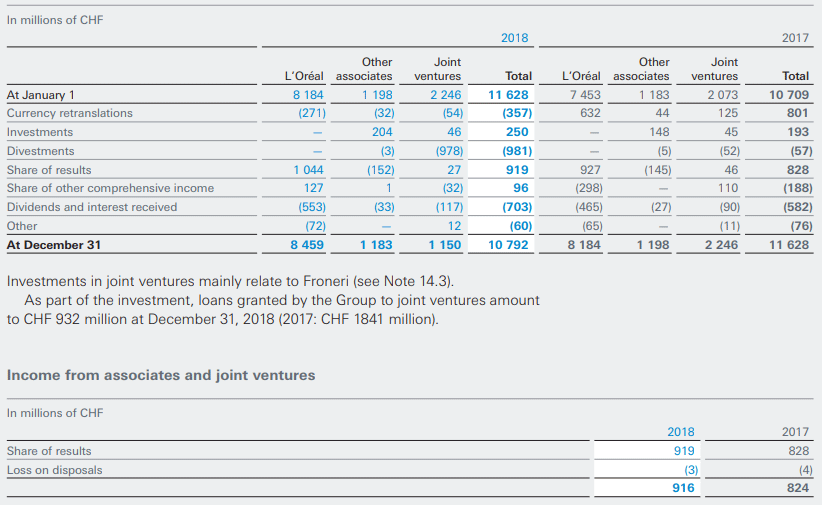

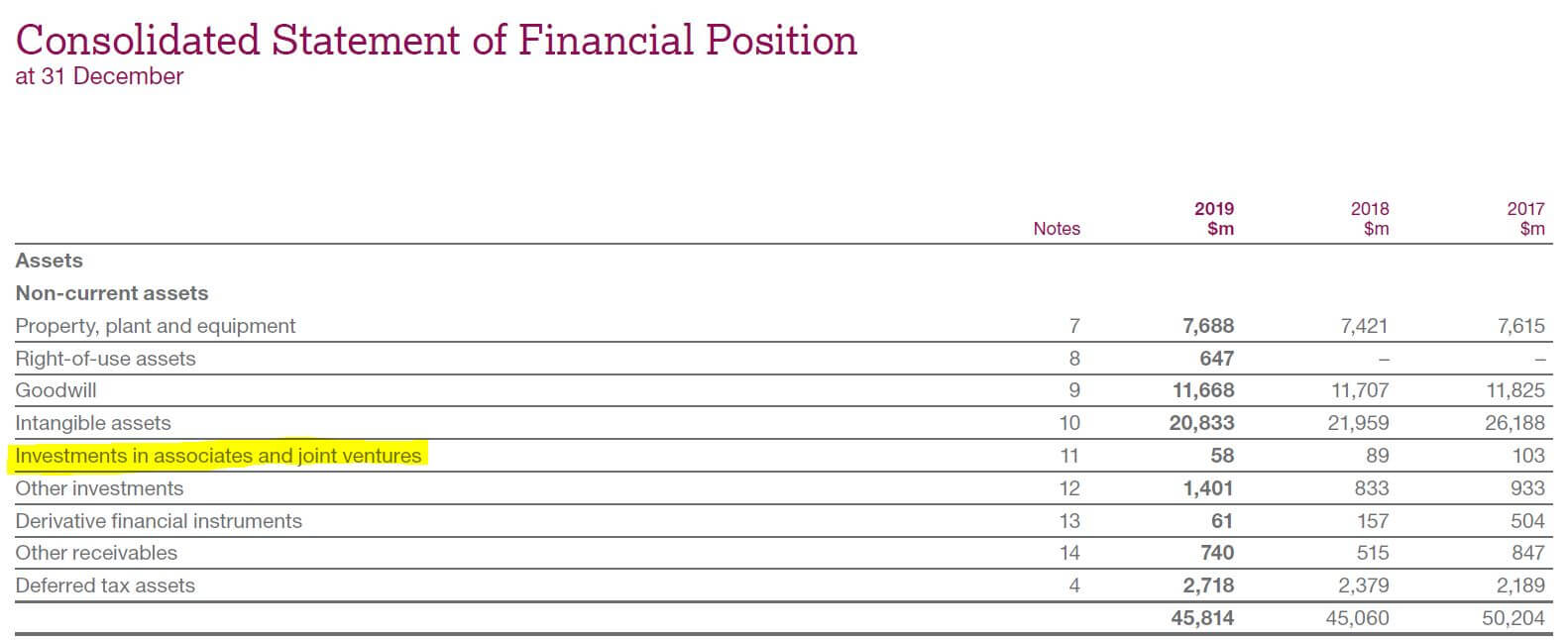

That means that Associates are not consolidated and in Balance sheet the line would mean the value of said investment and is a long term asset. But again it is difficult to understand what is exactly in this context. To account for the investment in the associate company A would record the following.

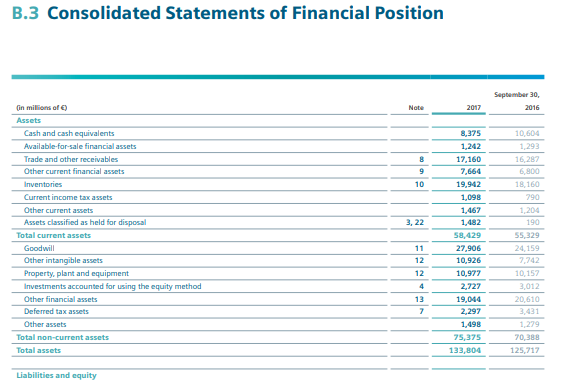

The investors share of the profits or losses of such investments should be disclosed separately in the. IAS 28 Investments in Associates outlines the accounting for investments in associates. Balance Sheets Non-Current Assets.

One of these three options should be selected by the investor. Share of associate xxx. The initial recognition of NCI occurs during the purchase accounting proscribed by ASC 805 when the fair value of the purchased assets and liabilities and the fair value of the NCI are recorded.

Investments in associates accounted for using the equity method should be classified as long-term investments and disclosed separately in the consolidated balance sheet. The treatment required is to just make one line entry into the financial statements as follows. Short-term investments and long-term investments on the balance sheet are both assets but they arent recorded together on the balance sheet.

An associate is an entity over which an investor has significant influence being the power to participate in the financial and operating policy decisions of the investee but not control or joint control and investments in associates are with limited exceptions required to be accounted for using the equity. It is recognised that the traditional manner of accounting for investments in associates- recognising the investment in the balance sheet at cost subject to reduction for any other than temporary diminution in the value of the investment and recognising the income from investment on the basis of distributions received from the associate may not be an adequate measure of the investors. When an investment in an associate or a joint venture is held by in entity that is a venture capital organization mutual fund unit trust or similar entity then investor might opt to measure investments at fair value through profit or loss under IFRS 9 and thus not apply equity methodThe same applies for the situation when an investor has an investment in an associate a portion of.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)