Divine Retained Earnings Formula In Balance Sheet

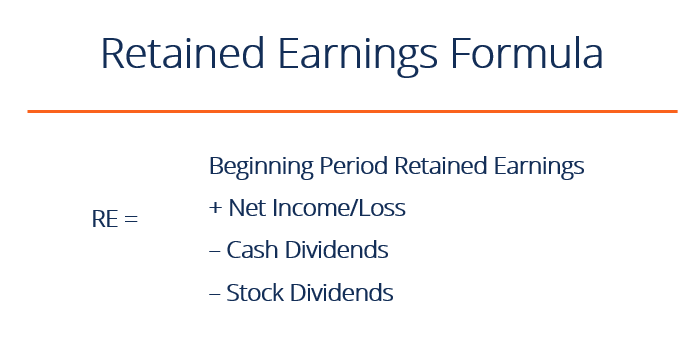

The retained earnings are calculated by the following formula.

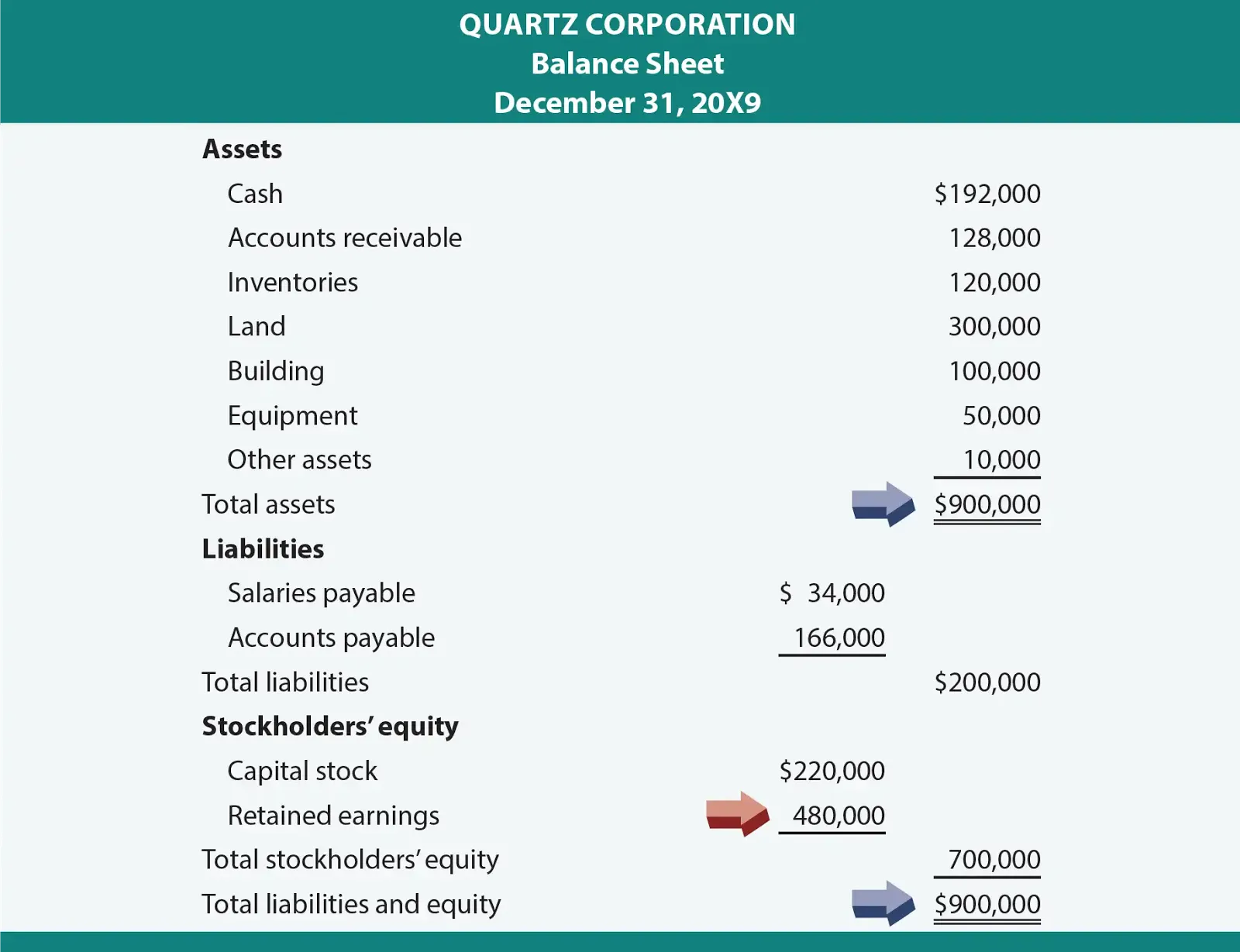

Retained earnings formula in balance sheet. Heres where thats located for NLSN. Infact all the companies in India registered under Companies Act are required to prepare Balance Sheet as per the Schedule iii Part 1 where retained earnings form a part of Reserves and Surplus. The retained earnings formula is simple.

