Breathtaking Small Business Financial Statements Difference Between Current Tax And Deferred Tax With Example

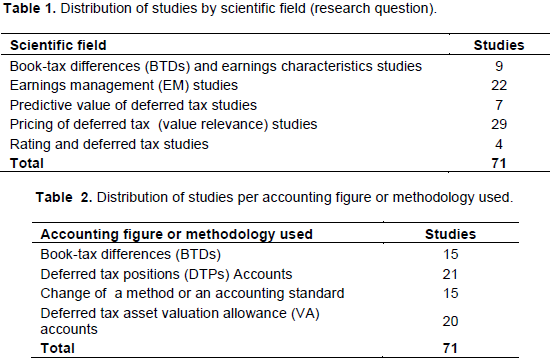

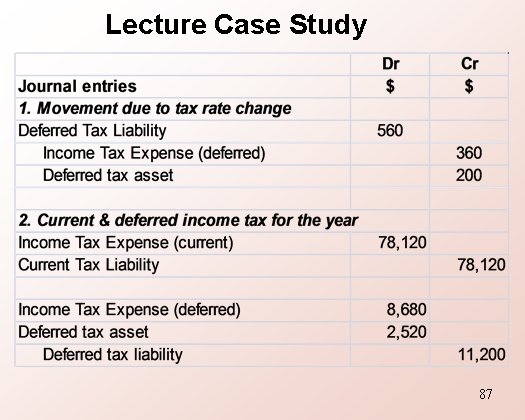

