Unique Segment Margin Income Statement

Segment margin helps to.

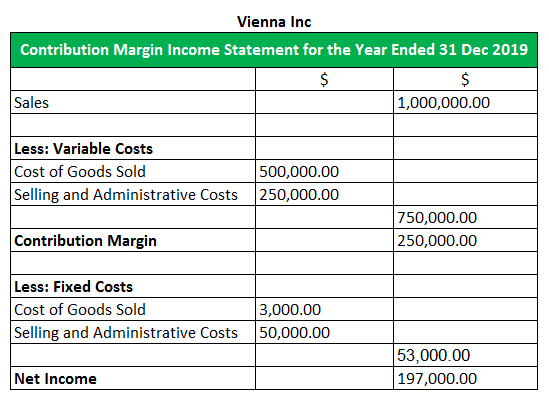

Segment margin income statement. Preparing a segmented income statement for various scenarios assists management in determining the estimated financial impact of making one choice over another. Segment margin only takes into account the segments revenue and expenses. If properly designed a segmented income statement can enhance profitability.

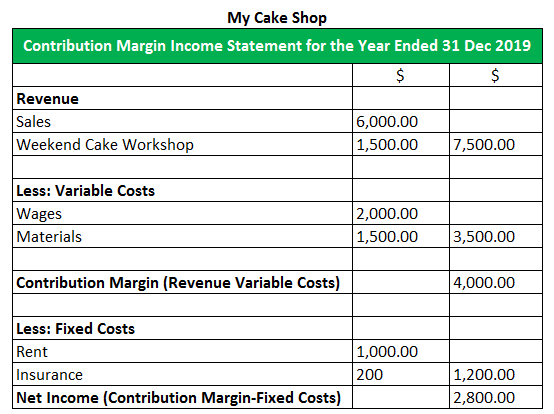

Segment margin is the amount of profit or loss produced by one component of a business. 450000 - 234000 216000 900000 - 441000 459000. Contribution margin - Direct fixed costs controllable by managers Contribution controllable by segment managers also known as short-run segment margin 3.

Income Statement format has fixed expenses as a part. 216000 - 45000 171000. As a result we deduct the total variable expenses from the net sales when computing the contribution.

So its a good idea to report contribution margins on your segmented income statement. A segment margin is a companys net loss or net profit in relation to the specific segment analyzed within the segmented income statement. Contribution controllable by segment managers - Direct fixed costs controllable by others Segment margin.

The segment margin income statement excludes All allocated costs in the calculation of the segment margin. Since it includes non controllable fixed costs it is a useful measure of the overall performance of. It is expected that you understand how costs behave and that you are familiar with the contribution margin concept.

The contribution by profit center sometimes referred to as CPC or as Segment margin is a measure of the profitability of the profit center after deducting all costs traceable to it. 450000 - 234000 216000 459000 - 171000 288000. The second subtotal in the contribution margin format income statement is the segments contribution to indirect expenses.

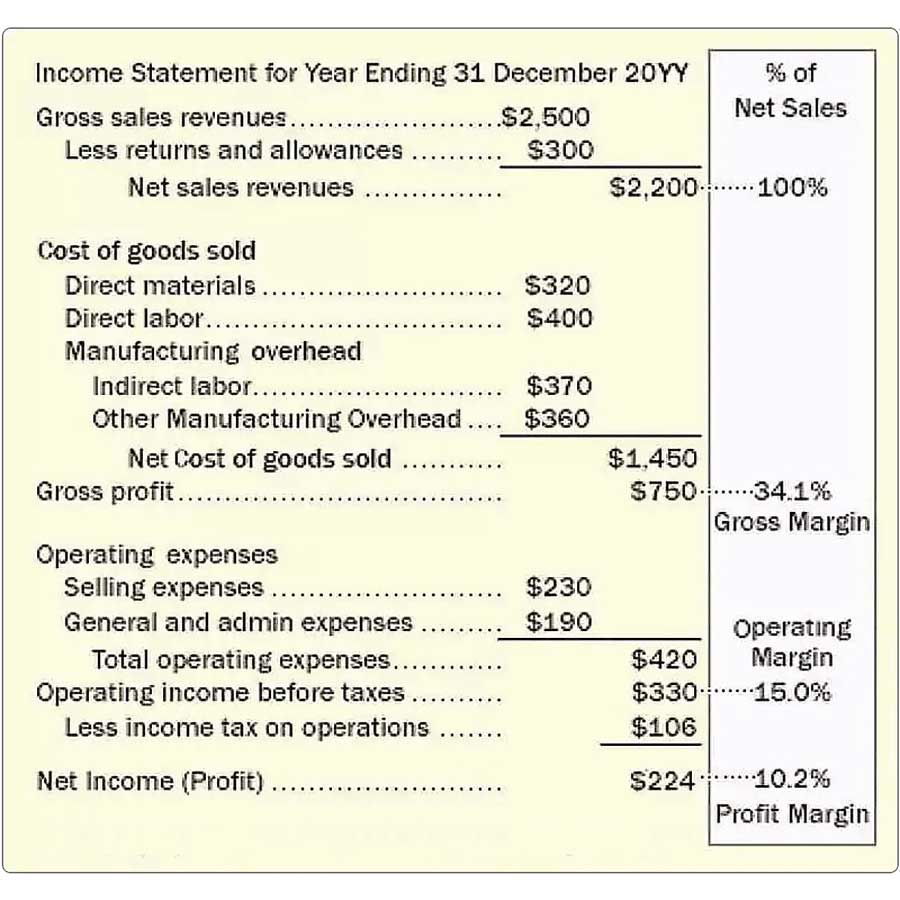

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)