Formidable Interest Paid Is Financing Activity

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

Dividends received are classified as operating activities.

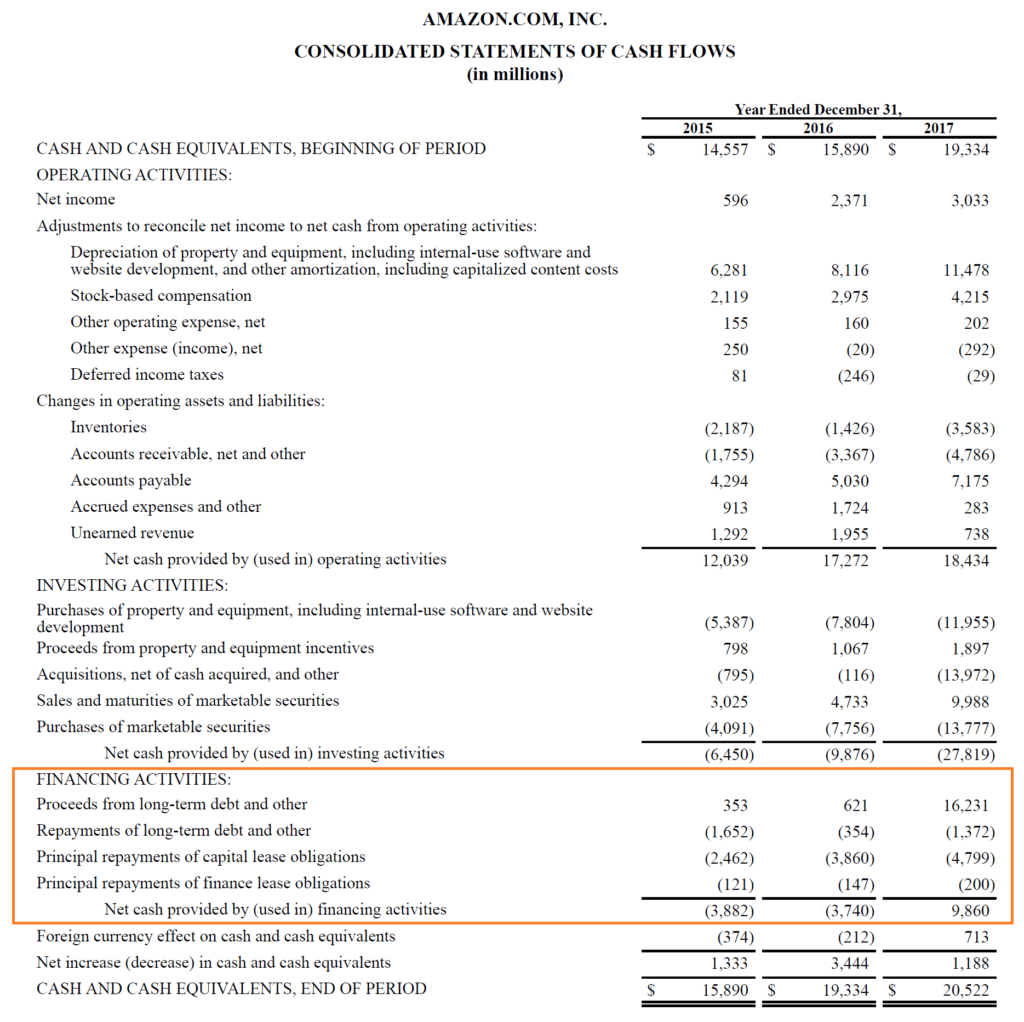

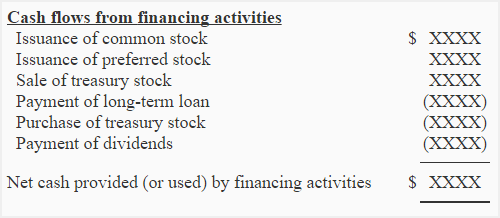

Interest paid is financing activity. Note that interest received from loans is included in operating activities Financing activities include cash activities related to noncurrent liabilities and owners equity. Options A and C give accurate statements. Only interest paid has an effect on the cash movement not interest expense.

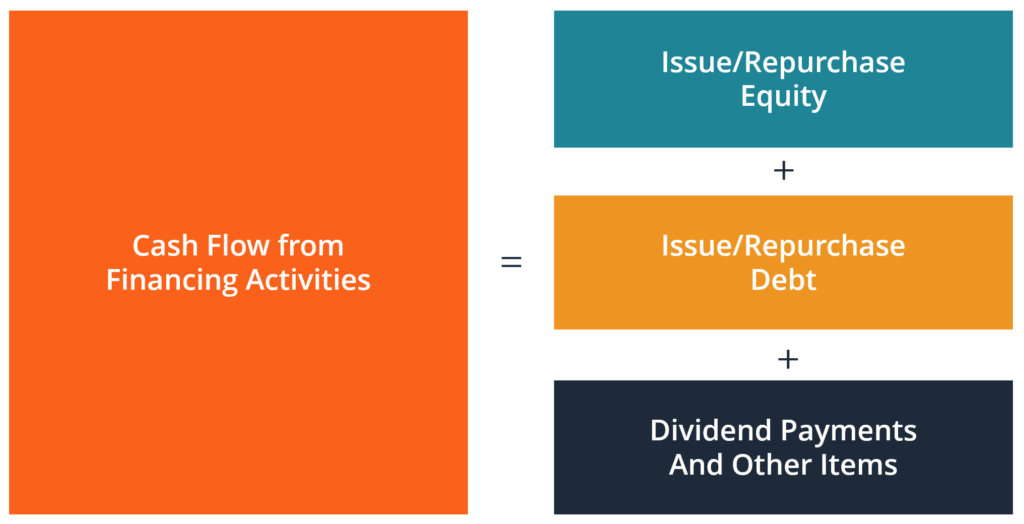

A Cash Flow from Operating Activities B Cash Flow from Investing Activities C Cash Flow from Financing Activities D No Cash Flow. Hence interest expense is one of the subtractions from a companys revenues in calculating a companys net income. It focuses on how the business raises capital and pays back its investors.

While the majority of the members say that because this interest comes from in the normal course of business. In the context of individual income tax most interest can be classified as one of five types. Definition of Interest Expense Interest expense is the cost of borrowing money.

Some members of GAAP have a view that if the source of this expense is present in the finance activity then the interest paid should be included in the financing activity. Therefore the interest appears on the income statement and reduces a companys net income. However the interest paid also causes a change in the companys balance sheet and.

The activities include issuing and selling stock paying cash dividends and adding loans. Under the accrual method of accounting interest expense is reported on a companys income statement in the period in which it is incurred. Interest is the amount paid for use of borrowed fundsThe tax treatment of interest a taxpayer pays or accrues depends on the type of interest.

Qualified student loan interest. Under IFRS companies can however treat both the cash flows as either operating or financing cash flows. Under IFRS interest paid may be classified as either an operating activity or financing activity.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)