Beautiful Sections Of The Balance Sheet

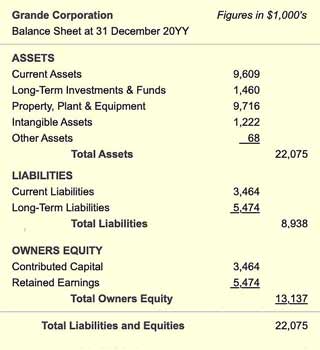

A classified balance sheet presents information about an entitys assets liabilities and shareholders equity that is aggregated or classified into subcategories of accounts.

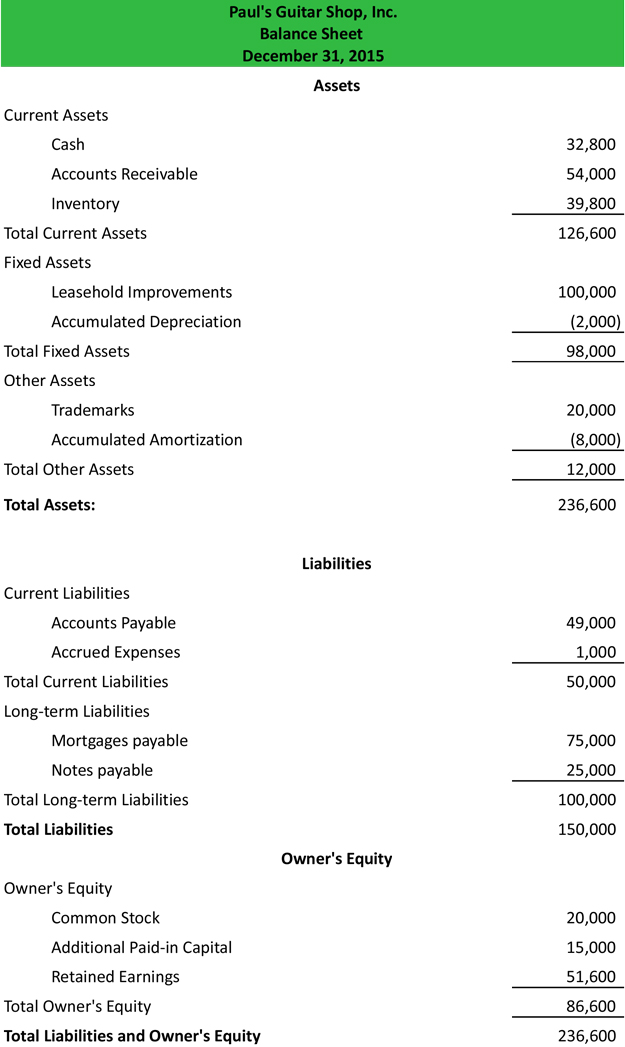

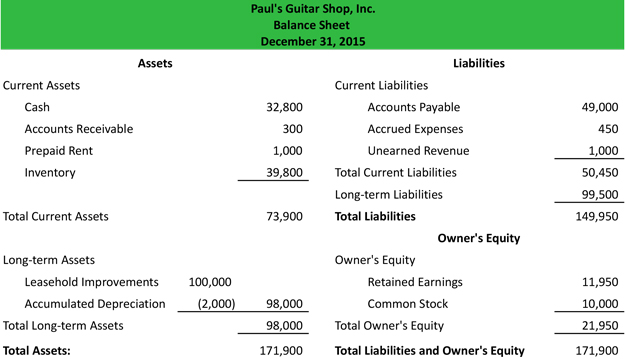

Sections of the balance sheet. What goes on a balance sheet. Lets start with assetsthe things your business owns that have a dollar value. These include accounts payable credit card accounts accrued payroll taxes unearned revenue deposits and those amounts due within one year related to debt instruments.

Paid-in capital treasury stock and retained earnings. List your assets in order of liquidity or how easily they can be turned into cash sold or consumed. The current liabilities section of the balance sheet identifies those amounts due to third parties within the current year.

All balance sheets are organized into three categories. Assets Liabilities Owners Equity. Recall the accounting equation we learned above.

It is dated January 1st of the following year. The balance sheet is sometimes called the statement of financial position. The accounts that are reported on the Balance Sheet are shaded.

A balance sheet is fairly straightforward in that it consists of just two columns. It captures the financial position of a company at a particular point in time. Balance sheets are an important tool for assessing and monitoring the financial health of a business.

Schedule III part 1 of the companies act 2013. The four sections of a balance sheet are Assets1Current or short term assets2Fixed Assets non current assetslong term assets Liabilities3Current Liabilities4. A balance sheet is a financial statement that summarises a companys equity liabilities and assets at a specific point in time.