Unique Publicly Traded Companies Must File Audited Financial Statements With The

SEC reporting companies are required to file quarterly reports on Form 10-Q within 45 days after the end of each of the first three quarters of their fiscal year.

Publicly traded companies must file audited financial statements with the. The Act requires public companies and state owned companies to have audited financial statements. How to Research Public Companies Learn how to quickly research a companys operations and financial information with EDGAR search tools. Public companies are obligated by law to ensure that their financial statements are audited by a registered CPA.

Closing entries never involve posting a credit to the. B All large companies in the United States are required to file audited financial statements with the SEC. A All companies in the United States are required to file audited financial statements with the SEC.

Publicly traded companies must have their statements and their control systems over the financial reporting process audited by an independent auditor following auditing standards established by. Accounts for a trading company but must. Some companies will file a full set of FS in XBRL format while some others will file key financial data in XBRL format and a full set of signed copy of the FS tabled at annual general meeting andor circulated to members AGM FS in PDF.

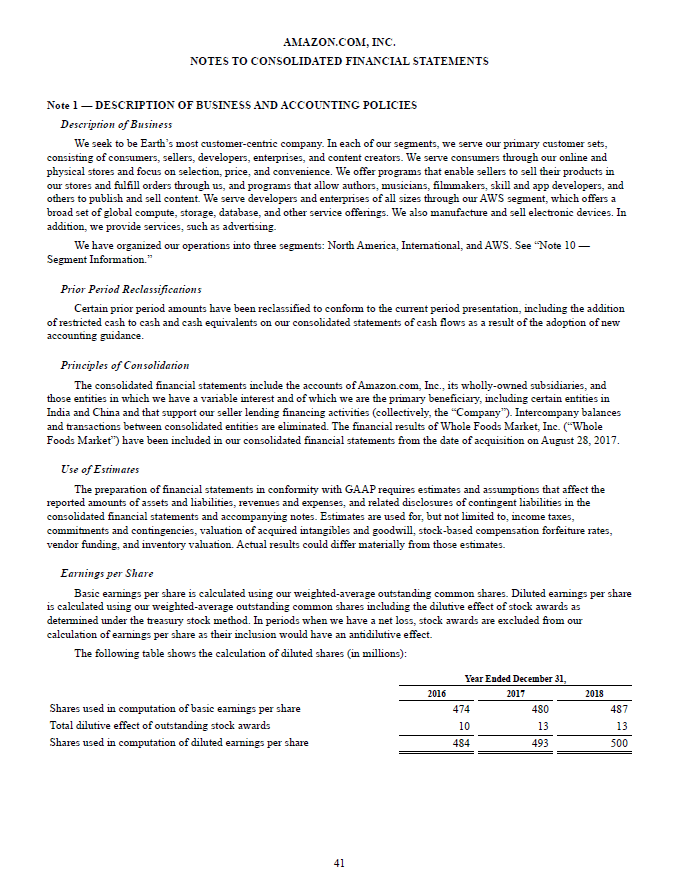

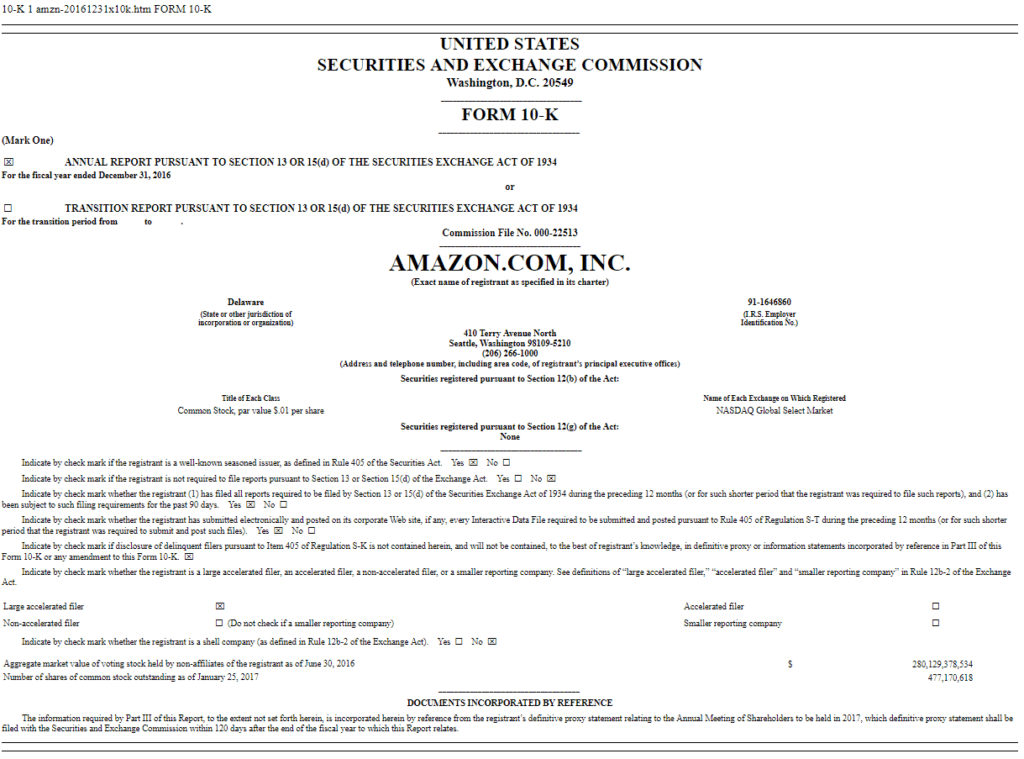

3-30 Publicly traded companies must electronically file a variety of forms or reports with the SEC including the Form 10-K which includes the audited annual financial statements. The total assets for the company and its subsidiaries were more than NZ60 million the total revenue was more than NZ30 million. Should the company have audited financial statements.

The SEC makes most of these electronic documents available on the Internet via EDGAR which stands for Electronic Data Gathering Analysis and Retrieval system. All private limited and public companies must file their. An NZ company with 25 per cent or more of its voting shares held overseas must file audited financial statements if at the balance date for the 2 preceding accounting periods at least 1 of the following applies.

Section 302 states that the Chief Executive Officer CEO and Chief Financial Officer CFO are directly responsible for the accuracy documentation and submission of all financial reports and the internal control structure to the SEC. Reflective Thinking AICPA BB. C All publicly-traded companies in the United States are required to file audited financial statements.

-act-2017/Companies_AGMtimelines_2018.png)

-act-2017/Companies_AGMtimelines.png)

-act-2014/Figure2.png)

:max_bytes(150000):strip_icc()/PNCProspectus2019-5c88003746e0fb00015f901b.jpg)