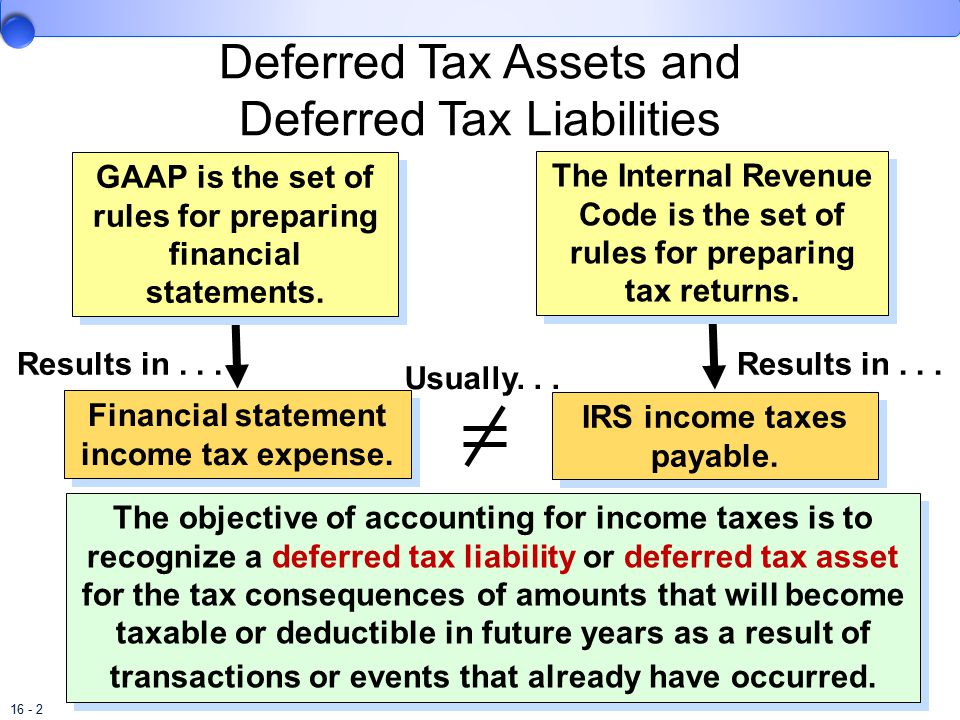

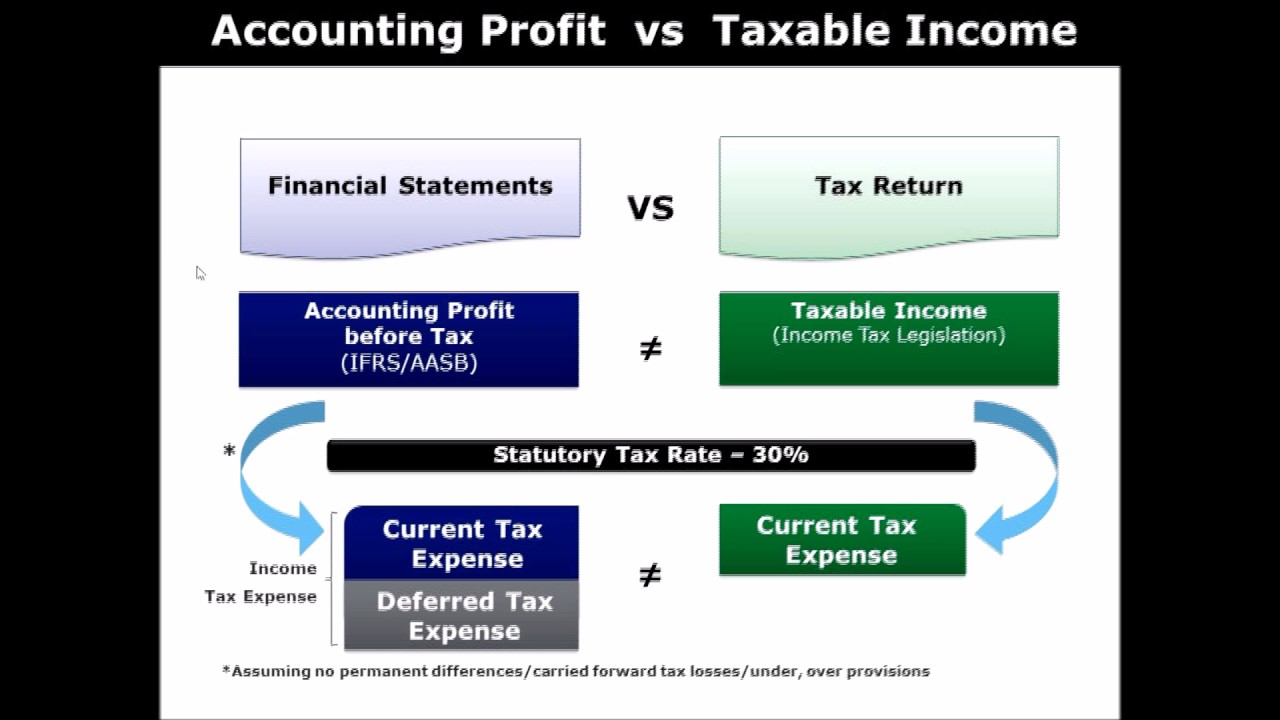

These differences arise from the treatment of a transaction differing within the financial and taxation accounts.

