Ace Common Size Analysis Formula

In this article we discuss what a common-size analysis is how financial managers use it and how the formula works for calculations on a balance sheet.

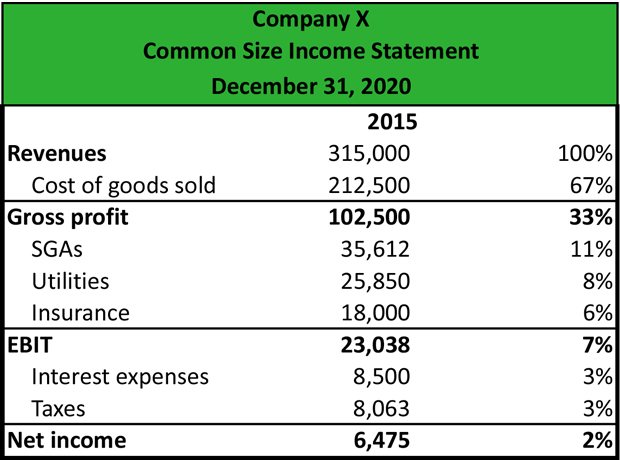

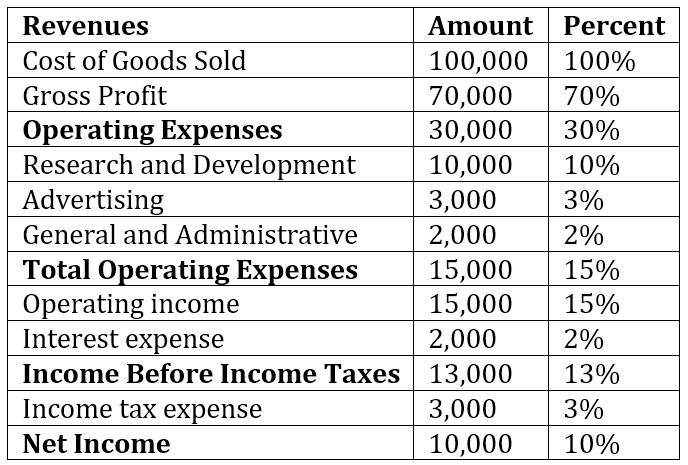

Common size analysis formula. Remember on the balance sheet the base is total assets and on the income statement the base is net sales. Revenue divided by 100000 is 100. Here is the common size analysis formula.

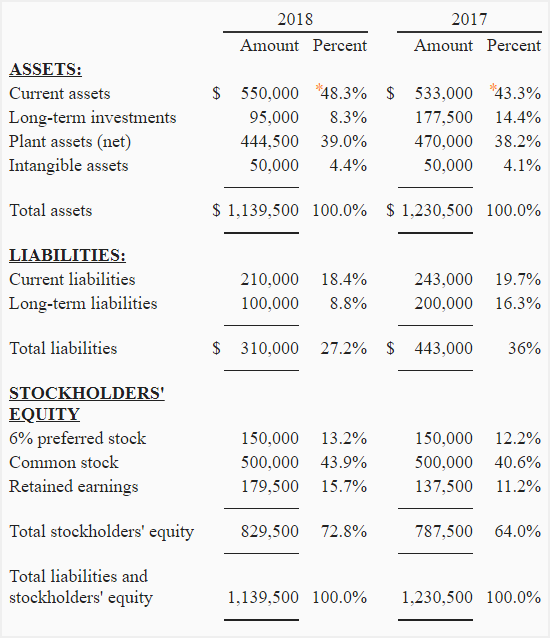

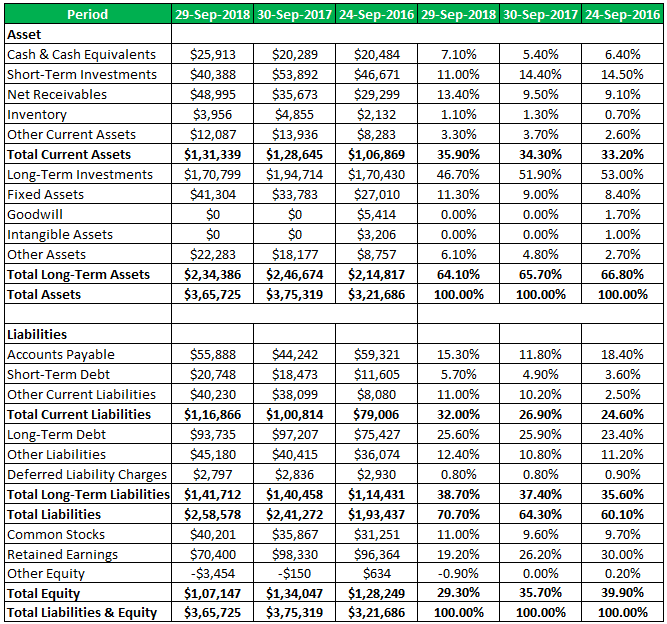

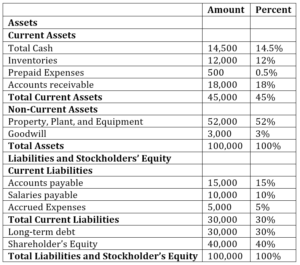

Balance Sheet Common Size Analysis The balance sheet common size analysis mostly uses the total assets value as the base value. The ratios in common size statements tend to have less variation than the absolute values themselves and trends in the ratios can reveal important changes in the business. Amount Base amount and multiply by 100 to get a percentage.

The way we do this is simple. There are many financial analysis tools available that can help them gain insights into their business and reach informed conclusions. Supposing that the business posted a COGS of 2 million the common size revenue per COGS would be 5 2 x 100 250.

The common figure for a common size balance sheet analysis is total assets. As a base. COGS divided by 100000 is 50 operating profit divided by.

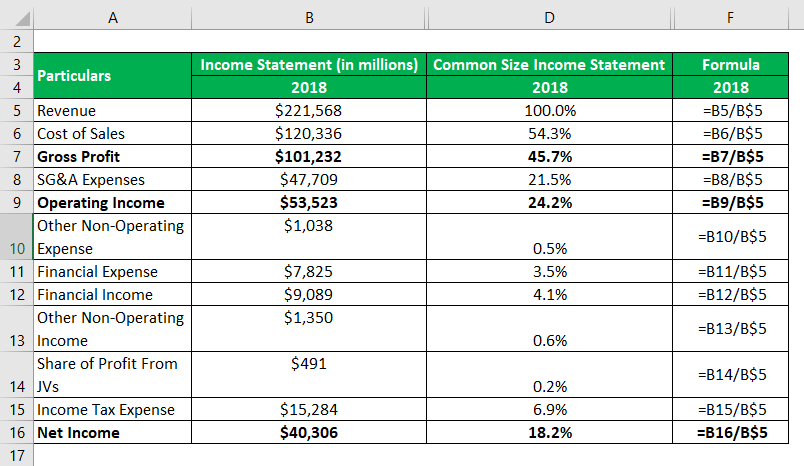

To calculate a common size analysis we need to convert the income statements financial data for example into percentages. Percentage of Base 4533 5687 x 100 7971. There are two reasons to use common-size analysis.

Common size financial statement analysis is computed using the following formula. The common size version of this income statement divides each line item by revenue or 100000. Percentage of Overall Base Figure Line Item Overall Base Figure x 100 There are two different types of common size analysisvertical and horizontal.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)