Ace Deferred Tax In P&l

Thus deferred tax is the tax for those items which are accounted in Profit Loss Ac but not accounted in taxable income which may be accounted in future taxable income vice versa.

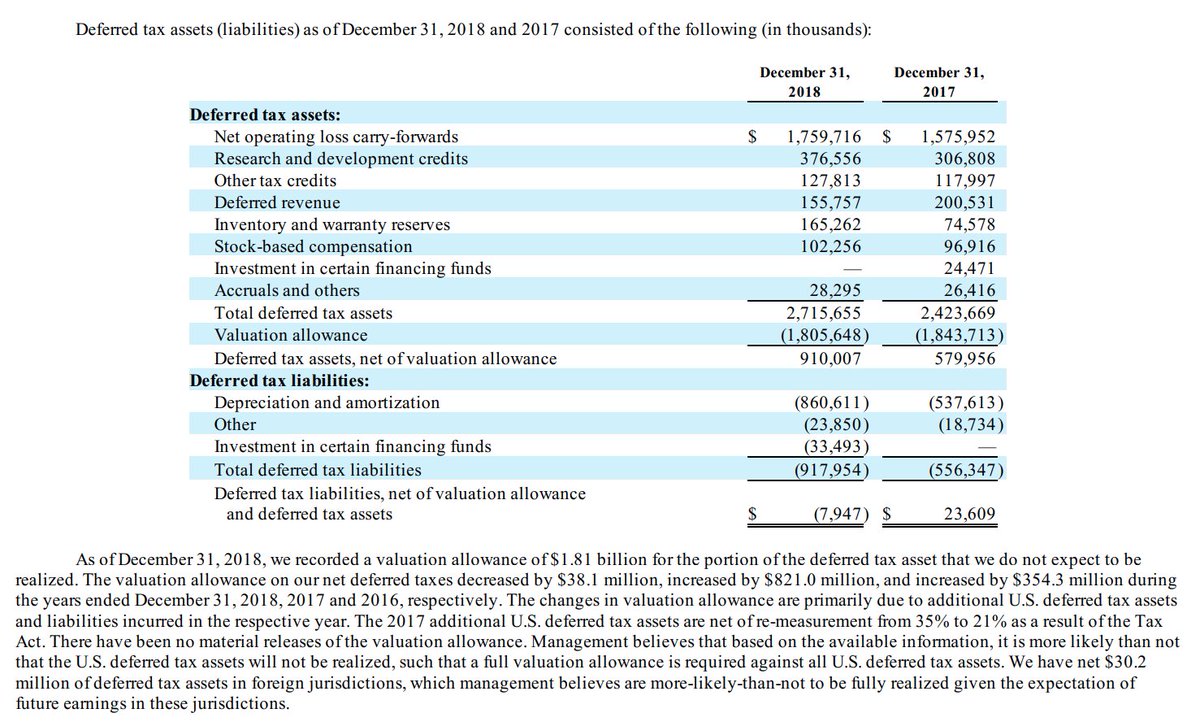

Deferred tax in p&l. This adjustment made at year-end closing of Books of Accounts affects the Income-tax outgo of the Business for that year as well as the years ahead. Deferred Tax Liabilities or Deferred Tax Liability DTL is the deferment of the due tax liabilities. A deferred tax liability represents an obligation to pay taxes in the future.

See a simple example below. Try it free for 7 days. The carrying amount of an asset is higher than its tax baseor The carrying amount of a liability is lower than its tax base.

Avoiding pitfalls the manner of recovery and the blended rate 22 Section 5. Deferred taxexpense PL XX Deferred tax balance FP XX Change in tax rate deferred tax consequences If a DTA OBalX decrease in TR Old TR If b DTL OBal X increase in TR Old TR c Opening balance is a deferred tax liability and the tax rate decreases. Calculating a deferred tax balance the basics 3 Section 2.

Deferred tax Deferred tax is a topic that is consistently tested in Paper F7 Financial Reporting and is often tested in further detail in Paper P2 Corporate Reporting. A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces. A deferred tax asset is an item on the balance sheet that results from overpayment or advance payment of taxes.

Avoiding pitfalls share-based payments 33. A deferred tax liability is a liability to future income tax. If different tax rates apply to different levels of taxable profit deferred tax is measured using an average rate s that have been enacted or substantively enacted at the balance sheet date and that will apply to the taxable profit or loss of the periods in which the company expects the deferred tax asset or liability to be realised or settled.

Lets look at an example. Such a difference in tax primarily arises because of the timing difference when the tax is due and when the company pays it. Allocating the deferred tax charge or credit 12 Section 3.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)