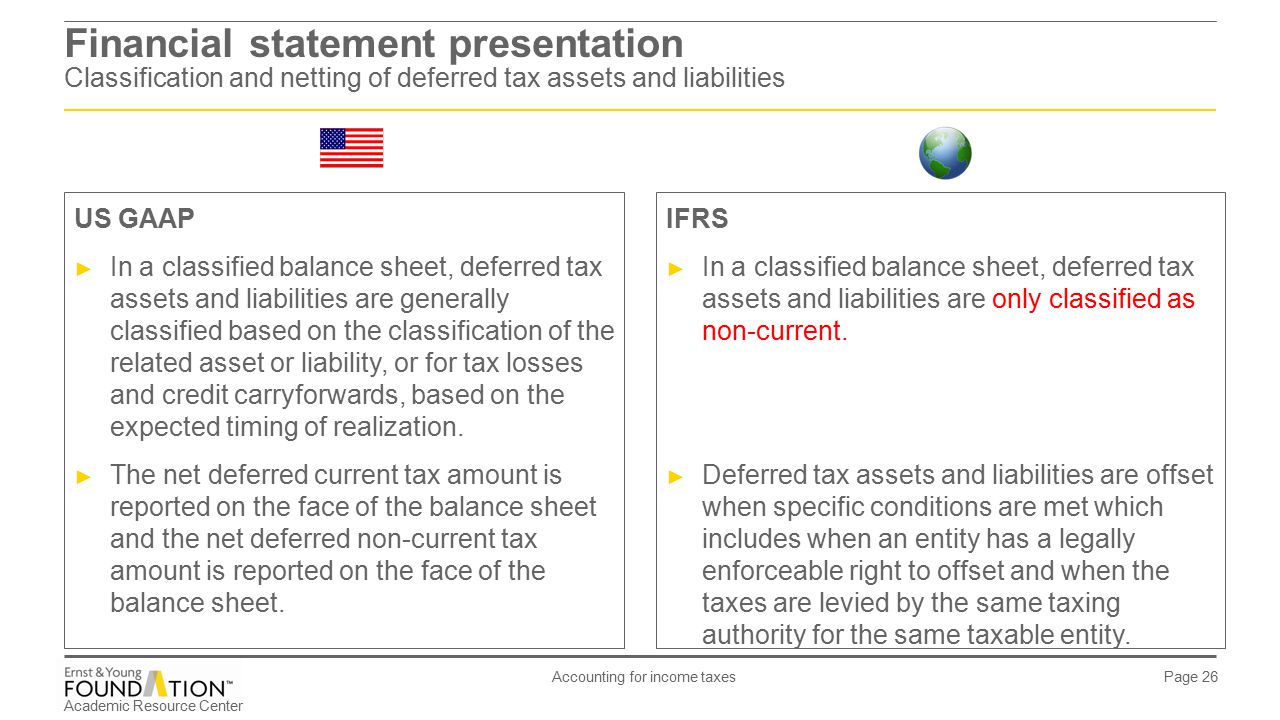

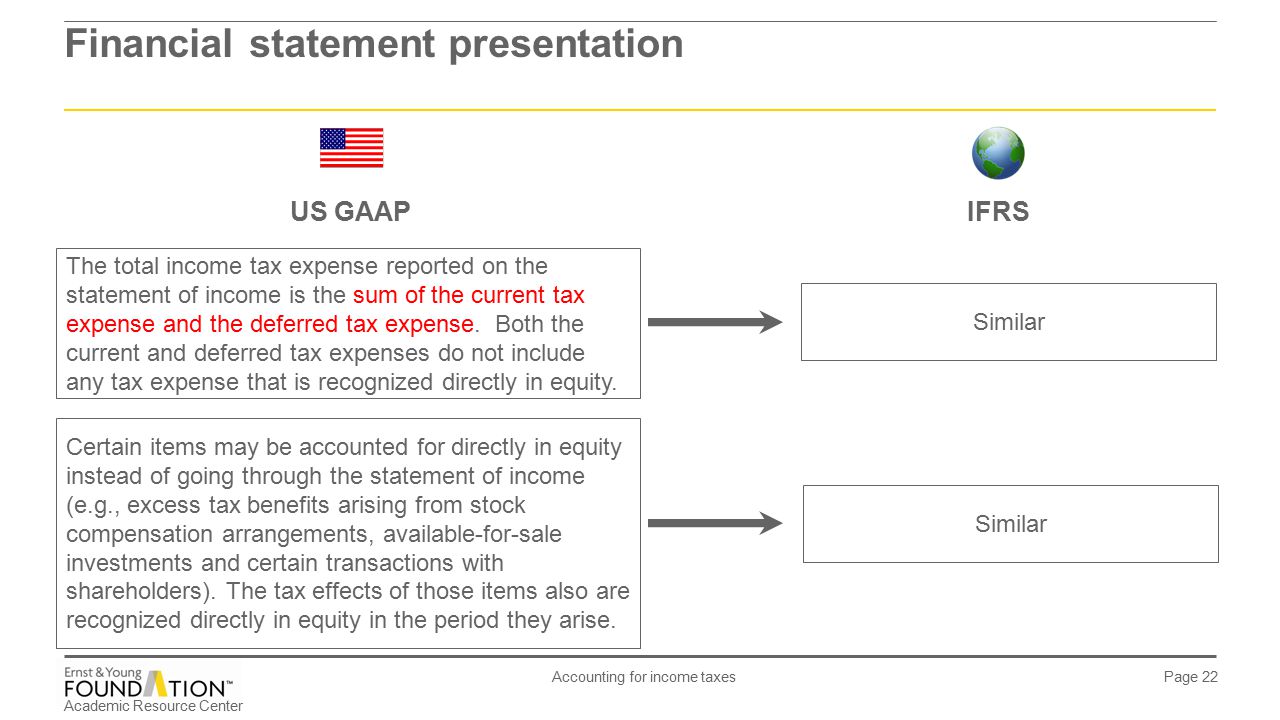

Small business financial statements difference between current tax and deferred tax with example. Most entities will now experience a lower effective tax rate which will impact the current tax expense for financial statements for the year ended December 31 2018. IAS 12 implements a so-called comprehensive balance sheet method of accounting for income taxes which recognises both the current tax consequences of transactions and events and the future tax consequences of the future recovery or settlement of the carrying amount of an entitys assets and liabilities. And b result in taxable or deductible amounts in future years based on the provisions of the tax law FASB 2009.