The retained earnings balance is an equity account in the balance sheet and equity is the difference between assets and liabilities. The retained earnings formula is a calculation that derives the balance in the retained earnings account as of the end of a reporting period. The formula for Retained Earnings posted on a balance sheet is.

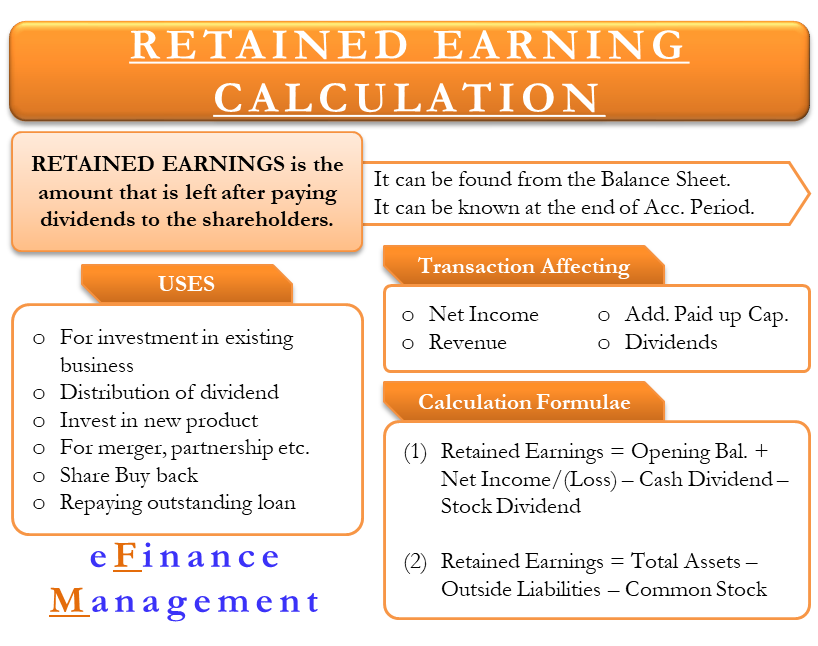

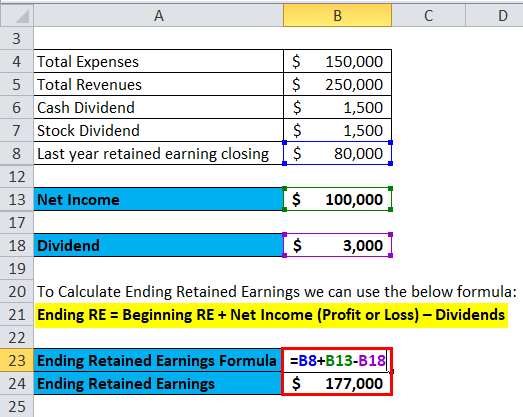

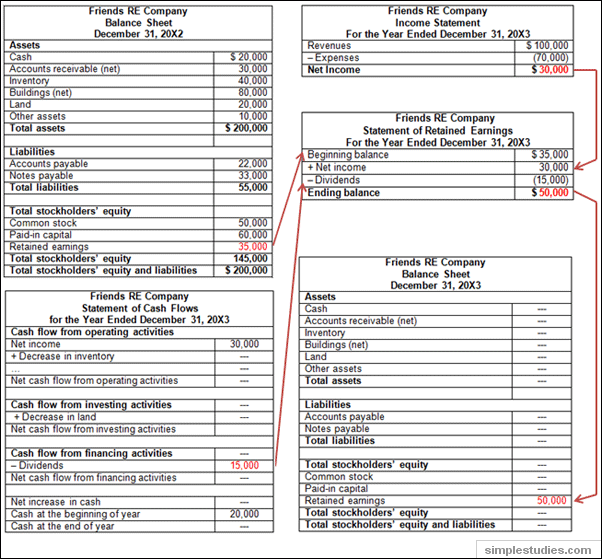

Z2 Retained Earnings Total Assets. Retained Earnings End RE Beginning Net Income Dividends. When earnings are retained rather than paid out as dividends they need to be accounted for on the balance sheet.

The retained earnings formula is fairly straightforward. The period beginning retained earnings is a cumulative balance of all the retained earnings. Retained Earnings RE Beginning balance of the RE Net IncomeLoss Cash Dividends Stock Dividends Retained earnings might not always be a positive number as the company might earn a profit or lose revenue during a year.

Current Retained Earnings ProfitLoss Dividends Retained Earnings. A retained earnings balance is increased by net income profit and cash dividend payments to shareholders reduce the balance. Retained earnings can be calculated using below Beginning RE Net Income Profit or Loss Dividends Ending RE.

Net Income is the balance amount left for the company after deducting the expenses such as the cost of goods sold salary expenses interest taxes depreciation amortization from the Net Sales of the company. Warren Buffet recommended creating at least 1 in market value. This is the same balance that must hold for the temporal method.