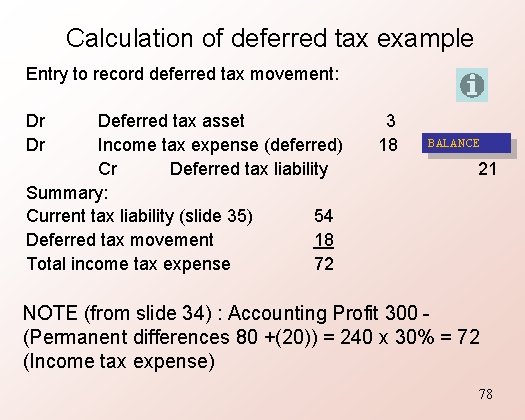

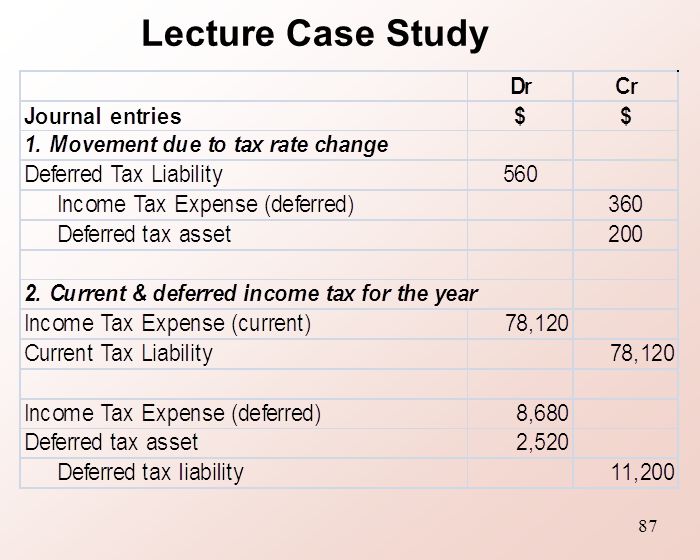

Income taxes as defined in IAS 12 include current tax and deferred tax. If the tax rate for the company is 30 the difference of 18 60 x 30 between the taxes payable in the income statement and the actual taxes paid to the tax authorities is a deferred tax asset. During the periods of rising costs and when the companys inventory takes a long time to sell the temporary differences between tax and financial books arise resulting in deferred tax liability.

Fortunately due to the deferred taxes update most of the heavy lifting regarding financial statements is complete. Income taxes are provided based on current enacted and applicable income tax rates. For many finance executives the concepts underlying deferred tax are not intuitive.

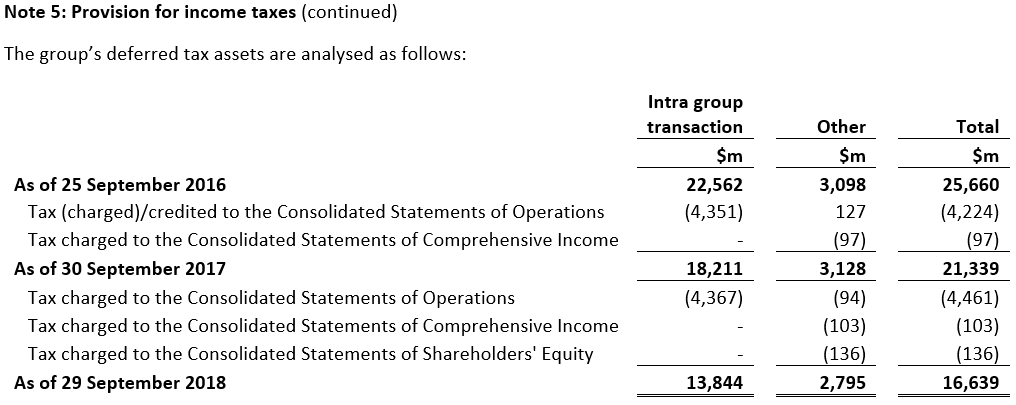

At 31 December 2020 deferred tax assets of 37801 2019. 20844 relate to entities which suffered a loss in either the current or the preceding period. Recognized in the financial statements.

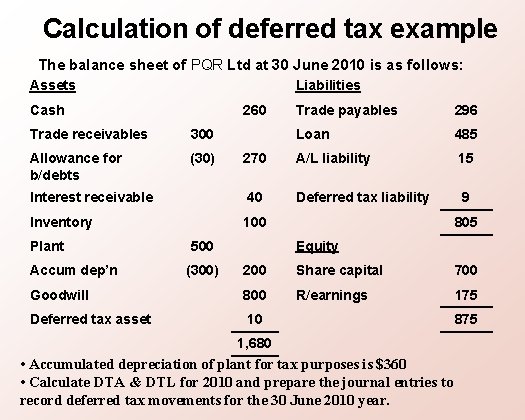

Deferred income tax assets and liabilities are computed annually for differences between the financial statement and tax. The differences are due to the timing of the expense each year. Deferred taxes on unused incentive tax credits relate to incentive tax credit in Germany of 10605 2019.

The Financial Accounting Standards Board FASB recently proposed a delay in the implementation of Accounting Standards Update on Topic 842 Leases originally enacted on February 25 2016Although the delay will give most private companies until fiscal years beginning after December 15 2020 to comply it is important for companies to be proactive in considering the tax as well as the. The difference between depreciation expense in the accounting records and the tax return is only temporary. C Deferred tax arises if at the end of the year the carrying amount it different from the tax base.